- China

- /

- Water Utilities

- /

- SHSE:600187

3 Global Penny Stocks With Market Caps Under US$3B

Reviewed by Simply Wall St

Global markets have shown resilience with U.S. stocks climbing on easing trade concerns and better-than-feared earnings, while the eurozone economy doubled its growth rate in the first quarter. For investors willing to explore beyond well-known names, penny stocks—often representing smaller or newer companies—still hold potential for growth despite being a somewhat outdated term. In this article, we highlight several penny stocks that combine strong balance sheets with solid fundamentals, offering opportunities that might defy typical expectations associated with this segment of the market.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.42 | SGD170.22M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.11 | SGD8.3B | ✅ 5 ⚠️ 0 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.78 | SEK283.44M | ✅ 4 ⚠️ 3 View Analysis > |

| SKP Resources Bhd (KLSE:SKPRES) | MYR0.895 | MYR1.4B | ✅ 5 ⚠️ 1 View Analysis > |

| NEXG Berhad (KLSE:NEXG) | MYR0.335 | MYR972.23M | ✅ 4 ⚠️ 3 View Analysis > |

| Hume Cement Industries Berhad (KLSE:HUMEIND) | MYR2.69 | MYR1.95B | ✅ 4 ⚠️ 2 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.09 | HK$668.81M | ✅ 4 ⚠️ 2 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £3.755 | £424.34M | ✅ 4 ⚠️ 1 View Analysis > |

| QinetiQ Group (LSE:QQ.) | £4.008 | £2.2B | ✅ 5 ⚠️ 1 View Analysis > |

| EZZ Life Science Holdings (ASX:EZZ) | A$1.515 | A$72.17M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 5,649 stocks from our Global Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Heilongjiang Interchina Water TreatmentLtd (SHSE:600187)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Heilongjiang Interchina Water Treatment Co., Ltd operates in the construction and management of water treatment, environmental protection projects, and clean energy initiatives in China, with a market cap of CN¥4.95 billion.

Operations: Heilongjiang Interchina Water Treatment Co., Ltd has not reported any specific revenue segments.

Market Cap: CN¥4.95B

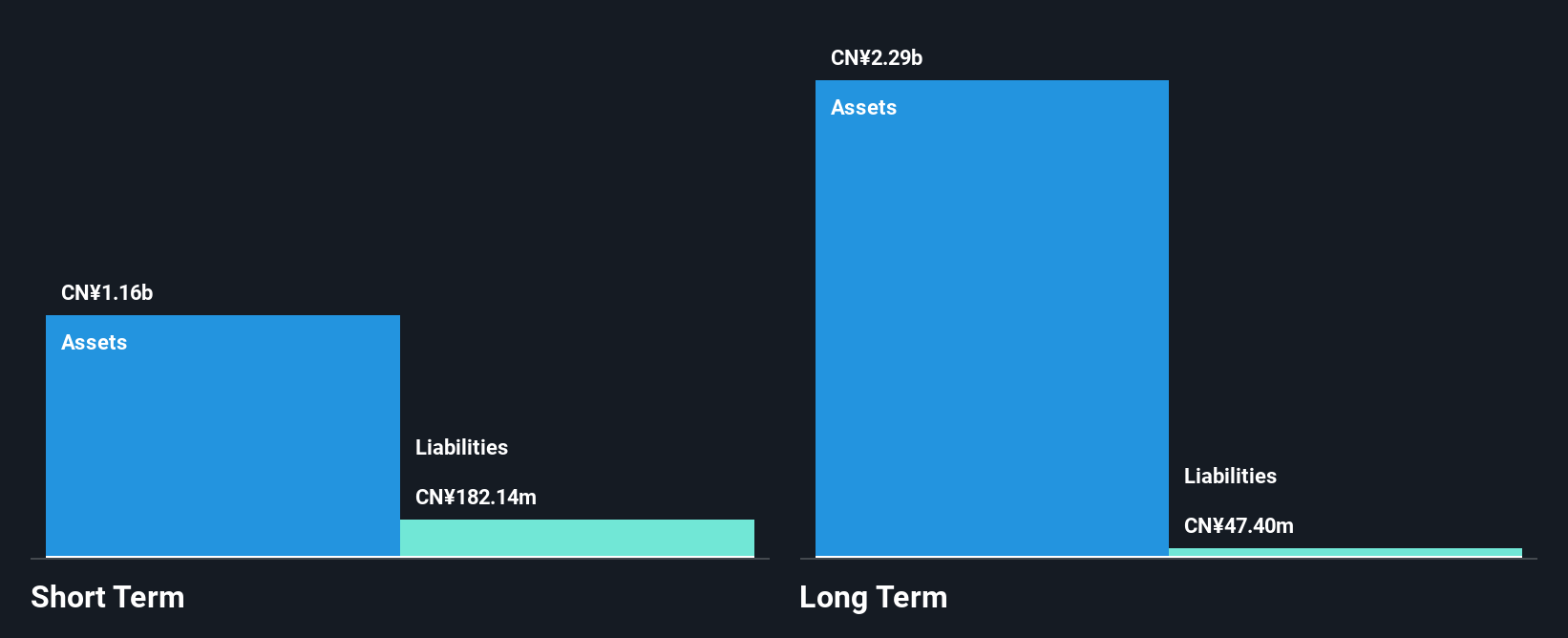

Heilongjiang Interchina Water Treatment Co., Ltd has demonstrated a mixed financial performance, with earnings growing by 43.6% over the past year, surpassing industry averages despite a decline in sales from CN¥226.02 million to CN¥179.16 million for 2024. The company reported a net income of CN¥43.58 million for the full year but faced a net loss of CN¥1.02 million in Q1 2025, highlighting volatility in short-term results. While its debt-to-equity ratio improved significantly over five years and short-term assets exceed liabilities, operating cash flow remains negative, indicating potential challenges in covering debt obligations without sufficient liquidity management strategies.

- Take a closer look at Heilongjiang Interchina Water TreatmentLtd's potential here in our financial health report.

- Gain insights into Heilongjiang Interchina Water TreatmentLtd's past trends and performance with our report on the company's historical track record.

CNNC Hua Yuan Titanium Dioxide (SZSE:002145)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: CNNC Hua Yuan Titanium Dioxide Co., Ltd, along with its subsidiaries, is engaged in the production and sale of rutile titanium dioxide products both domestically and internationally, with a market cap of CN¥14.91 billion.

Operations: No specific revenue segments are reported for CNNC Hua Yuan Titanium Dioxide Co., Ltd.

Market Cap: CN¥14.91B

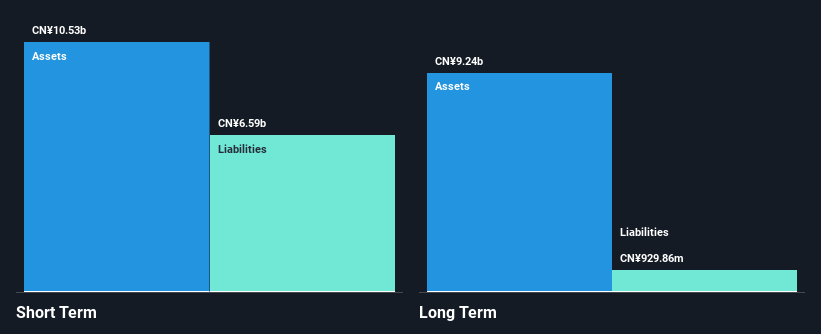

CNNC Hua Yuan Titanium Dioxide Co., Ltd has shown robust sales growth, with first-quarter revenue reaching CN¥2.04 billion, up from CN¥1.44 billion a year ago, and net income increasing slightly to CN¥134.09 million. Despite this growth, the company's debt is not well covered by operating cash flow at 13.8%, although short-term assets exceed both short and long-term liabilities significantly. The board of directors is experienced with an average tenure of three years; however, the management team is relatively new with less than a year in tenure. The company also maintains more cash than total debt, which supports financial stability amidst its low return on equity at 4.6%.

- Unlock comprehensive insights into our analysis of CNNC Hua Yuan Titanium Dioxide stock in this financial health report.

- Evaluate CNNC Hua Yuan Titanium Dioxide's historical performance by accessing our past performance report.

Guangxi Oriental Intelligent Manufacturing Technology (SZSE:002175)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. operates in the intelligent manufacturing sector and has a market cap of CN¥5.44 billion.

Operations: Revenue segments for Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. are not reported.

Market Cap: CN¥5.44B

Guangxi Oriental Intelligent Manufacturing Technology Co., Ltd. has demonstrated a significant reduction in its debt to equity ratio over the past five years, now standing at 9.6%, and maintains more cash than total debt, indicating strong financial management. Despite this, its recent earnings report shows a decline in net income to CN¥16.61 million for 2024 from CN¥43.94 million the previous year, with profit margins decreasing from 16.1% to 4.6%. The company's short-term assets comfortably cover both short and long-term liabilities, while an experienced board and management team contribute positively to its operational stability amidst high share price volatility.

- Navigate through the intricacies of Guangxi Oriental Intelligent Manufacturing Technology with our comprehensive balance sheet health report here.

- Understand Guangxi Oriental Intelligent Manufacturing Technology's track record by examining our performance history report.

Key Takeaways

- Embark on your investment journey to our 5,649 Global Penny Stocks selection here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang Interchina Water TreatmentLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600187

Heilongjiang Interchina Water TreatmentLtd

Engages in the construction and operation of water treatment, environmental protection projects, energy saving and clean energy transformation and other related project and other related projects in China.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives