In the current landscape where major U.S. stock indexes like the S&P 500 and Nasdaq Composite continue to hit record highs, small-cap stocks represented by the Russell 2000 have shown recent declines despite previous outperformance. With economic indicators such as job growth rebounding and potential interest rate cuts on the horizon, investors are increasingly focused on uncovering opportunities within lesser-known small-cap stocks that could benefit from these shifts. Identifying a promising stock in this environment often involves looking at companies with strong fundamentals and growth potential that may not yet be fully appreciated by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Sinotherapeutics (SHSE:688247)

Simply Wall St Value Rating: ★★★★★★

Overview: Sinotherapeutics Inc. is a specialty pharmaceutical company focused on developing generic and formulation products in China, with a market cap of CN¥4.94 billion.

Operations: Sinotherapeutics generates revenue primarily from pharmaceutical manufacturing, amounting to CN¥449.12 million.

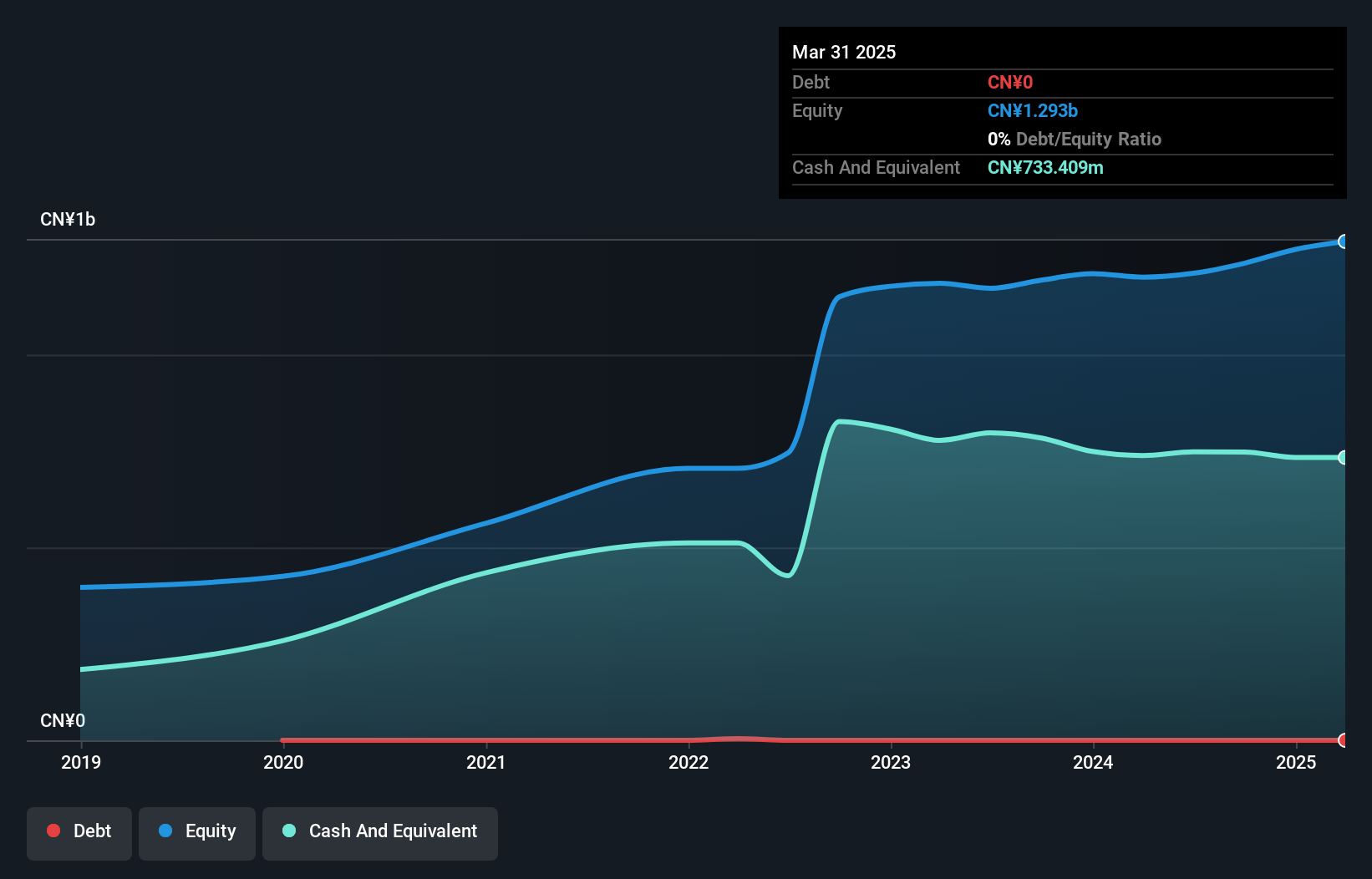

Sinotherapeutics, a nimble player in the pharmaceuticals space, has been making waves with a notable 56.7% earnings growth over the past year, outpacing the industry average of -2.5%. The company reported net income of CNY 92.57 million for the first nine months of 2024, up from CNY 44.08 million last year, and basic earnings per share doubled to CNY 0.21 from CNY 0.1. With no debt on its books and high-quality non-cash earnings bolstering its financial health, Sinotherapeutics seems well-positioned for future growth despite recent share buybacks totaling CNY 36.13 million potentially impacting liquidity slightly.

Eastcompeace TechnologyLtd (SZSE:002017)

Simply Wall St Value Rating: ★★★★★★

Overview: Eastcompeace Technology Co. Ltd offers smart card and system solutions both in China and internationally, with a market capitalization of CN¥6.50 billion.

Operations: Eastcompeace Technology Co. Ltd generates revenue primarily from smart card and system solutions. The company has a market capitalization of CN¥6.50 billion, indicating its scale in the industry.

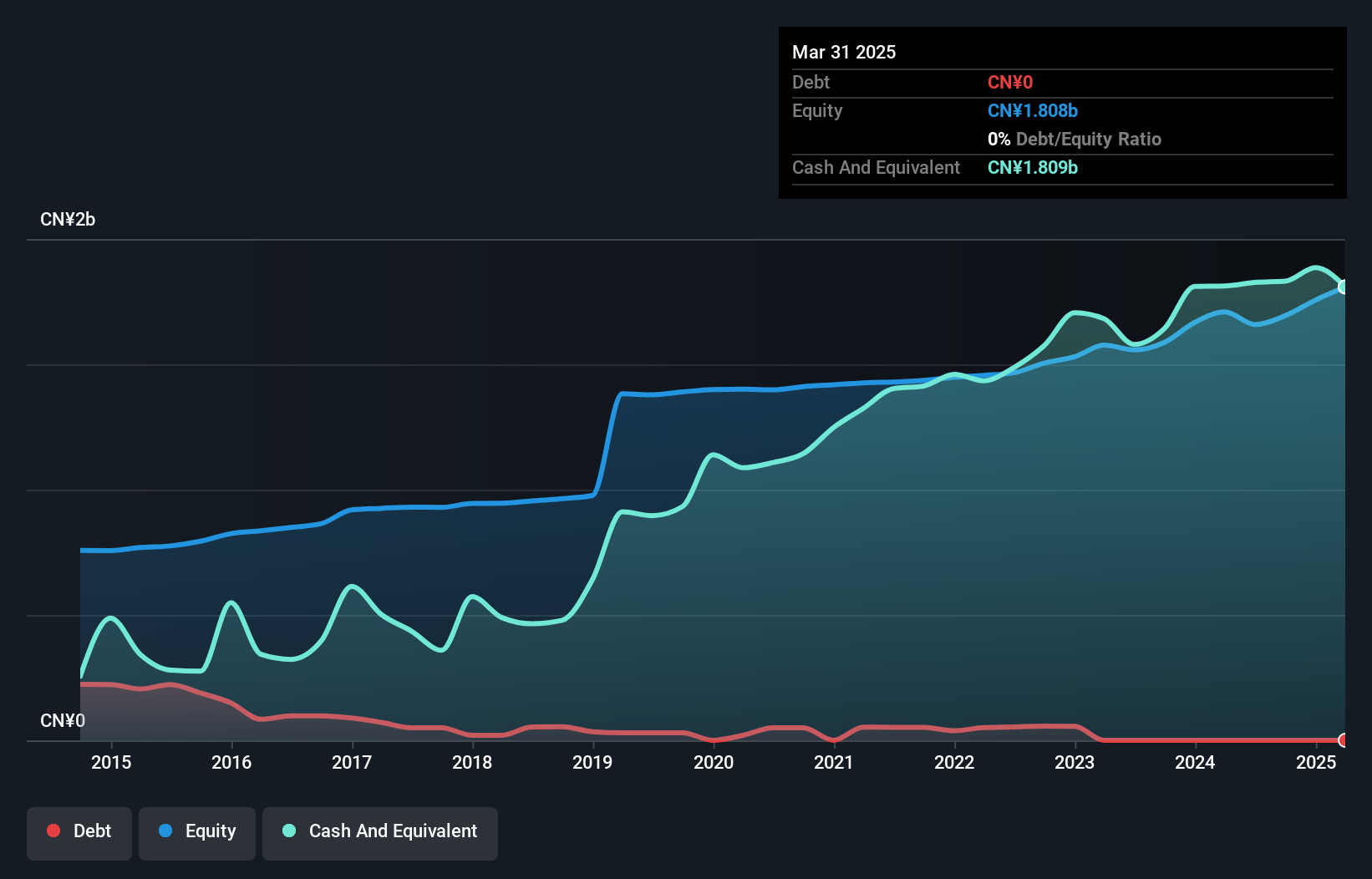

Eastcompeace Technology is making waves with its solid financial footing and growth trajectory. Over the past year, earnings surged by 38.5%, outpacing the tech industry's average. The company has no debt, a notable improvement from a debt-to-equity ratio of 2.2% five years ago, highlighting its robust balance sheet management. Additionally, it trades at approximately 11.8% below estimated fair value, suggesting potential undervaluation in the market. Recent earnings reports show net income rising to CNY 118.92 million from CNY 103.87 million last year, reflecting strong operational performance and shareholder value creation through consistent profitability and strategic positioning in the tech sector.

NOVA Technology (SZSE:300921)

Simply Wall St Value Rating: ★★★★★★

Overview: NOVA Technology Corporation Limited offers network communication services in China with a market capitalization of CN¥3.11 billion.

Operations: The company generates revenue primarily from its network communication services in China. It has a market capitalization of CN¥3.11 billion.

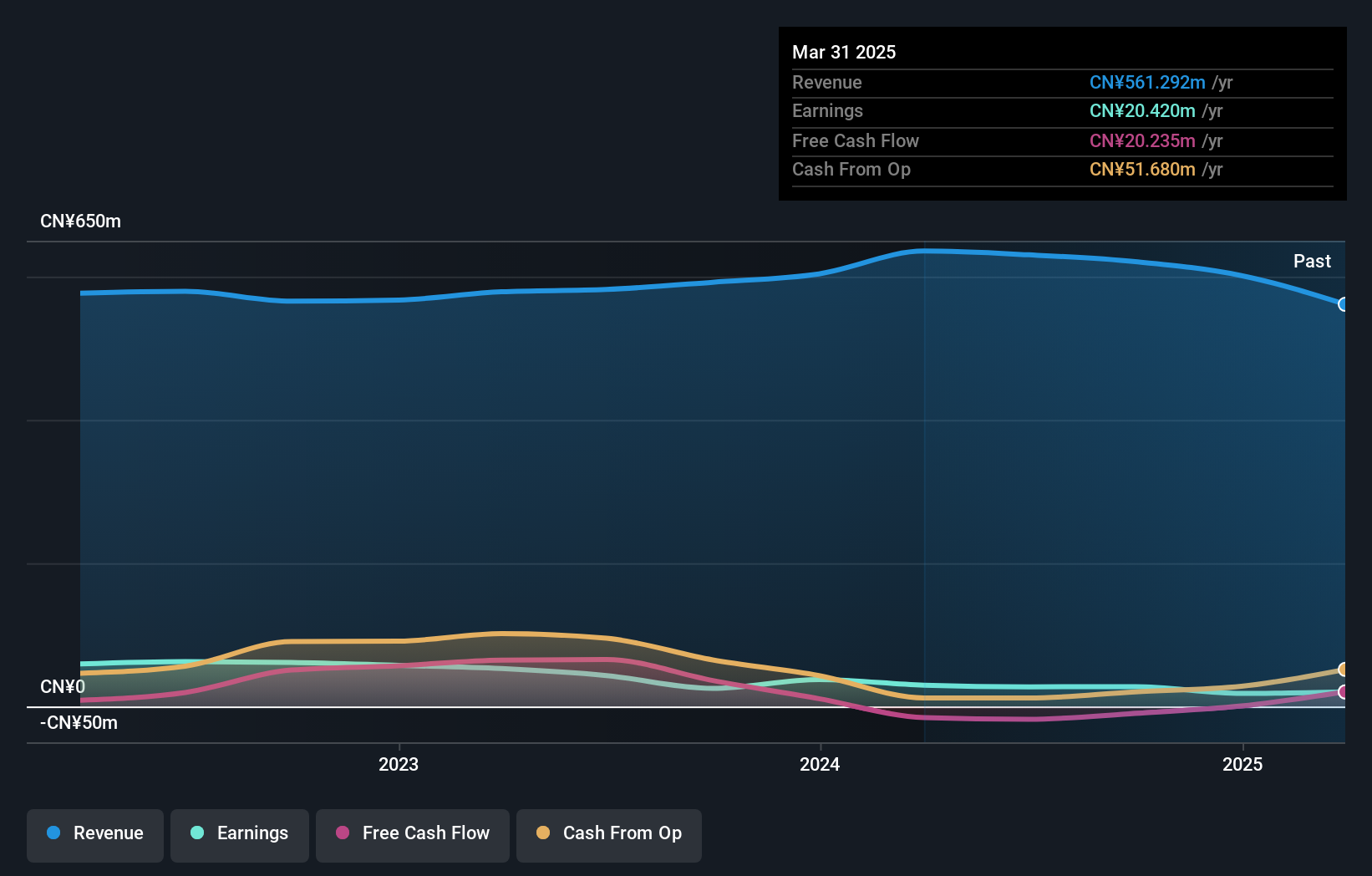

NOVA Technology, a small player in the tech space, has experienced some financial turbulence recently. Despite reporting sales of CNY 446.22 million for the first nine months of 2024, up from CNY 429.14 million last year, net income took a hit, dropping to CNY 5.75 million from CNY 15.56 million previously. This decline is reflected in basic earnings per share falling to CNY 0.04 from CNY 0.12 year-over-year. On the positive side, NOVA's debt-to-equity ratio improved significantly over five years from 1.3% to 0.8%, indicating better financial health despite recent earnings challenges.

- Unlock comprehensive insights into our analysis of NOVA Technology stock in this health report.

Explore historical data to track NOVA Technology's performance over time in our Past section.

Next Steps

- Click through to start exploring the rest of the 1397 Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688247

Sinotherapeutics

A specialty pharmaceutical company, develops generic and formulation products in China.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives