- China

- /

- Electronic Equipment and Components

- /

- SZSE:301486

Undiscovered Gems In Asia To Explore This December 2025

Reviewed by Simply Wall St

As global markets navigate the final month of 2025, attention is drawn to Asia where small-cap stocks present intriguing opportunities amidst fluctuating economic indicators and evolving investor sentiment. With U.S. indices like the Russell 2000 showing gains and manufacturing activity contracting, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential in uncertain environments.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dear LifeLtd | 53.23% | 18.86% | 15.70% | ★★★★★★ |

| Yashima Denki | 2.28% | 2.70% | 25.81% | ★★★★★★ |

| New Asia Construction & Development | 42.25% | 8.68% | 50.79% | ★★★★★★ |

| Woojin | 1.02% | 8.91% | -11.74% | ★★★★★★ |

| Saha-Union | 0.70% | 0.67% | 18.29% | ★★★★★★ |

| Yibin City Commercial Bank | 82.57% | -1.19% | 15.94% | ★★★★★★ |

| Anhui Huaren Health Pharmaceutical | 55.17% | 17.65% | 10.18% | ★★★★★☆ |

| ITCENGLOBAL | 63.28% | 18.49% | 32.80% | ★★★★★☆ |

| TSTE | 37.68% | 4.91% | -5.78% | ★★★★★☆ |

| Iljin DiamondLtd | 2.08% | -4.09% | 13.10% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Xiamen Port Development (SZSE:000905)

Simply Wall St Value Rating: ★★★★★☆

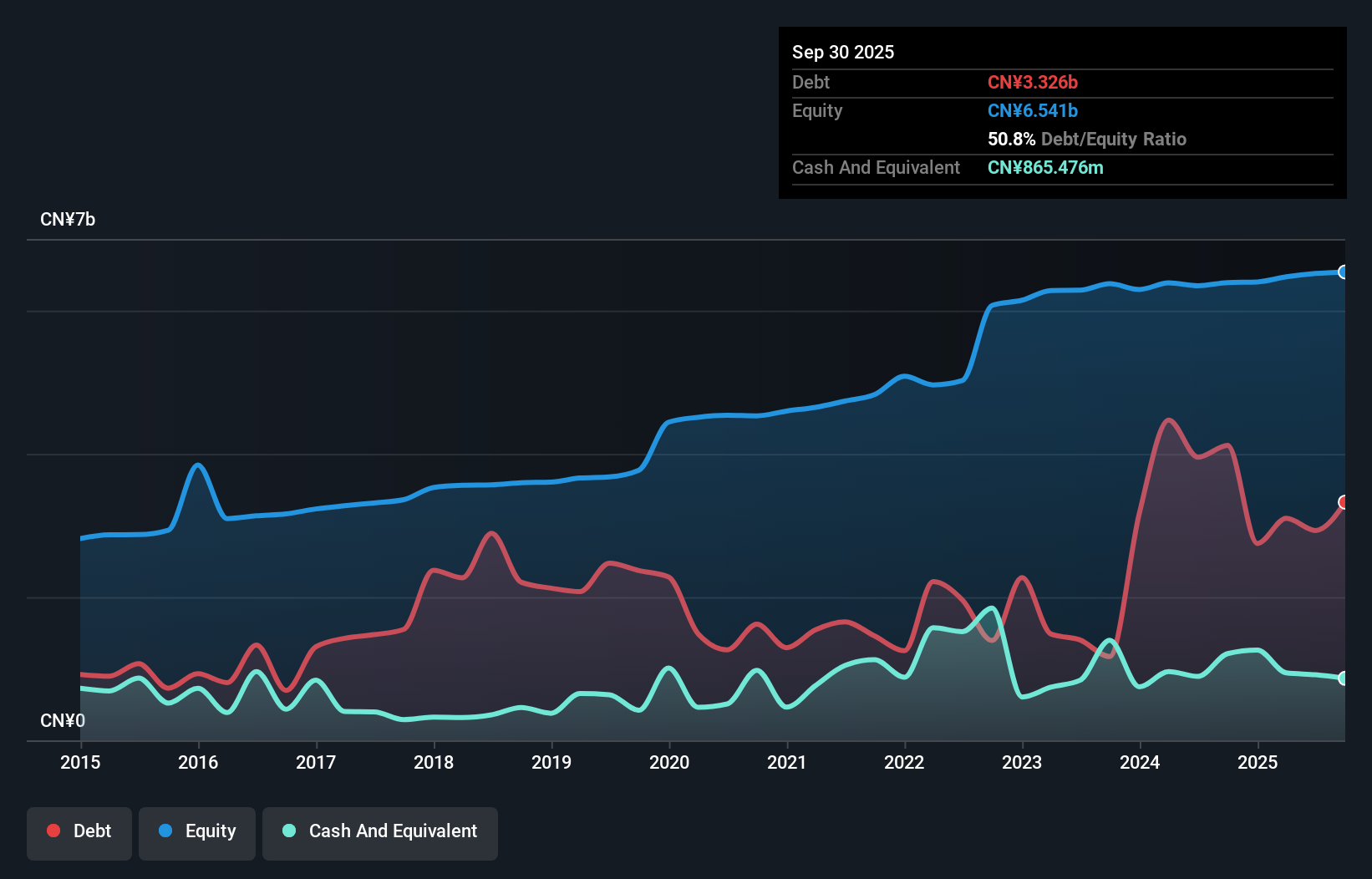

Overview: Xiamen Port Development Co., Ltd. operates in China providing port terminal and comprehensive logistics services, with a market capitalization of CN¥11.28 billion.

Operations: The company generates revenue primarily through its port terminal and logistics services. The gross profit margin is 12.5%, reflecting the efficiency of its operations in managing costs relative to sales.

Xiamen Port Development, a smaller player in the infrastructure sector, is trading at 31.5% below its estimated fair value, offering potential upside for investors. Over the past year, earnings grew by 2.2%, outpacing the industry average of -0.7%. The company reported a net income of CN¥195.81 million for the nine months ending September 2025, slightly improving from CN¥189.89 million in the previous year despite sales dropping to CN¥16.61 billion from CN¥17.99 billion. A notable one-off gain of CN¥147 million also impacted recent financial results positively while maintaining satisfactory debt levels with a net debt to equity ratio of 37.6%.

- Take a closer look at Xiamen Port Development's potential here in our health report.

Gain insights into Xiamen Port Development's past trends and performance with our Past report.

Shenzhen Zesum Technology (SZSE:301486)

Simply Wall St Value Rating: ★★★★★☆

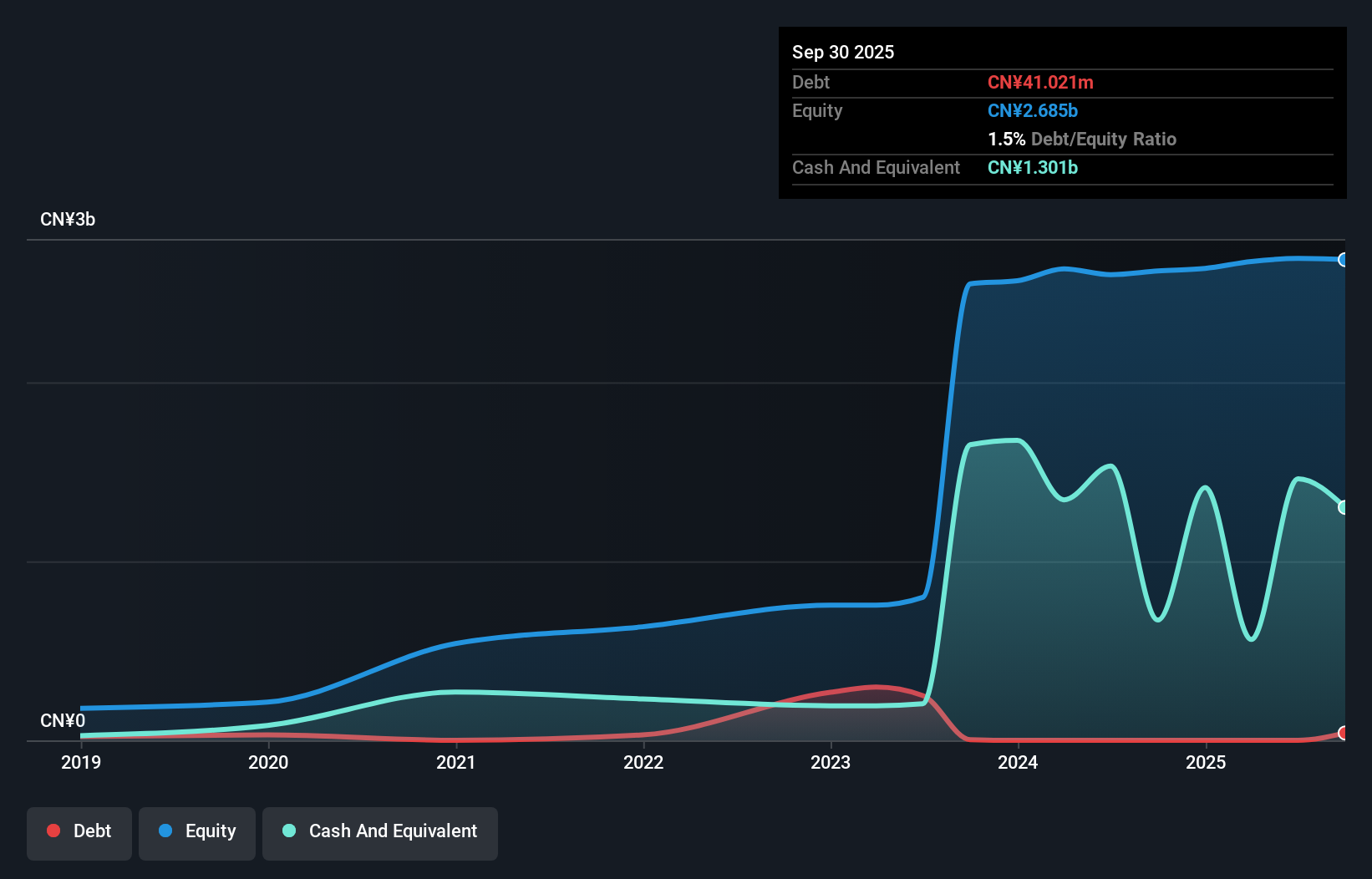

Overview: Shenzhen Zesum Technology Co., Ltd. is involved in the research, design, development, manufacturing, and sale of precision electronic components both in China and internationally with a market cap of CN¥13.22 billion.

Operations: The primary revenue stream for Shenzhen Zesum Technology comes from its electronic components and parts segment, generating CN¥997.69 million.

Shenzhen Zesum Technology, a small but dynamic player in the electronics sector, reported impressive earnings growth of 125.2% over the past year, significantly outpacing the industry's 9%. The company's net income for the nine months ending September 2025 rose to CNY 163.22 million from CNY 59.71 million a year earlier, showcasing robust profitability with basic earnings per share climbing to CNY 1.28 from CNY 0.47. Despite this financial strength and having more cash than debt, its share price has been highly volatile recently, reflecting market uncertainties or investor sentiment shifts following recent bylaw amendments approved at their November meeting.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Zesum Technology.

Learn about Shenzhen Zesum Technology's historical performance.

Top Bright Holding (TWSE:8499)

Simply Wall St Value Rating: ★★★★★☆

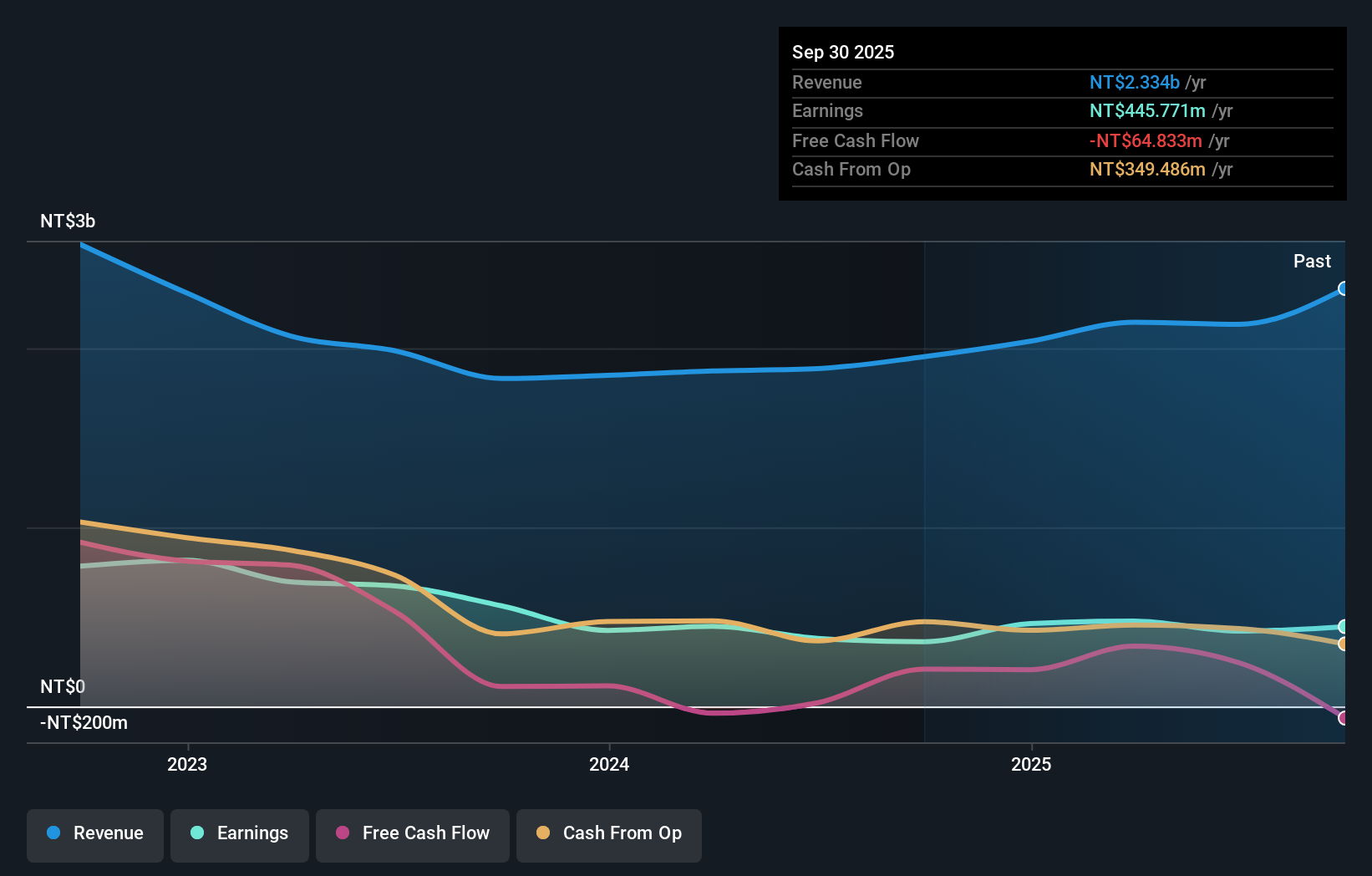

Overview: Top Bright Holding Co., Ltd. specializes in the research, development, manufacture, and sale of weighing instruments and electronic materials across China, Asia, Europe, and the Americas with a market cap of NT$16.30 billion.

Operations: Top Bright generates revenue primarily from the sale of weighing instruments and electronic materials. The company's net profit margin is a critical financial metric, reflecting its profitability after accounting for all expenses.

Top Bright Holding, a smaller player in the electronics sector, has shown impressive earnings growth of 23.4% over the past year, outpacing the industry average of 6.6%. Despite this positive momentum, earnings have seen an annual decline of 11.8% over five years. The company has successfully reduced its debt to equity ratio from 29.2% to 18.4%, indicating better financial health and more cash than total debt on hand, which supports interest coverage comfortably. However, shareholders experienced dilution recently and free cash flow remains negative, presenting a mixed outlook for potential investors looking at future prospects in this space.

- Unlock comprehensive insights into our analysis of Top Bright Holding stock in this health report.

Examine Top Bright Holding's past performance report to understand how it has performed in the past.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2493 more companies for you to explore.Click here to unveil our expertly curated list of 2496 Asian Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301486

Shenzhen Zesum Technology

Engages in the research, design, development, manufacturing, and sale of precision electronic components in China and internationally.

Solid track record with excellent balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)