- China

- /

- Transportation

- /

- SHSE:603069

Pinning Down Hainan Haiqi Transportation Group Co.,Ltd.'s (SHSE:603069) P/S Is Difficult Right Now

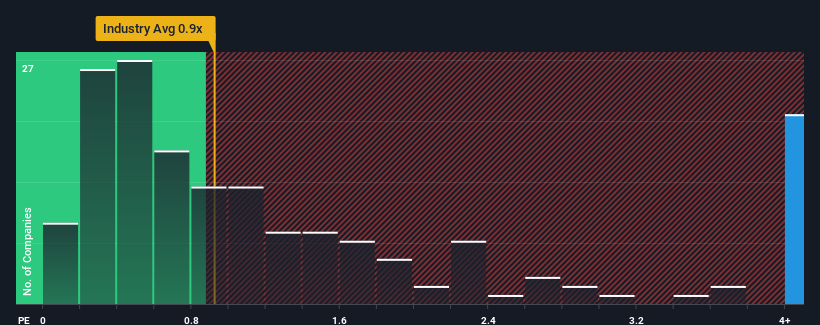

When you see that almost half of the companies in the Transportation industry in China have price-to-sales ratios (or "P/S") below 2.2x, Hainan Haiqi Transportation Group Co.,Ltd. (SHSE:603069) looks to be giving off strong sell signals with its 6.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Hainan Haiqi Transportation GroupLtd

What Does Hainan Haiqi Transportation GroupLtd's Recent Performance Look Like?

Hainan Haiqi Transportation GroupLtd could be doing better as it's been growing revenue less than most other companies lately. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Hainan Haiqi Transportation GroupLtd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Hainan Haiqi Transportation GroupLtd's Revenue Growth Trending?

In order to justify its P/S ratio, Hainan Haiqi Transportation GroupLtd would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 32%. Pleasingly, revenue has also lifted 30% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 0.4% during the coming year according to the one analyst following the company. With the industry predicted to deliver 19% growth, that's a disappointing outcome.

With this in mind, we find it intriguing that Hainan Haiqi Transportation GroupLtd's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a very good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Hainan Haiqi Transportation GroupLtd's P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

For a company with revenues that are set to decline in the context of a growing industry, Hainan Haiqi Transportation GroupLtd's P/S is much higher than we would've anticipated. Right now we aren't comfortable with the high P/S as the predicted future revenue decline likely to impact the positive sentiment that's propping up the P/S. At these price levels, investors should remain cautious, particularly if things don't improve.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Hainan Haiqi Transportation GroupLtd you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hainan Haiqi Transportation GroupLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603069

Hainan Haiqi Transportation GroupLtd

Hainan Haiqi Transportation Group Co.,Ltd.

Worrying balance sheet minimal.

Market Insights

Community Narratives