- China

- /

- Telecom Services and Carriers

- /

- SZSE:300578

With A 29% Price Drop For BizConf Telecom Co.,Ltd. (SZSE:300578) You'll Still Get What You Pay For

The BizConf Telecom Co.,Ltd. (SZSE:300578) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

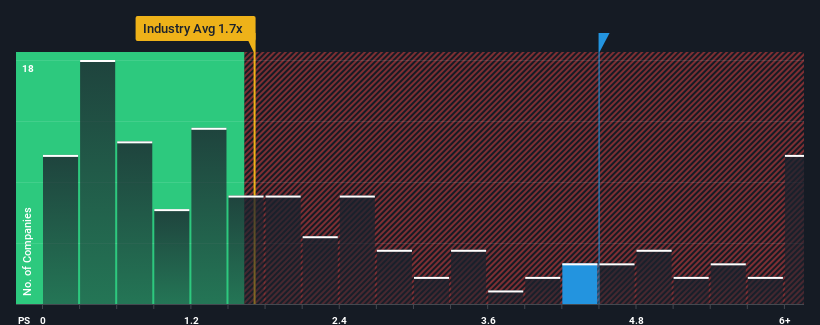

In spite of the heavy fall in price, when almost half of the companies in China's Telecom industry have price-to-sales ratios (or "P/S") below 3.5x, you may still consider BizConf TelecomLtd as a stock probably not worth researching with its 4.5x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for BizConf TelecomLtd

How BizConf TelecomLtd Has Been Performing

While the industry has experienced revenue growth lately, BizConf TelecomLtd's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on BizConf TelecomLtd will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, BizConf TelecomLtd would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 29% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 50% during the coming year according to the lone analyst following the company. That's shaping up to be materially higher than the 20% growth forecast for the broader industry.

With this information, we can see why BizConf TelecomLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On BizConf TelecomLtd's P/S

BizConf TelecomLtd's P/S remain high even after its stock plunged. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that BizConf TelecomLtd maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Telecom industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for BizConf TelecomLtd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if BizConf TelecomLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300578

BizConf TelecomLtd

Provides cloud video communication services in China and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives