- China

- /

- Telecom Services and Carriers

- /

- SZSE:300025

Optimistic Investors Push Hangzhou Huaxing Chuangye Communication Technology Co., Ltd. (SZSE:300025) Shares Up 37% But Growth Is Lacking

Hangzhou Huaxing Chuangye Communication Technology Co., Ltd. (SZSE:300025) shareholders are no doubt pleased to see that the share price has bounced 37% in the last month, although it is still struggling to make up recently lost ground. Looking back a bit further, it's encouraging to see the stock is up 45% in the last year.

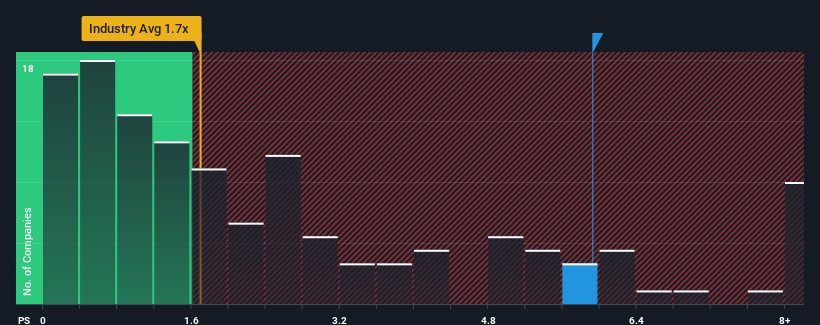

Since its price has surged higher, Hangzhou Huaxing Chuangye Communication Technology may be sending bearish signals at the moment with its price-to-sales (or "P/S") ratio of 5.9x, since almost half of all companies in the Telecom in China have P/S ratios under 4.1x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Hangzhou Huaxing Chuangye Communication Technology

How Has Hangzhou Huaxing Chuangye Communication Technology Performed Recently?

We'd have to say that with no tangible growth over the last year, Hangzhou Huaxing Chuangye Communication Technology's revenue has been unimpressive. One possibility is that the P/S is high because investors think the benign revenue growth will improve to outperform the broader industry in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Hangzhou Huaxing Chuangye Communication Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Hangzhou Huaxing Chuangye Communication Technology's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Hangzhou Huaxing Chuangye Communication Technology's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 13% drop in revenue. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for expansion of 20% shows it's an unpleasant look.

With this information, we find it concerning that Hangzhou Huaxing Chuangye Communication Technology is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Hangzhou Huaxing Chuangye Communication Technology shares have taken a big step in a northerly direction, but its P/S is elevated as a result. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Hangzhou Huaxing Chuangye Communication Technology currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. With a revenue decline on investors' minds, the likelihood of a souring sentiment is quite high which could send the P/S back in line with what we'd expect. Unless the the circumstances surrounding the recent medium-term improve, it wouldn't be wrong to expect a a difficult period ahead for the company's shareholders.

The company's balance sheet is another key area for risk analysis. Our free balance sheet analysis for Hangzhou Huaxing Chuangye Communication Technology with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Huaxing Chuangye Communication Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300025

Hangzhou Huaxing Chuangye Communication Technology

Hangzhou Huaxing Chuangye Communication Technology Co., Ltd.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives