Spotlighting Undiscovered Global Gems with Strong Potential In July 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, small-cap stocks are drawing attention for their potential resilience amid these challenges. In this environment, a good stock often exhibits strong fundamentals and adaptability to shifting market dynamics, making them compelling candidates for those seeking undiscovered opportunities with promising growth prospects.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| PSC | 15.34% | 1.17% | 10.86% | ★★★★★★ |

| Saha-Union | 0.84% | 0.90% | 15.45% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Alf Meem Yaa for Medical Supplies and Equipment | NA | 17.03% | 18.37% | ★★★★★★ |

| MOBI Industry | 6.50% | 5.60% | 24.00% | ★★★★★★ |

| Sure Global Tech | NA | 11.95% | 18.65% | ★★★★★★ |

| Najran Cement | 14.20% | -2.87% | -22.60% | ★★★★★★ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.60% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| National Environmental Recycling | 69.43% | 43.47% | 32.77% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Antong Holdings (SHSE:600179)

Simply Wall St Value Rating: ★★★★★★

Overview: Antong Holdings Co., Ltd. operates in the container shipping and transport logistics sector within China and has a market capitalization of CN¥12.33 billion.

Operations: Antong Holdings generates revenue primarily from its container shipping and transport logistics services within China. The company's financial performance is influenced by its cost structure, which impacts its net profit margin.

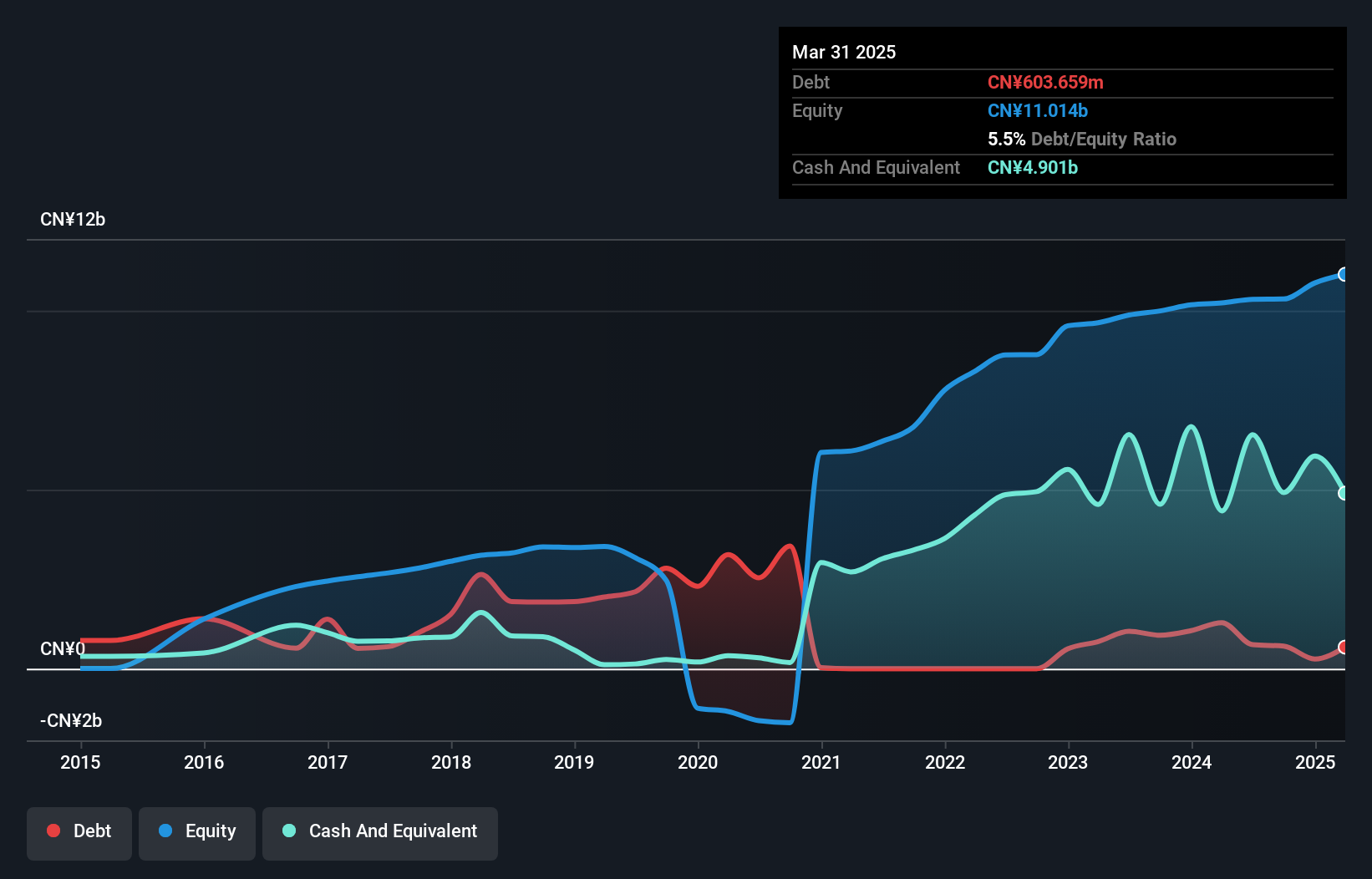

Antong Holdings, a player in the shipping industry, has shown impressive growth with its earnings surging by 49.3% over the past year, outpacing the industry's 33.3%. The company's recent Q1 results highlight a significant jump in net income to CNY 241.45 million from CNY 51.2 million last year and sales climbing to CNY 2.04 billion from CNY 1.62 billion previously reported for the same period. With a price-to-earnings ratio of 15.9x below the CN market average of 40.4x, Antong appears undervalued while maintaining high-quality earnings and strong interest coverage capabilities.

- Click to explore a detailed breakdown of our findings in Antong Holdings' health report.

Evaluate Antong Holdings' historical performance by accessing our past performance report.

Ficont Industry (Beijing) (SHSE:605305)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ficont Industry (Beijing) Co., Ltd. engages in the provision of wind energy, construction, and safety protection equipment both in China and internationally, with a market capitalization of CN¥6.54 billion.

Operations: Ficont's primary revenue stream is from construction machinery and equipment, generating CN¥1.37 billion. The company's market capitalization stands at CN¥6.54 billion.

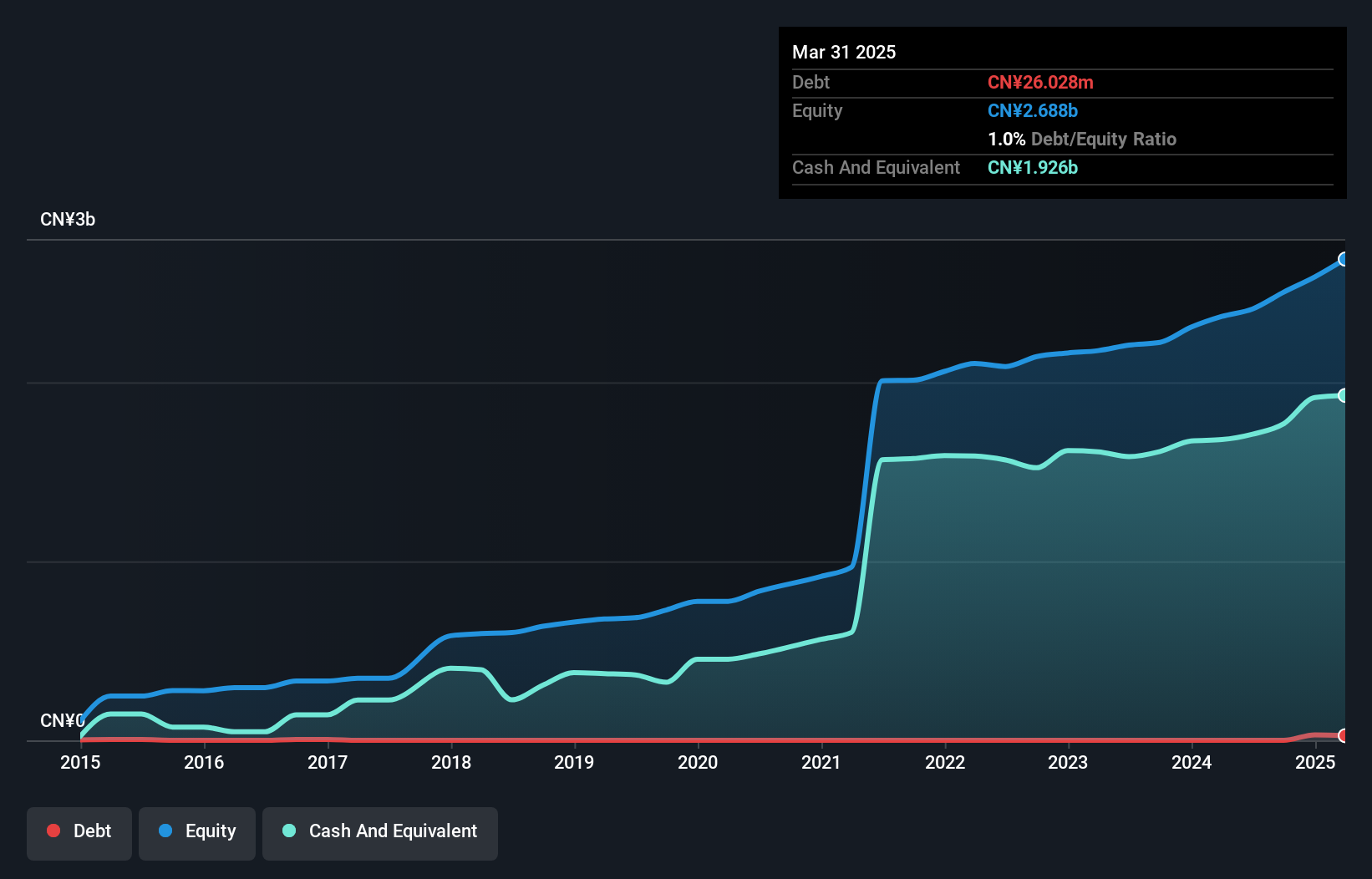

Ficont Industry, a smaller player in the machinery sector, has been making waves with its impressive financial performance. The company reported a net income of CNY 314.8 million for 2024, up from CNY 206.84 million the previous year, showcasing robust growth. Its earnings per share increased to CNY 1.48 from CNY 0.97, reflecting strong operational efficiency and profitability improvements over time. With sales reaching CNY 1,289 million in the same period, Ficont is trading at an attractive value compared to peers and industry standards while maintaining high-quality earnings that outpace industry growth rates by a significant margin.

- Delve into the full analysis health report here for a deeper understanding of Ficont Industry (Beijing).

Learn about Ficont Industry (Beijing)'s historical performance.

create restaurants holdings (TSE:3387)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Create Restaurants Holdings Inc. is a company that plans, develops, and manages food courts, izakaya bars, dinner-time restaurants, and bakeries in Japan with a market capitalization of approximately ¥291.90 billion.

Operations: The company generates revenue primarily through its diverse portfolio of dining establishments, including food courts, izakaya bars, dinner-time restaurants, and bakeries. It operates within Japan and has a market capitalization of approximately ¥291.90 billion.

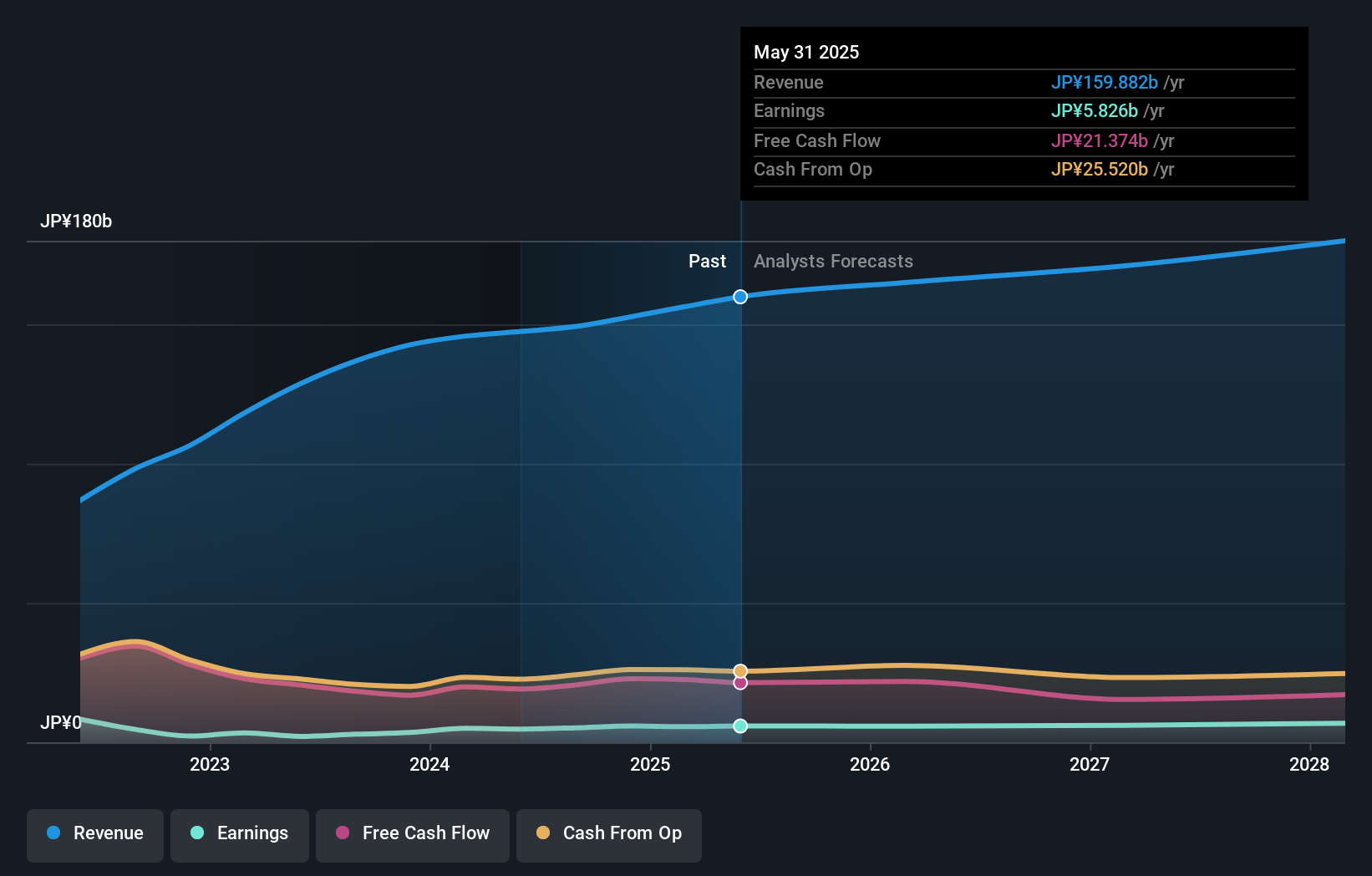

In the bustling world of hospitality, create restaurants holdings stands out with a net debt to equity ratio at a satisfactory 12.9%, showcasing financial prudence. The company has impressed with earnings growth of 22.8% over the past year, surpassing the industry average of 9.4%. Trading at a discount of 10.6% below its estimated fair value, it offers potential for investors seeking value opportunities. With high-quality past earnings and positive free cash flow, this small-cap entity appears well-positioned in its sector, especially as it continues to reduce its debt from an earlier high of 530.3% five years ago to now just under 60%.

- Take a closer look at create restaurants holdings' potential here in our health report.

Understand create restaurants holdings' track record by examining our Past report.

Seize The Opportunity

- Take a closer look at our Global Undiscovered Gems With Strong Fundamentals list of 3162 companies by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605305

Ficont Industry (Beijing)

Provides wind energy, construction, and safety protection equipment in China and internationally.

Undervalued with solid track record.

Market Insights

Community Narratives