- China

- /

- Electric Utilities

- /

- SHSE:600505

Sichuan Xichang Electric PowerLtd (SHSE:600505) shareholder returns have been respectable, earning 45% in 1 year

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Sichuan Xichang Electric Power Co.,Ltd. (SHSE:600505) share price is up 45% in the last 1 year, clearly besting the market return of around 7.6% (not including dividends). So that should have shareholders smiling. However, the longer term returns haven't been so impressive, with the stock up just 22% in the last three years.

The past week has proven to be lucrative for Sichuan Xichang Electric PowerLtd investors, so let's see if fundamentals drove the company's one-year performance.

View our latest analysis for Sichuan Xichang Electric PowerLtd

Sichuan Xichang Electric PowerLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Sichuan Xichang Electric PowerLtd actually shrunk its revenue over the last year, with a reduction of 1.0%. The stock is up 45% in that time, a fine performance given the revenue drop. We can correlate the share price rise with revenue or profit growth, but it seems the market had previously expected weaker results, and sentiment around the stock is improving.

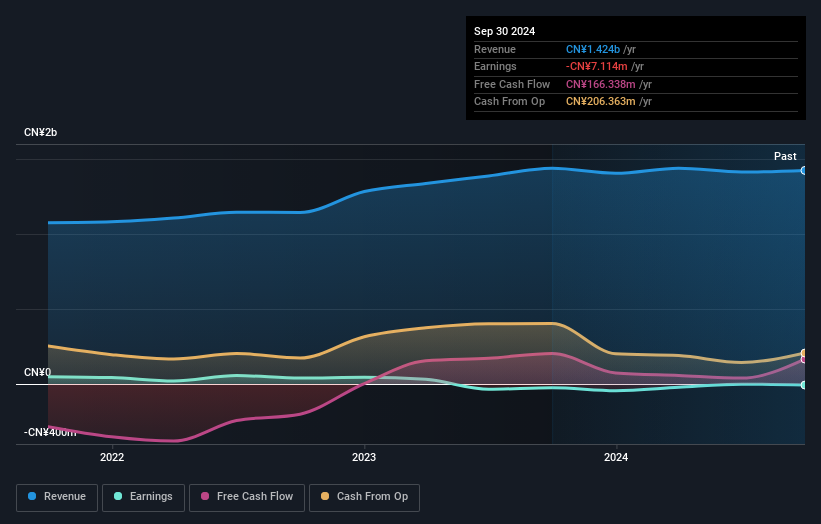

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

We're pleased to report that Sichuan Xichang Electric PowerLtd shareholders have received a total shareholder return of 45% over one year. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 4% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Even so, be aware that Sichuan Xichang Electric PowerLtd is showing 2 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600505

Sichuan Xichang Electric PowerLtd

Engages in generation, supply, distribution, and sale of hydropower power in Liangshan prefecture, Sichuan province, China.

Very low with weak fundamentals.