- China

- /

- Infrastructure

- /

- SHSE:601188

What Heilongjiang Transport Development Co., Ltd.'s (SHSE:601188) 26% Share Price Gain Is Not Telling You

Heilongjiang Transport Development Co., Ltd. (SHSE:601188) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Notwithstanding the latest gain, the annual share price return of 6.1% isn't as impressive.

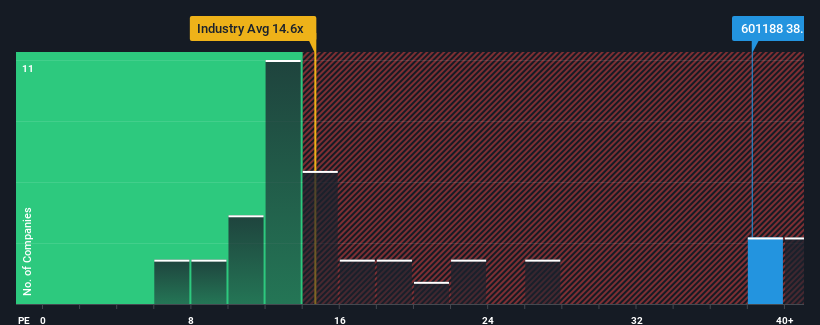

Since its price has surged higher, Heilongjiang Transport Development's price-to-earnings (or "P/E") ratio of 38.2x might make it look like a sell right now compared to the market in China, where around half of the companies have P/E ratios below 27x and even P/E's below 16x are quite common. However, the P/E might be high for a reason and it requires further investigation to determine if it's justified.

For instance, Heilongjiang Transport Development's receding earnings in recent times would have to be some food for thought. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

Check out our latest analysis for Heilongjiang Transport Development

How Is Heilongjiang Transport Development's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as high as Heilongjiang Transport Development's is when the company's growth is on track to outshine the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.1%. This means it has also seen a slide in earnings over the longer-term as EPS is down 51% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's an unpleasant look.

With this information, we find it concerning that Heilongjiang Transport Development is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Heilongjiang Transport Development shares have received a push in the right direction, but its P/E is elevated too. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Heilongjiang Transport Development currently trades on a much higher than expected P/E since its recent earnings have been in decline over the medium-term. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Heilongjiang Transport Development (at least 1 which makes us a bit uncomfortable), and understanding these should be part of your investment process.

You might be able to find a better investment than Heilongjiang Transport Development. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Heilongjiang Transport Development might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601188

Heilongjiang Transport Development

Engages in the investment, development, construction, operation, and management of toll roads in China.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives