- China

- /

- Transportation

- /

- SZSE:000008

Revenues Not Telling The Story For China High-Speed Railway Technology Co., Ltd. (SZSE:000008) After Shares Rise 28%

China High-Speed Railway Technology Co., Ltd. (SZSE:000008) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Notwithstanding the latest gain, the annual share price return of 3.2% isn't as impressive.

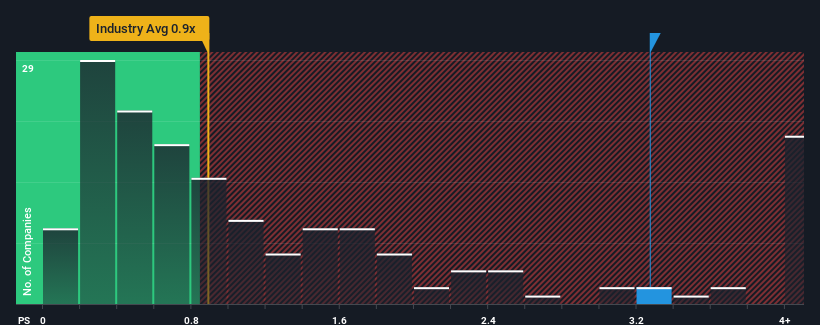

After such a large jump in price, you could be forgiven for thinking China High-Speed Railway Technology is a stock not worth researching with a price-to-sales ratios (or "P/S") of 3.3x, considering almost half the companies in China's Transportation industry have P/S ratios below 2.1x. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for China High-Speed Railway Technology

How Has China High-Speed Railway Technology Performed Recently?

For example, consider that China High-Speed Railway Technology's financial performance has been pretty ordinary lately as revenue growth is non-existent. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China High-Speed Railway Technology's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For China High-Speed Railway Technology?

In order to justify its P/S ratio, China High-Speed Railway Technology would need to produce impressive growth in excess of the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 18% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 19% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that China High-Speed Railway Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

The large bounce in China High-Speed Railway Technology's shares has lifted the company's P/S handsomely. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of China High-Speed Railway Technology revealed its shrinking revenue over the medium-term isn't resulting in a P/S as low as we expected, given the industry is set to grow. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for China High-Speed Railway Technology (1 doesn't sit too well with us) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000008

China High-Speed Railway Technology

China High-Speed Railway Technology Co., Ltd.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives