- China

- /

- Infrastructure

- /

- SHSE:600717

Tianjin Port Holdings Co., Ltd.'s (SHSE:600717) Shares Lagging The Market But So Is The Business

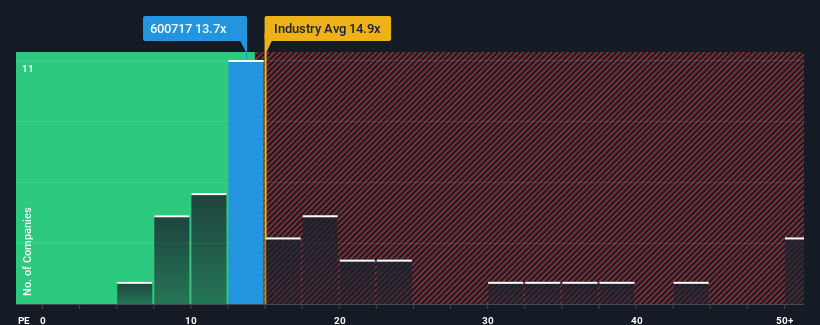

With a price-to-earnings (or "P/E") ratio of 13.7x Tianjin Port Holdings Co., Ltd. (SHSE:600717) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 30x and even P/E's higher than 58x are not unusual. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Earnings have risen firmly for Tianjin Port Holdings recently, which is pleasing to see. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

View our latest analysis for Tianjin Port Holdings

Is There Any Growth For Tianjin Port Holdings?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Tianjin Port Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 17% last year. Pleasingly, EPS has also lifted 32% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 36% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Tianjin Port Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Tianjin Port Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 1 warning sign for Tianjin Port Holdings you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

Valuation is complex, but we're here to simplify it.

Discover if Tianjin Port Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600717

Tianjin Port Holdings

Engages in the cargo loading and unloading activities in China.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives