- China

- /

- Telecom Services and Carriers

- /

- SHSE:600804

Investors Don't See Light At End Of Dr. Peng Telecom & Media Group Co., Ltd.'s (SHSE:600804) Tunnel And Push Stock Down 26%

Unfortunately for some shareholders, the Dr. Peng Telecom & Media Group Co., Ltd. (SHSE:600804) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 55% loss during that time.

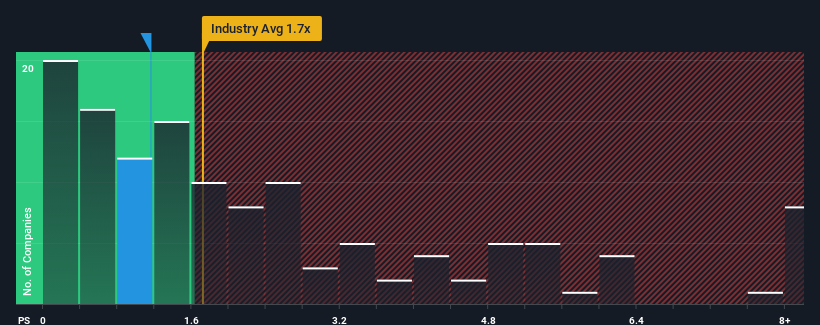

Following the heavy fall in price, considering about half the companies operating in China's Telecom industry have price-to-sales ratios (or "P/S") above 3.4x, you may consider Dr. Peng Telecom & Media Group as an great investment opportunity with its 1.2x P/S ratio. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Dr. Peng Telecom & Media Group

How Has Dr. Peng Telecom & Media Group Performed Recently?

Dr. Peng Telecom & Media Group certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Dr. Peng Telecom & Media Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For Dr. Peng Telecom & Media Group?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Dr. Peng Telecom & Media Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 11%. However, this wasn't enough as the latest three year period has seen an unpleasant 36% overall drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 5.8% as estimated by the sole analyst watching the company. Meanwhile, the rest of the industry is forecast to expand by 24%, which is noticeably more attractive.

With this in consideration, its clear as to why Dr. Peng Telecom & Media Group's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Dr. Peng Telecom & Media Group's P/S looks about as weak as its stock price lately. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Dr. Peng Telecom & Media Group's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. The company will need a change of fortune to justify the P/S rising higher in the future.

Before you take the next step, you should know about the 1 warning sign for Dr. Peng Telecom & Media Group that we have uncovered.

If these risks are making you reconsider your opinion on Dr. Peng Telecom & Media Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600804

Dr. Peng Telecom & Media Group

Engages in smart cloud network, home broadband and value-added, data center, industrial Internet, and digital economy industrial park businesses.

Slight and slightly overvalued.

Market Insights

Community Narratives