Guangzhou Jiacheng International Logistics Co.,Ltd.'s (SHSE:603535) Earnings Are Not Doing Enough For Some Investors

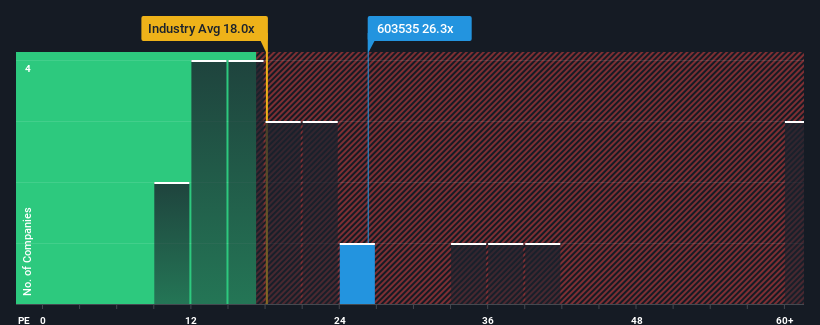

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 35x, you may consider Guangzhou Jiacheng International Logistics Co.,Ltd. (SHSE:603535) as an attractive investment with its 26.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

For example, consider that Guangzhou Jiacheng International LogisticsLtd's financial performance has been poor lately as its earnings have been in decline. One possibility is that the P/E is low because investors think the company won't do enough to avoid underperforming the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Guangzhou Jiacheng International LogisticsLtd

How Is Guangzhou Jiacheng International LogisticsLtd's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as low as Guangzhou Jiacheng International LogisticsLtd's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered a frustrating 9.1% decrease to the company's bottom line. This means it has also seen a slide in earnings over the longer-term as EPS is down 19% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Comparing that to the market, which is predicted to deliver 40% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

In light of this, it's understandable that Guangzhou Jiacheng International LogisticsLtd's P/E would sit below the majority of other companies. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Guangzhou Jiacheng International LogisticsLtd's P/E

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Guangzhou Jiacheng International LogisticsLtd maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

Before you settle on your opinion, we've discovered 1 warning sign for Guangzhou Jiacheng International LogisticsLtd that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603535

Guangzhou Jiacheng International LogisticsLtd

Guangzhou Jiacheng International Logistics Co.,Ltd.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives