- China

- /

- Communications

- /

- SZSE:002792

Unveiling 3 Undiscovered Gems with Robust Financial Foundations

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding trade tariffs and mixed economic indicators have led to a cautious sentiment among investors, with major indices like the S&P 500 experiencing slight declines. Despite these challenges, manufacturing activity has shown signs of recovery, providing a glimmer of hope for small-cap companies that might benefit from renewed industrial momentum. In such an environment, identifying stocks with robust financial foundations becomes crucial as they can offer stability and potential growth opportunities amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Techshine ElectronicsLtd | NA | 15.38% | 17.24% | ★★★★★★ |

| Ingersoll-Rand (India) | NA | 15.75% | 28.28% | ★★★★★★ |

| AzureWave Technologies | NA | 3.00% | 29.49% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Sinotherapeutics | NA | 12.57% | 1.89% | ★★★★★★ |

| SML Isuzu | 88.08% | 26.24% | 57.97% | ★★★★☆☆ |

| Pizu Group Holdings | 48.10% | -4.86% | -19.23% | ★★★★☆☆ |

| Shandong Longquan Pipe IndustryLtd | 34.82% | 2.24% | -22.15% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Ningxia Western Venture IndustrialLtd (SZSE:000557)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningxia Western Venture Industrial Co., Ltd. operates in various industrial sectors and has a market capitalization of CN¥7.70 billion.

Operations: Ningxia Western Venture Industrial Co., Ltd. generates revenue across multiple industrial sectors. The company has a market capitalization of CN¥7.70 billion, reflecting its diverse business operations and financial scale.

Ningxia Western Venture Industrial, a small player in the market, showcases strong financial health with its debt-free status and high-quality earnings. The company's Price-to-Earnings ratio of 28.5x is attractively below the Chinese market average of 36.3x, indicating potential undervaluation. Over the past year, earnings growth reached an impressive 30%, outpacing the Transportation industry's modest 1.9% increase. Free cash flow remains positive, suggesting robust operational efficiency and financial stability. A recent shareholders meeting focused on future transactions for 2025 highlights proactive management engagement in strategic planning to support ongoing growth initiatives.

- Click here to discover the nuances of Ningxia Western Venture IndustrialLtd with our detailed analytical health report.

Understand Ningxia Western Venture IndustrialLtd's track record by examining our Past report.

Tongyu Communication (SZSE:002792)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Tongyu Communication Inc. is involved in the research, development, manufacturing, sales, and servicing of mobile communication antennas, RF devices, optical modules, and other products globally with a market cap of CN¥7.88 billion.

Operations: Tongyu Communication generates revenue primarily from the sale of mobile communication antennas, RF devices, and optical modules. The company's financial performance is influenced by its cost structure and market demand for these products.

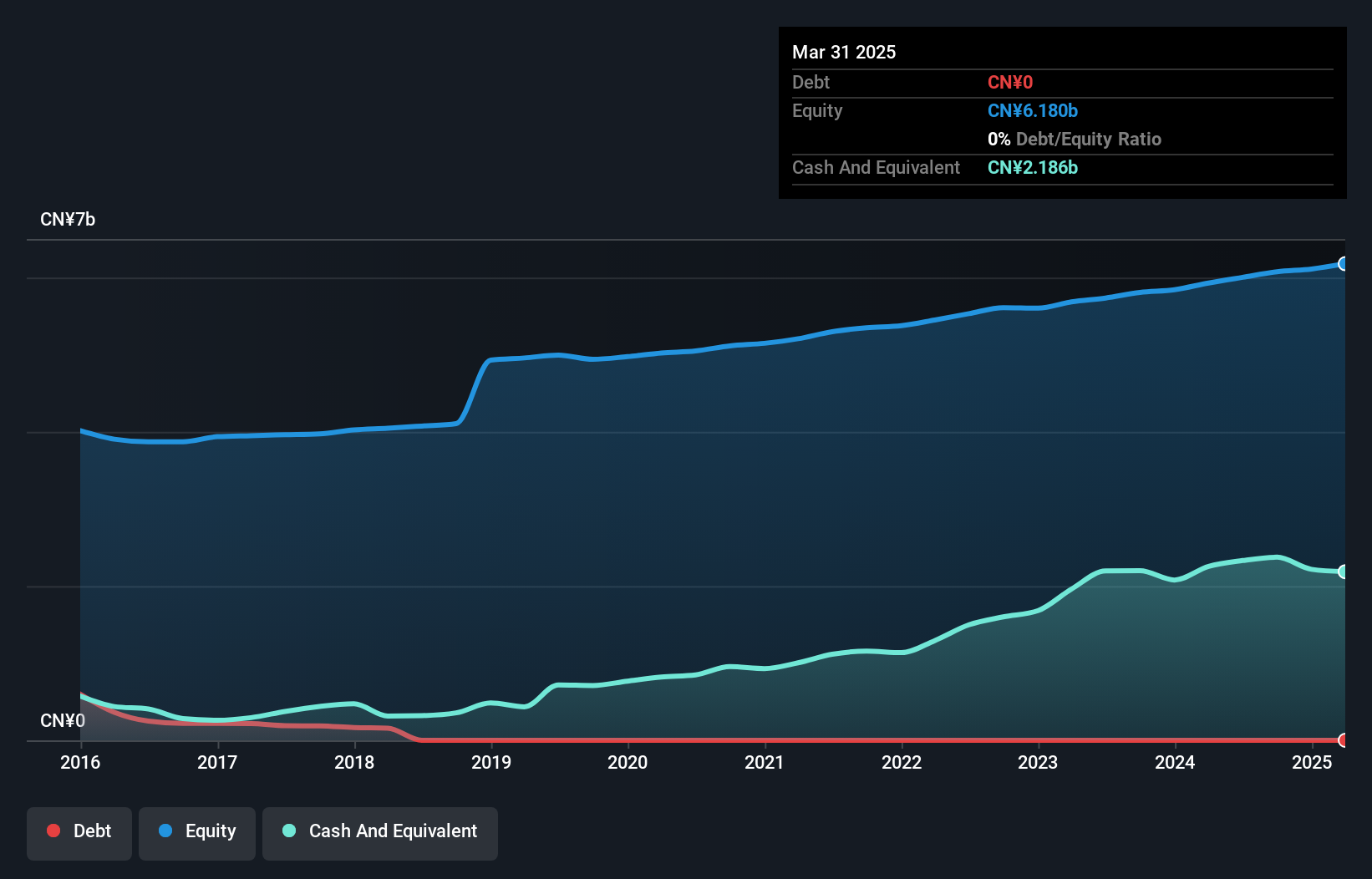

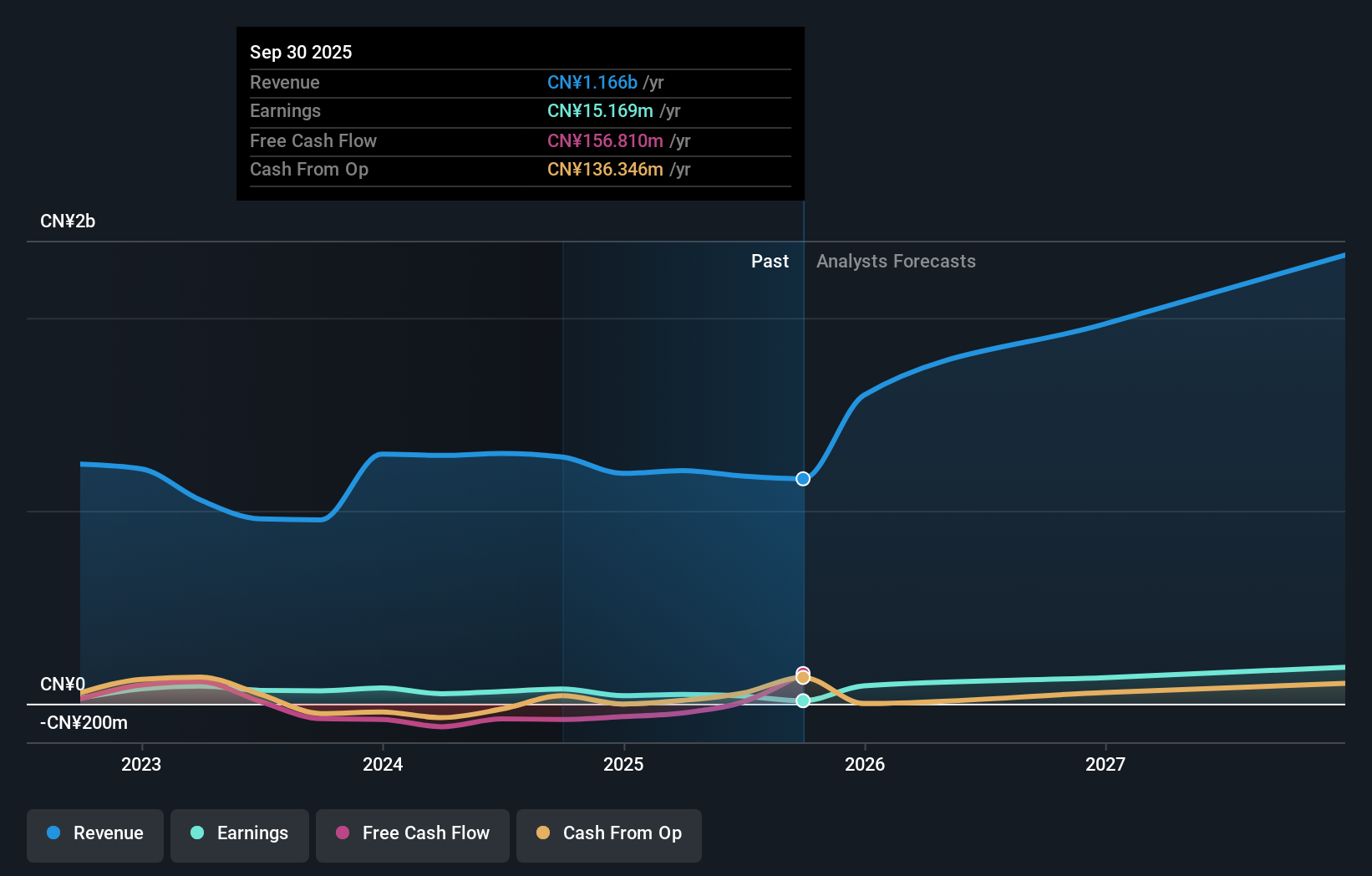

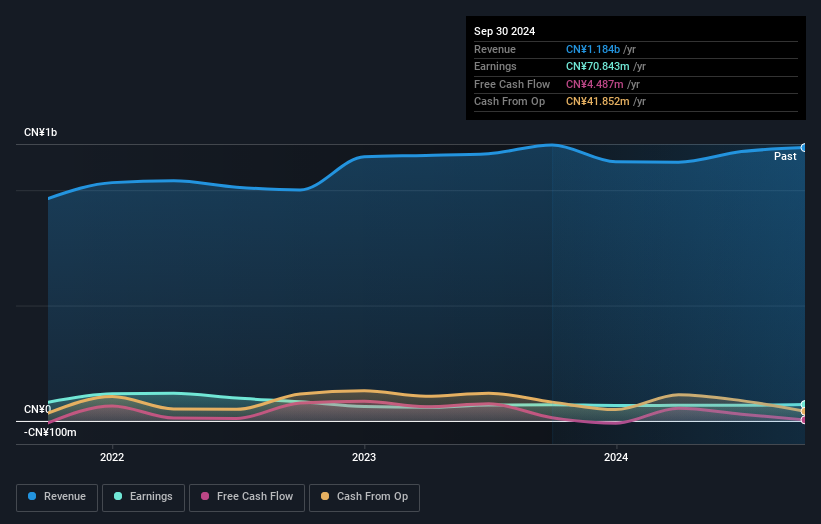

Tongyu Communication, a player in the communications sector, has seen its earnings grow by 21% over the past year, outpacing the industry average of -3%. This growth is bolstered by a one-off gain of CN¥31.5M impacting recent financial results. The company holds more cash than its total debt, suggesting solid financial health despite an increase in its debt-to-equity ratio from 0% to 0.9% over five years. With earnings forecasted to grow at 50% annually, Tongyu seems poised for further expansion while managing cash effectively as discussed in their upcoming shareholder meeting on January 10, 2025.

Beijing Jiaxun Feihong Electrical (SZSE:300213)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing Jiaxun Feihong Electrical Co., Ltd. is a company with a market cap of CN¥4.82 billion, focusing on electrical operations.

Operations: Beijing Jiaxun Feihong Electrical generates revenue primarily from its electrical operations. The company has a market cap of CN¥4.82 billion.

Jiaxun Feihong, a modestly sized player in the communications sector, showcases intriguing financial dynamics. Its earnings growth of 0.6% over the past year outpaced the industry average of -3%, hinting at resilience amidst broader challenges. The company boasts a debt-to-equity ratio reduction from 29.9% to 11.8% over five years, reflecting prudent financial management and possibly contributing to its high-quality earnings profile. With an EBIT coverage of interest payments at 8.3 times, it seems well-positioned to handle its obligations comfortably, while its price-to-earnings ratio stands attractively below industry standards at 68x compared to 72.7x.

Turning Ideas Into Actions

- Investigate our full lineup of 4721 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tongyu Communication might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002792

Tongyu Communication

Researches and develops, manufactures, sells, and services mobile communication antennas, radio frequency (RF) devices, optical modules, and other products worldwide.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives