- China

- /

- Telecom Services and Carriers

- /

- SZSE:002467

Asian Growth Stocks With Strong Insider Commitment

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and inflation dynamics, Asian economies remain a focal point for investors seeking growth opportunities. In this context, companies with high insider ownership can be particularly appealing, as they often signal strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.5% | 23.4% |

| Fulin Precision (SZSE:300432) | 9.7% | 44.2% |

| Sineng ElectricLtd (SZSE:300827) | 36% | 26.9% |

| Samyang Foods (KOSE:A003230) | 11.7% | 24.3% |

| NEXTIN (KOSDAQ:A348210) | 12.4% | 33.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11% | 63.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 40.6% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.1% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Techwing (KOSDAQ:A089030) | 18.8% | 68% |

Let's uncover some gems from our specialized screener.

Linklogis (SEHK:9959)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Linklogis Inc. is an investment holding company that provides supply chain finance technology and data-driven solutions in China, with a market cap of HK$3.39 billion.

Operations: Linklogis Inc. generates revenue through its Emerging Solutions, which include Cross-Border Cloud (CN¥51.06 million) and SME Credit Tech Solutions (CN¥9.57 million), as well as Supply Chain Finance Technology Solutions, comprising FI Cloud (CN¥306.89 million) and Anchor Cloud (CN¥663.66 million).

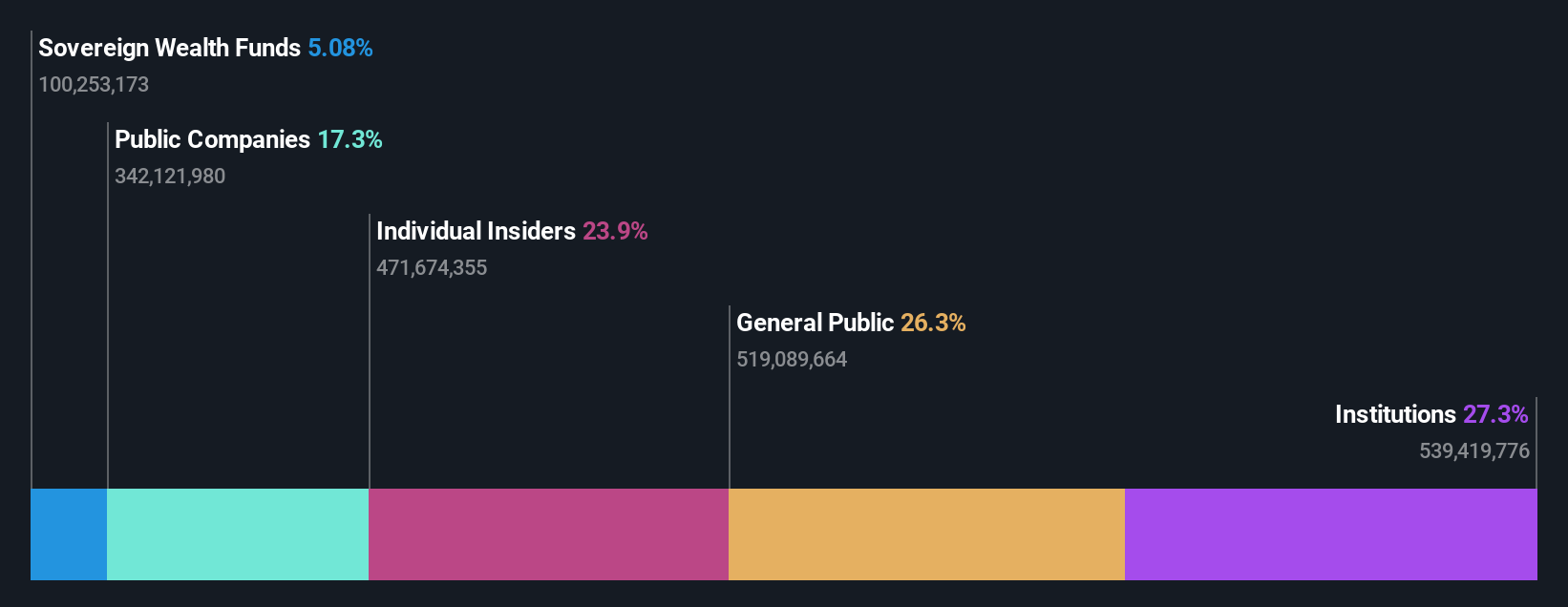

Insider Ownership: 23.9%

Revenue Growth Forecast: 10.6% p.a.

Linklogis is positioned for significant growth, with earnings projected to increase by 130.8% annually and profitability expected within three years. Despite a net loss of CNY 835.38 million in 2024, revenue rose to CNY 1.03 billion from the previous year, indicating positive momentum. Insider ownership remains stable without recent substantial insider trading activity. However, the share price has been highly volatile recently, and return on equity is forecasted to be low at 1.1%.

- Click here to discover the nuances of Linklogis with our detailed analytical future growth report.

- The valuation report we've compiled suggests that Linklogis' current price could be inflated.

NET263 (SZSE:002467)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NET263 Ltd. provides cloud services in China and internationally, with a market cap of CN¥8.36 billion.

Operations: Revenue Segments (in millions of CN¥):

Insider Ownership: 18.1%

Revenue Growth Forecast: 19.2% p.a.

NET263 is experiencing substantial earnings growth, projected at 39.38% annually, outpacing the broader CN market. Despite a decline in first-quarter revenue to CNY 188.29 million from CNY 257.98 million year-over-year, the company has turned profitable with a net income of CNY 68.54 million for 2024, compared to a prior loss. Insider ownership remains high without significant recent trading activity, supporting stability amid slower-than-expected revenue growth of 19.2% annually against forecasts above 20%.

- Unlock comprehensive insights into our analysis of NET263 stock in this growth report.

- According our valuation report, there's an indication that NET263's share price might be on the expensive side.

Shenzhen Envicool Technology (SZSE:002837)

Simply Wall St Growth Rating: ★★★★★★

Overview: Shenzhen Envicool Technology Co., Ltd. specializes in producing and selling temperature control and energy-saving solutions in China, with a market cap of CN¥24.59 billion.

Operations: The company generates revenue from its Precision Temperature Control Energy Saving Equipment segment, totaling CN¥4.78 billion.

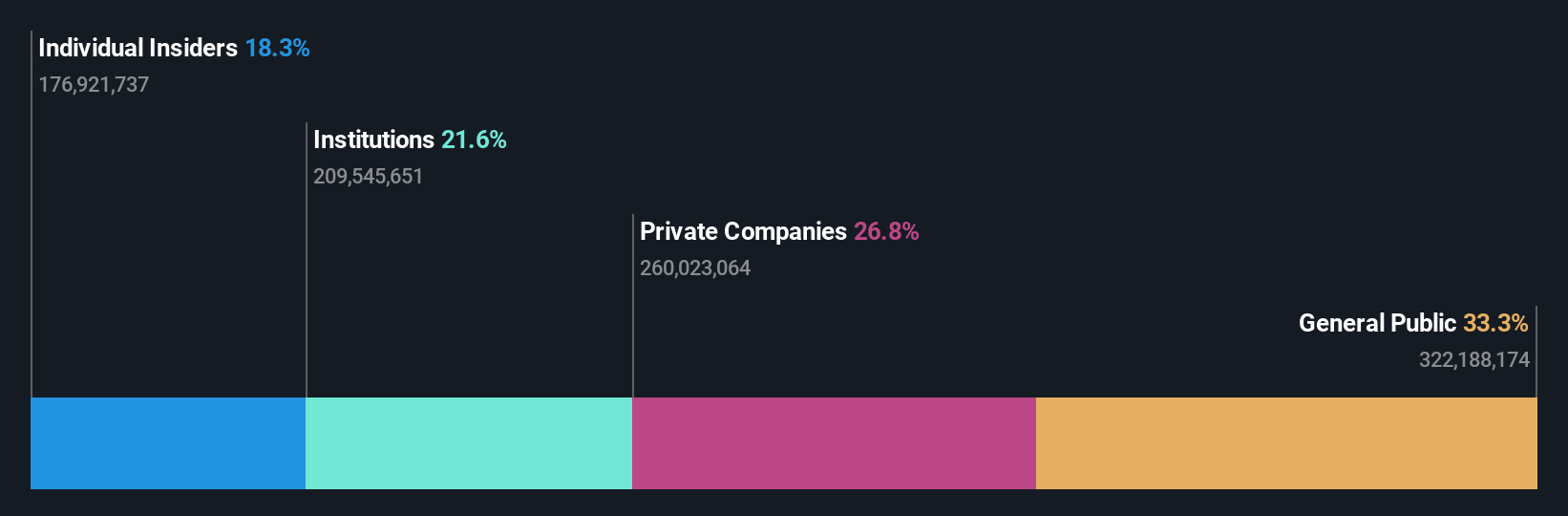

Insider Ownership: 18.3%

Revenue Growth Forecast: 25% p.a.

Shenzhen Envicool Technology demonstrates strong growth potential, with earnings forecasted to increase significantly at 27.8% annually, surpassing the broader Chinese market. The company reported a revenue rise to CNY 4.59 billion for 2024, and net income improved to CNY 452.66 million from the previous year. Despite trading well below its estimated fair value, dividends remain modest and not fully covered by free cash flow. Recent AGM amendments suggest strategic adjustments in governance structures.

- Take a closer look at Shenzhen Envicool Technology's potential here in our earnings growth report.

- The valuation report we've compiled suggests that Shenzhen Envicool Technology's current price could be quite moderate.

Taking Advantage

- Take a closer look at our Fast Growing Asian Companies With High Insider Ownership list of 620 companies by clicking here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NET263 might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002467

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives