CMST Development Co.,Ltd.'s (SHSE:600787) Price Is Right But Growth Is Lacking After Shares Rocket 38%

Despite an already strong run, CMST Development Co.,Ltd. (SHSE:600787) shares have been powering on, with a gain of 38% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 47% in the last year.

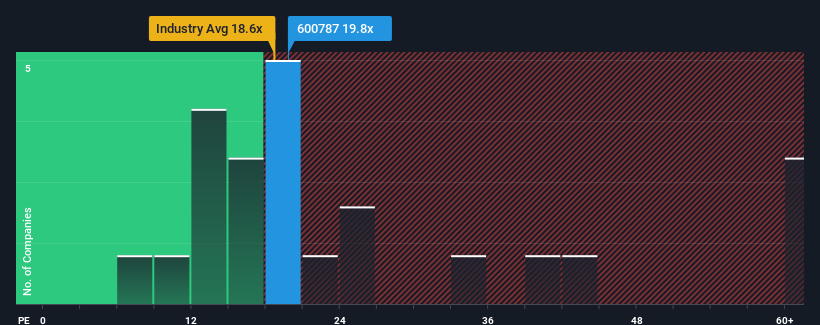

Even after such a large jump in price, CMST DevelopmentLtd may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 19.8x, since almost half of all companies in China have P/E ratios greater than 37x and even P/E's higher than 73x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for CMST DevelopmentLtd as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for CMST DevelopmentLtd

What Are Growth Metrics Telling Us About The Low P/E?

In order to justify its P/E ratio, CMST DevelopmentLtd would need to produce sluggish growth that's trailing the market.

If we review the last year of earnings growth, the company posted a terrific increase of 61%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 14% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to grow by 38% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we are not surprised that CMST DevelopmentLtd is trading at a P/E lower than the market. Nonetheless, there's no guarantee the P/E has reached a floor yet with earnings going in reverse. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From CMST DevelopmentLtd's P/E?

CMST DevelopmentLtd's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that CMST DevelopmentLtd maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You always need to take note of risks, for example - CMST DevelopmentLtd has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on CMST DevelopmentLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600787

CMST DevelopmentLtd

Provides warehouse logistics services in China, rest of Asia, Europe, and the United States.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives