- China

- /

- Infrastructure

- /

- SZSE:001965

Here's Why China Merchants Expressway Network & Technology HoldingsLtd (SZSE:001965) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like China Merchants Expressway Network & Technology HoldingsLtd (SZSE:001965), which has not only revenues, but also profits. Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for China Merchants Expressway Network & Technology HoldingsLtd

How Quickly Is China Merchants Expressway Network & Technology HoldingsLtd Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. China Merchants Expressway Network & Technology HoldingsLtd managed to grow EPS by 7.7% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

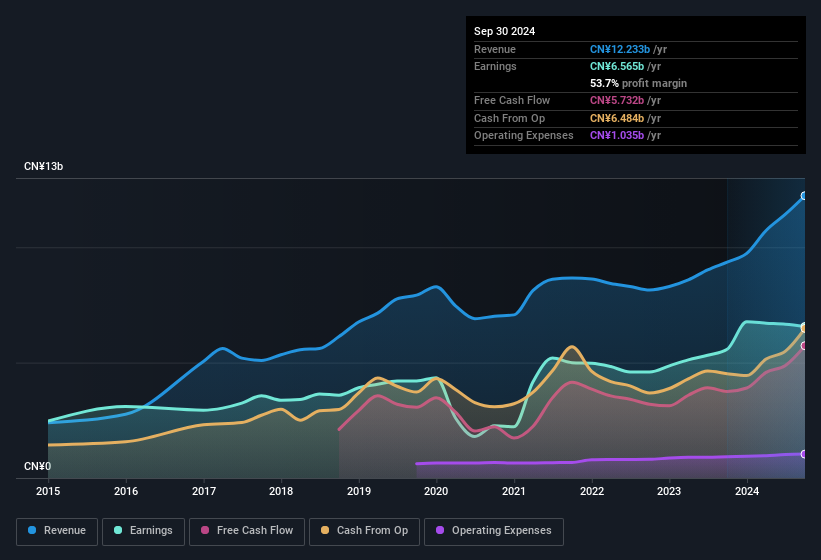

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. China Merchants Expressway Network & Technology HoldingsLtd maintained stable EBIT margins over the last year, all while growing revenue 31% to CN¥12b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of China Merchants Expressway Network & Technology HoldingsLtd's forecast profits?

Are China Merchants Expressway Network & Technology HoldingsLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. Our analysis has discovered that the median total compensation for the CEOs of companies like China Merchants Expressway Network & Technology HoldingsLtd, with market caps over CN¥58b, is about CN¥2.6m.

China Merchants Expressway Network & Technology HoldingsLtd's CEO took home a total compensation package worth CN¥1.8m in the year leading up to December 2023. That comes in below the average for similar sized companies and seems pretty reasonable. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is China Merchants Expressway Network & Technology HoldingsLtd Worth Keeping An Eye On?

As previously touched on, China Merchants Expressway Network & Technology HoldingsLtd is a growing business, which is encouraging. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. All things considered, China Merchants Expressway Network & Technology HoldingsLtd is definitely worth taking a deeper dive into. Even so, be aware that China Merchants Expressway Network & Technology HoldingsLtd is showing 3 warning signs in our investment analysis , and 1 of those is potentially serious...

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:001965

China Merchants Expressway Network & Technology HoldingsLtd

China Merchants Expressway Network & Technology Holdings Co.,Ltd.

Very undervalued average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026