- China

- /

- Telecom Services and Carriers

- /

- SHSE:603220

China Bester Group Telecom's (SHSE:603220) three-year earnings growth trails the 43% YoY shareholder returns

It might seem bad, but the worst that can happen when you buy a stock (without leverage) is that its share price goes to zero. But when you pick a company that is really flourishing, you can make more than 100%. For instance the China Bester Group Telecom Co., Ltd. (SHSE:603220) share price is 184% higher than it was three years ago. That sort of return is as solid as granite. Also pleasing for shareholders was the 39% gain in the last three months.

Since it's been a strong week for China Bester Group Telecom shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for China Bester Group Telecom

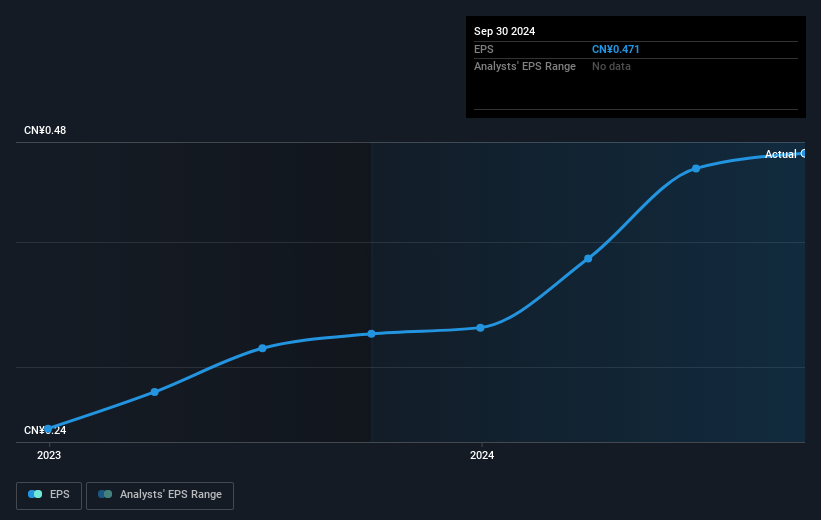

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During three years of share price growth, China Bester Group Telecom achieved compound earnings per share growth of 12% per year. This EPS growth is lower than the 42% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It is quite common to see investors become enamoured with a business, after a few years of solid progress. This optimism is also reflected in the fairly generous P/E ratio of 72.05.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, China Bester Group Telecom's TSR for the last 3 years was 192%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that China Bester Group Telecom shareholders have received a total shareholder return of 18% over one year. That's including the dividend. That's better than the annualised return of 14% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for China Bester Group Telecom (2 don't sit too well with us!) that you should be aware of before investing here.

Of course China Bester Group Telecom may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603220

China Bester Group Telecom

Engages in the planning, design, construction, maintenance, and optimization of communications networks for telecom operators in China.

Second-rate dividend payer with low risk.

Market Insights

Community Narratives