- China

- /

- Electronic Equipment and Components

- /

- SZSE:301205

Exploring Three Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In the current global market landscape, uncertainty surrounding tariffs and mixed economic indicators have led to a cautious sentiment among investors, with major indices like the S&P 500 experiencing slight declines. Despite these challenges, small-cap stocks, often overlooked in times of broader market volatility, can present unique opportunities for growth as they may benefit from localized economic trends or niche markets. Identifying promising small-cap stocks involves looking for companies with strong fundamentals and potential resilience amid changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 263.90% | 20.29% | 37.81% | ★★★★☆☆ |

| Nederman Holding | 73.66% | 11.98% | 17.61% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Datang Telecom Technology (SHSE:600198)

Simply Wall St Value Rating: ★★★★★☆

Overview: Datang Telecom Technology Co., Ltd. engages in integrated circuit design and special communications in China, with a market cap of CN¥12.21 billion.

Operations: Datang Telecom Technology generates revenue primarily from its integrated circuit design and special communications segments. The company's financial performance is characterized by a focus on these core areas, with specific emphasis on cost management to optimize profitability.

Datang Telecom has made significant strides, becoming profitable this year, which marks a notable turnaround in its financial trajectory. The company's debt-to-equity ratio has impressively decreased from 4434.3% to 43.5% over the past five years, indicating improved financial health. Despite recent share price volatility, Datang's strong non-cash earnings suggest underlying operational strength. With more cash than total debt and interest payments well-covered by profits, Datang seems financially stable despite not being free cash flow positive yet. An upcoming shareholders meeting on December 18 could provide further insights into strategic directions and potential growth opportunities for this telecommunications player.

- Take a closer look at Datang Telecom Technology's potential here in our health report.

Understand Datang Telecom Technology's track record by examining our Past report.

Linktel Technologies (SZSE:301205)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Linktel Technologies Co., Ltd. specializes in the research, development, production, and sale of optical transceiver modules both within China and internationally, with a market cap of CN¥10.48 billion.

Operations: Linktel Technologies generates revenue primarily from the optical communication industry, amounting to CN¥806.88 million. The company's financial data highlights its focus on this sector as a key revenue stream.

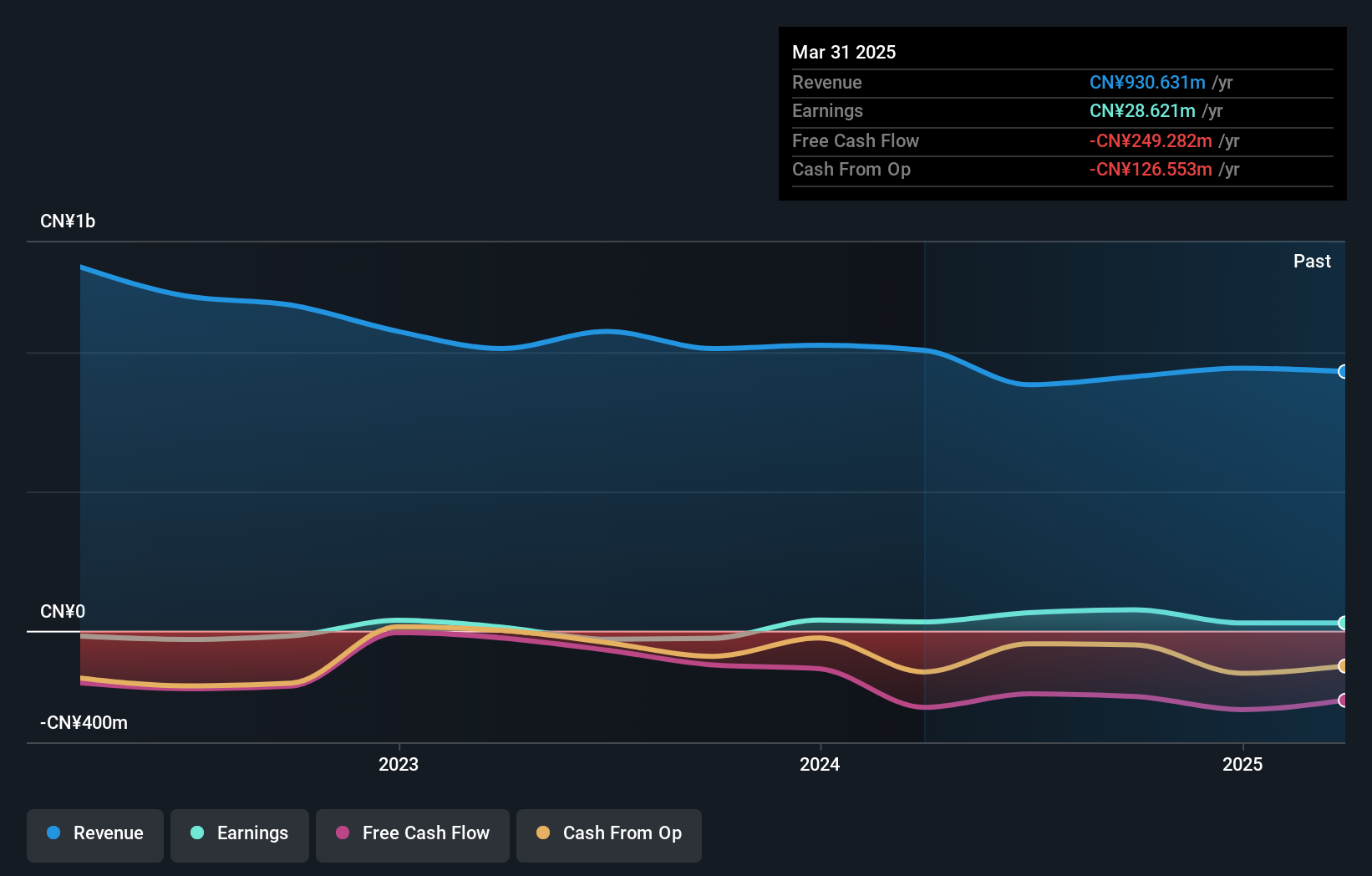

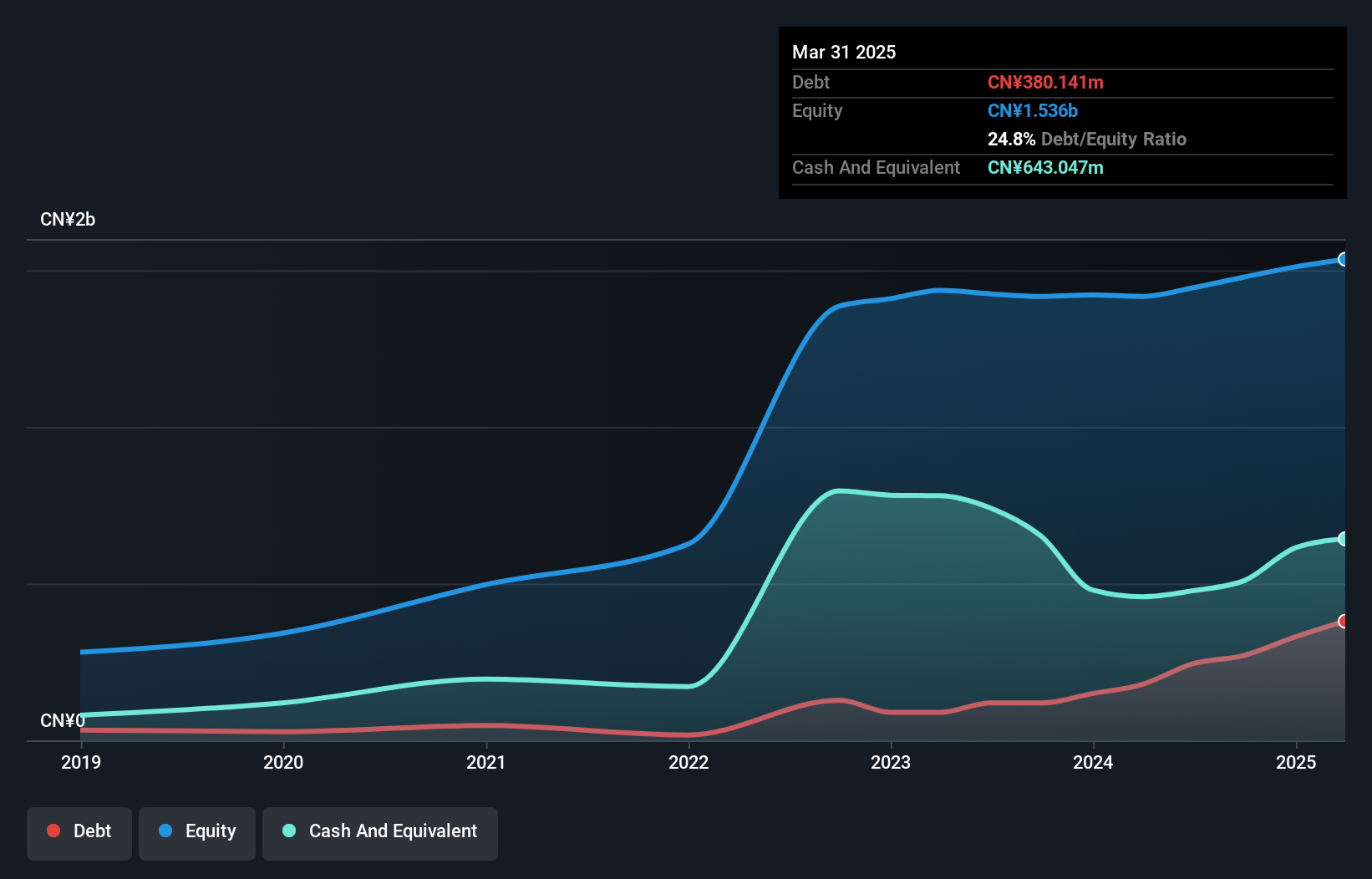

Linktel Technologies, a smaller player in the tech sector, has shown impressive earnings growth of 47% over the past year, outpacing the broader electronic industry. Despite this positive momentum, it faces challenges with its debt to equity ratio rising from 8.8% to 18.3% over five years and negative free cash flow standing at US$237 million as of September 2024. The company holds more cash than its total debt and remains profitable, suggesting financial stability amidst volatility in share price recently observed over three months. Overall, Linktel's robust earnings growth highlights potential despite financial hurdles.

- Click here and access our complete health analysis report to understand the dynamics of Linktel Technologies.

Gain insights into Linktel Technologies' past trends and performance with our Past report.

Suzhou Tianmai Thermal Technology (SZSE:301626)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Tianmai Thermal Technology Co., Ltd. specializes in the production of thermal management solutions and has a market cap of CN¥12.48 billion.

Operations: Suzhou Tianmai generates revenue primarily from its electronic components and parts segment, amounting to CN¥939.63 million.

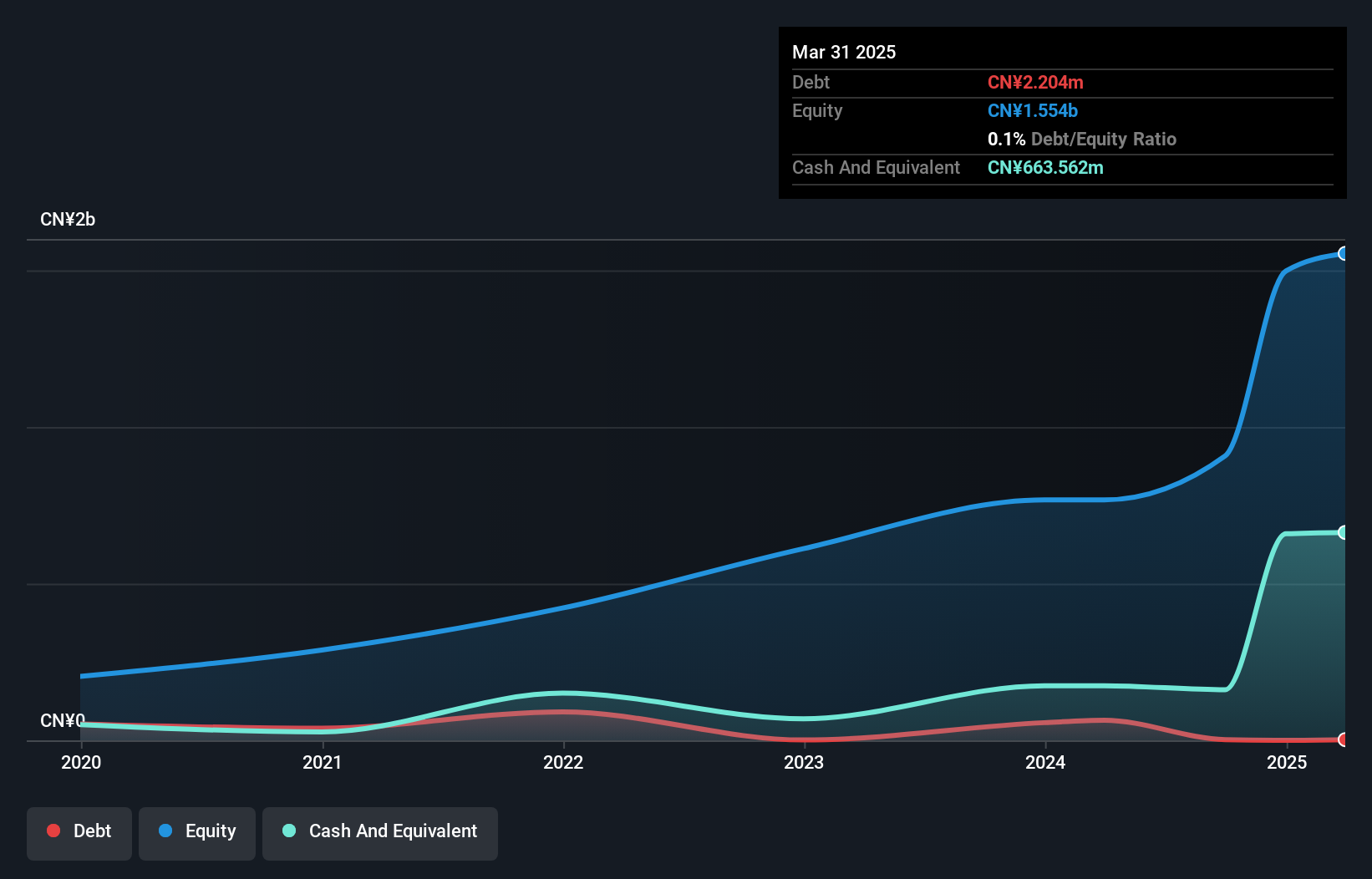

Tianmai Thermal, a smaller player in the electronics sector, has shown impressive earnings growth of 28.7% over the past year, outpacing the industry average of 3%. The company is free cash flow positive with recent figures reaching US$57.08 million as of September 2024. Despite insufficient data on debt reduction over five years, Tianmai's financial health seems solid with more cash than total debt and high-quality earnings reported. Recent changes to its articles of association suggest strategic adjustments are underway, potentially positioning it for future opportunities in its niche market segment.

Make It Happen

- Gain an insight into the universe of 4708 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301205

Linktel Technologies

Focuses on the research and development, production, and sale of optical transceiver modules in China and internationally.

High growth potential with proven track record.

Market Insights

Community Narratives