DEPPON LOGISTICS Co., LTD.'s (SHSE:603056) Shares Not Telling The Full Story

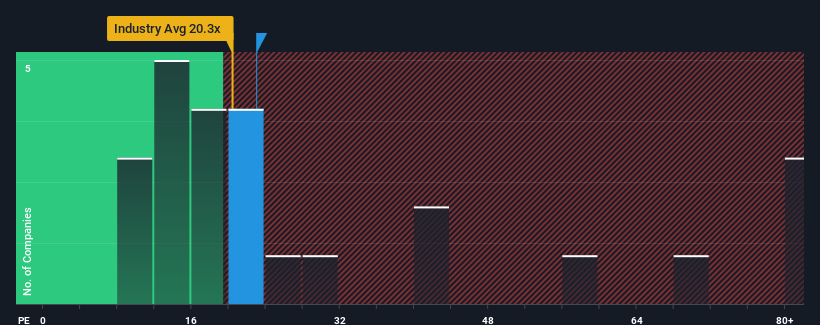

When close to half the companies in China have price-to-earnings ratios (or "P/E's") above 30x, you may consider DEPPON LOGISTICS Co., LTD. (SHSE:603056) as an attractive investment with its 23x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

DEPPON LOGISTICS certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for DEPPON LOGISTICS

Is There Any Growth For DEPPON LOGISTICS?

In order to justify its P/E ratio, DEPPON LOGISTICS would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a worthy increase of 14%. The latest three year period has also seen a 24% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 52% as estimated by the seven analysts watching the company. Meanwhile, the rest of the market is forecast to only expand by 34%, which is noticeably less attractive.

In light of this, it's peculiar that DEPPON LOGISTICS' P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

What We Can Learn From DEPPON LOGISTICS' P/E?

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of DEPPON LOGISTICS' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for DEPPON LOGISTICS with six simple checks.

You might be able to find a better investment than DEPPON LOGISTICS. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603056

DEPPON LOGISTICS

Operates as a customer-centered logistics company in Mainland China, Japan, South Korea, Europe, America, Southeast Asia, Hong Kong, Macao, and Taiwan, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives