Shareholders in Shandong Xinneng Taishan Power GenerationLtd (SZSE:000720) have lost 42%, as stock drops 8.7% this past week

Shandong Xinneng Taishan Power Generation Co.,Ltd. (SZSE:000720) shareholders will doubtless be very grateful to see the share price up 47% in the last quarter. But that cannot eclipse the less-than-impressive returns over the last three years. In fact, the share price is down 42% in the last three years, falling well short of the market return.

Since Shandong Xinneng Taishan Power GenerationLtd has shed CN¥427m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

View our latest analysis for Shandong Xinneng Taishan Power GenerationLtd

Shandong Xinneng Taishan Power GenerationLtd wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

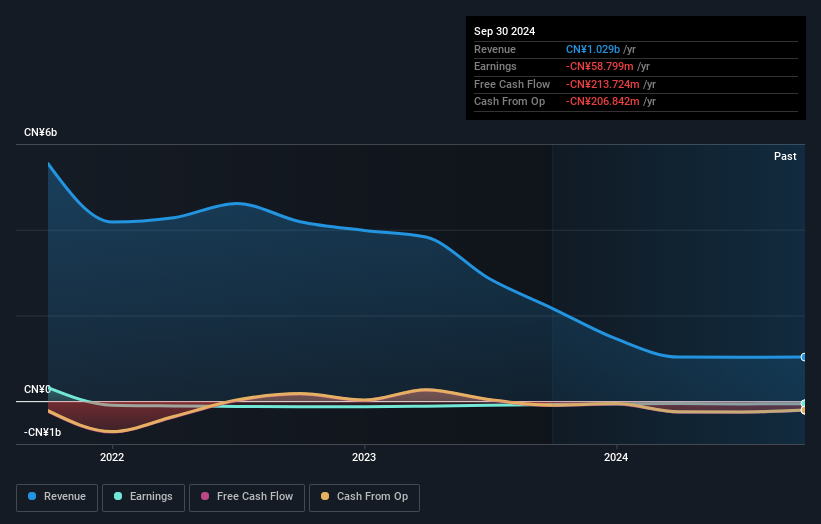

Over the last three years, Shandong Xinneng Taishan Power GenerationLtd's revenue dropped 50% per year. That's definitely a weaker result than most pre-profit companies report. With revenue in decline, the share price decline of 12% per year is hardly undeserved. It would probably be worth asking whether the company can fund itself to profitability. Of course, it is possible for businesses to bounce back from a revenue drop - but we'd want to see that before getting interested.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Investors in Shandong Xinneng Taishan Power GenerationLtd had a tough year, with a total loss of 16%, against a market gain of about 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for Shandong Xinneng Taishan Power GenerationLtd you should know about.

But note: Shandong Xinneng Taishan Power GenerationLtd may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000720

Shandong Xinneng Taishan Power GenerationLtd

Shandong Xinneng Taishan Power Generation Co.,Ltd.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives