- South Korea

- /

- Auto Components

- /

- KOSE:A036530

Top 3 Global Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by steady Federal Reserve rates and mixed economic signals, global markets showed resilience with U.S. indices rebounding after multi-week declines, while European stocks gained amidst spending hopes despite tariff concerns. Amidst this backdrop of uncertainty and cautious optimism, dividend stocks stand out as attractive options for investors seeking stable returns; they often provide consistent income even when market volatility is high.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.86% | ★★★★★★ |

| Chongqing Rural Commercial Bank (SEHK:3618) | 7.98% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.07% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 3.99% | ★★★★★★ |

| Intelligent Wave (TSE:4847) | 3.73% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 3.98% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.24% | ★★★★★★ |

| Sonae SGPS (ENXTLS:SON) | 5.80% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.78% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.60% | ★★★★★★ |

Click here to see the full list of 1438 stocks from our Top Global Dividend Stocks screener.

We'll examine a selection from our screener results.

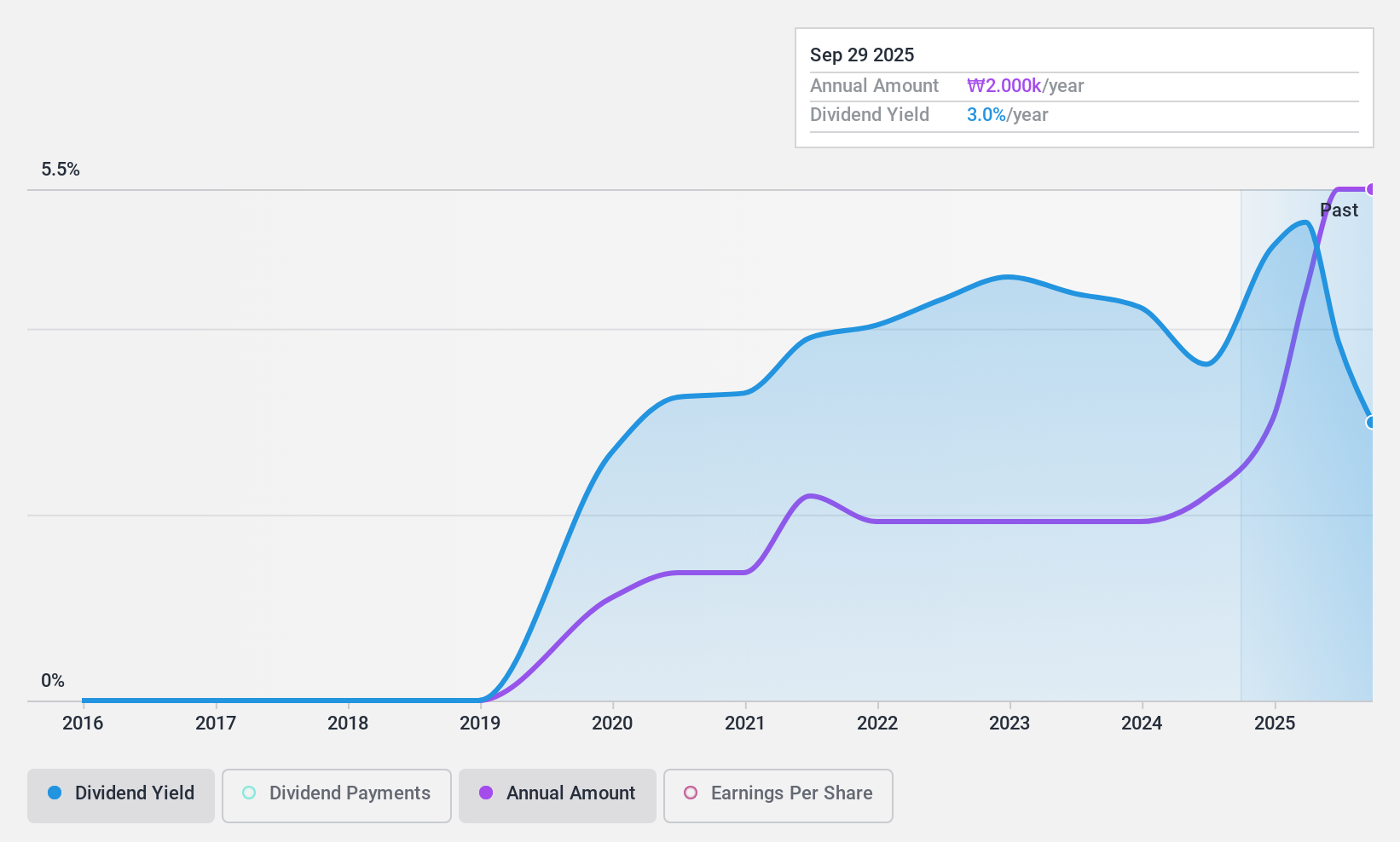

SNT Holdings (KOSE:A036530)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SNT Holdings CO., LTD operates in the auto parts and industrial facilities sectors, with a market cap of ₩480.78 billion.

Operations: SNT Holdings CO., LTD generates its revenue primarily from Vehicle Parts, amounting to ₩1.33 billion, and Industrial Equipment, contributing ₩294.26 million.

Dividend Yield: 4.6%

SNT Holdings has demonstrated strong earnings growth, with a 63.6% increase over the past year, supporting its dividend payments. The company's low payout ratio of 16.2% indicates dividends are well-covered by earnings and cash flows, with a reasonable cash payout ratio of 51.3%. However, its dividend track record is unstable and volatile despite being among the top 25% in yield within the KR market at 4.62%.

- Unlock comprehensive insights into our analysis of SNT Holdings stock in this dividend report.

- Upon reviewing our latest valuation report, SNT Holdings' share price might be too pessimistic.

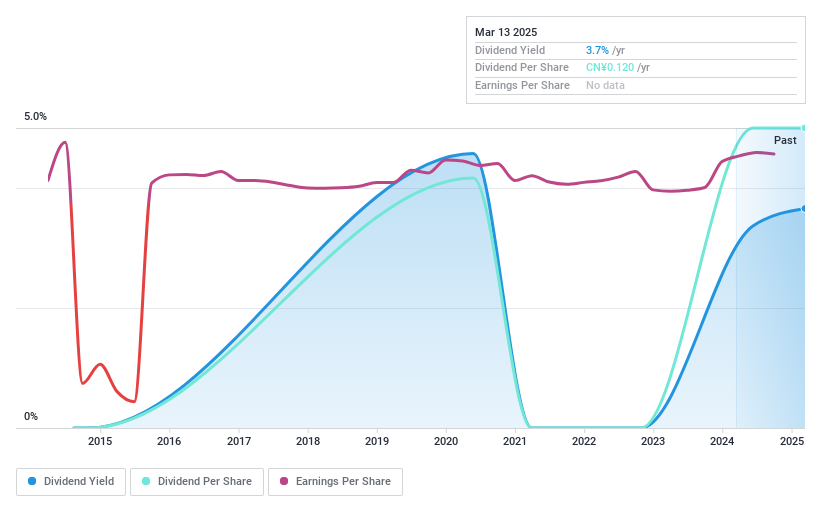

Huaihe Energy (Group)Ltd (SHSE:600575)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Huaihe Energy (Group) Co., Ltd operates in the logistics and trade sector in China with a market capitalization of approximately CN¥13.60 billion.

Operations: Huaihe Energy (Group) Co., Ltd's revenue is primarily derived from its operations in the logistics and trade sector within China.

Dividend Yield: 3.3%

Huaihe Energy's dividends are supported by a payout ratio of 46%, indicating coverage by earnings, and a cash payout ratio of 74.1% shows cash flow support. Despite this, the company's dividend history is unstable with volatility over its five-year payment period. Earnings surged by 216.1% last year, enhancing dividend potential, but reliability remains an issue. The dividend yield stands at 3.27%, placing it in the top tier within the CN market for yield attractiveness.

- Get an in-depth perspective on Huaihe Energy (Group)Ltd's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Huaihe Energy (Group)Ltd is priced higher than what may be justified by its financials.

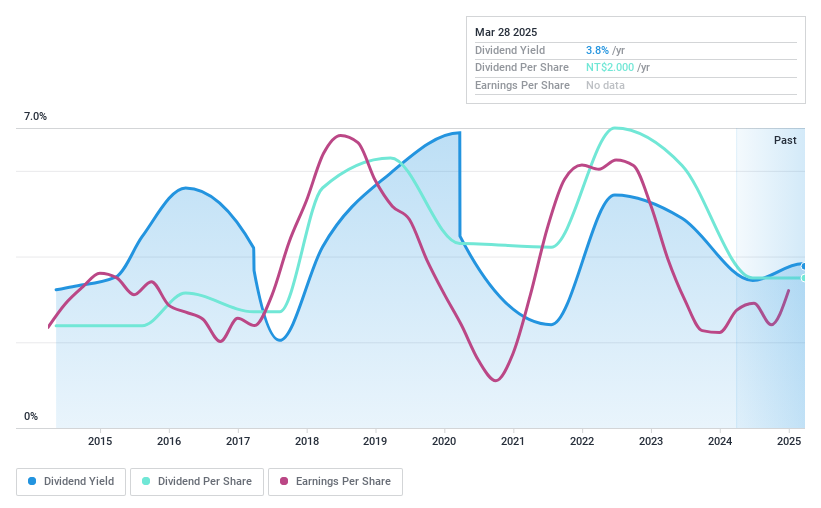

Jih Lin Technology (TWSE:5285)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Jih Lin Technology Co., Ltd. is engaged in the manufacturing and sale of lead frames and tooling products across Taiwan, China, and international markets, with a market cap of NT$5.20 billion.

Operations: Jih Lin Technology Co., Ltd. generates revenue of NT$5.03 billion from its semiconductor lead frame production and sales operations.

Dividend Yield: 3.6%

Jih Lin Technology's dividend payments have been volatile over the past decade, though they have increased overall. The payout ratio of 79.4% suggests dividends are covered by earnings, with a cash payout ratio of 55.3% indicating cash flow support. Despite a lower yield of 3.57% compared to top-tier payers in Taiwan, recent earnings growth and a price-to-earnings ratio below the industry average may appeal to some investors seeking value amidst volatility concerns.

- Delve into the full analysis dividend report here for a deeper understanding of Jih Lin Technology.

- Insights from our recent valuation report point to the potential overvaluation of Jih Lin Technology shares in the market.

Make It Happen

- Click through to start exploring the rest of the 1435 Top Global Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade SNT Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A036530

SNT Holdings

SNT Holdings CO.,LTD engages in auto parts and industrial facilities businesses.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives