Market Participants Recognise China Express Airlines Co.,LTD's (SZSE:002928) Revenues

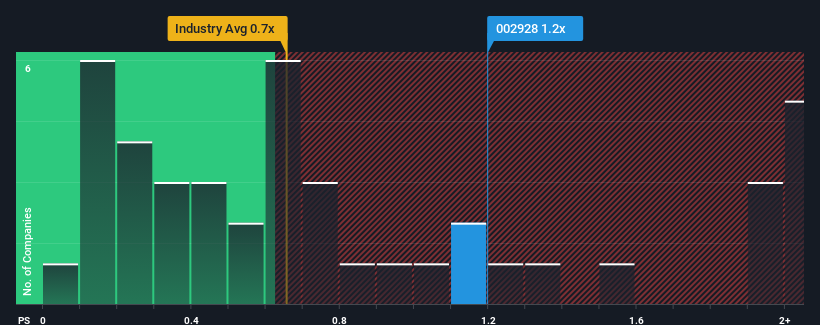

When close to half the companies in the Airlines industry in China have price-to-sales ratios (or "P/S") below 0.7x, you may consider China Express Airlines Co.,LTD (SZSE:002928) as a stock to potentially avoid with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for China Express AirlinesLTD

How China Express AirlinesLTD Has Been Performing

With revenue growth that's superior to most other companies of late, China Express AirlinesLTD has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on China Express AirlinesLTD will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

China Express AirlinesLTD's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered an exceptional 85% gain to the company's top line. The latest three year period has also seen a 20% overall rise in revenue, aided extensively by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 29% as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 11%, which is noticeably less attractive.

With this information, we can see why China Express AirlinesLTD is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that China Express AirlinesLTD maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Airlines industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for China Express AirlinesLTD with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:002928

China Express AirlinesLTD

Engages in the air passenger and cargo transportation business in China.

High growth potential and good value.

Market Insights

Community Narratives