- China

- /

- Electronic Equipment and Components

- /

- SHSE:603516

Undiscovered Gems Including 3 Small Caps with Strong Fundamentals

Reviewed by Simply Wall St

As the year draws to a close, global markets have experienced moderate gains amidst fluctuating consumer confidence and economic indicators, with small-cap stocks like those in the S&P 600 navigating a complex landscape of declining durable goods orders and shifting jobless claims. Despite these challenges, small-cap companies with strong fundamentals can be attractive opportunities for investors seeking potential growth, as they often possess unique qualities such as robust financial health and innovative business models that can thrive even in uncertain market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Beijing Tricolor Technology (SHSE:603516)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Tricolor Technology Co., Ltd is a company that manufactures and sells professional audio and video products globally, with a market capitalization of CN¥11.15 billion.

Operations: Tricolor Technology generates revenue primarily from the display control industry, amounting to CN¥484.76 million. The company's market capitalization stands at CN¥11.15 billion.

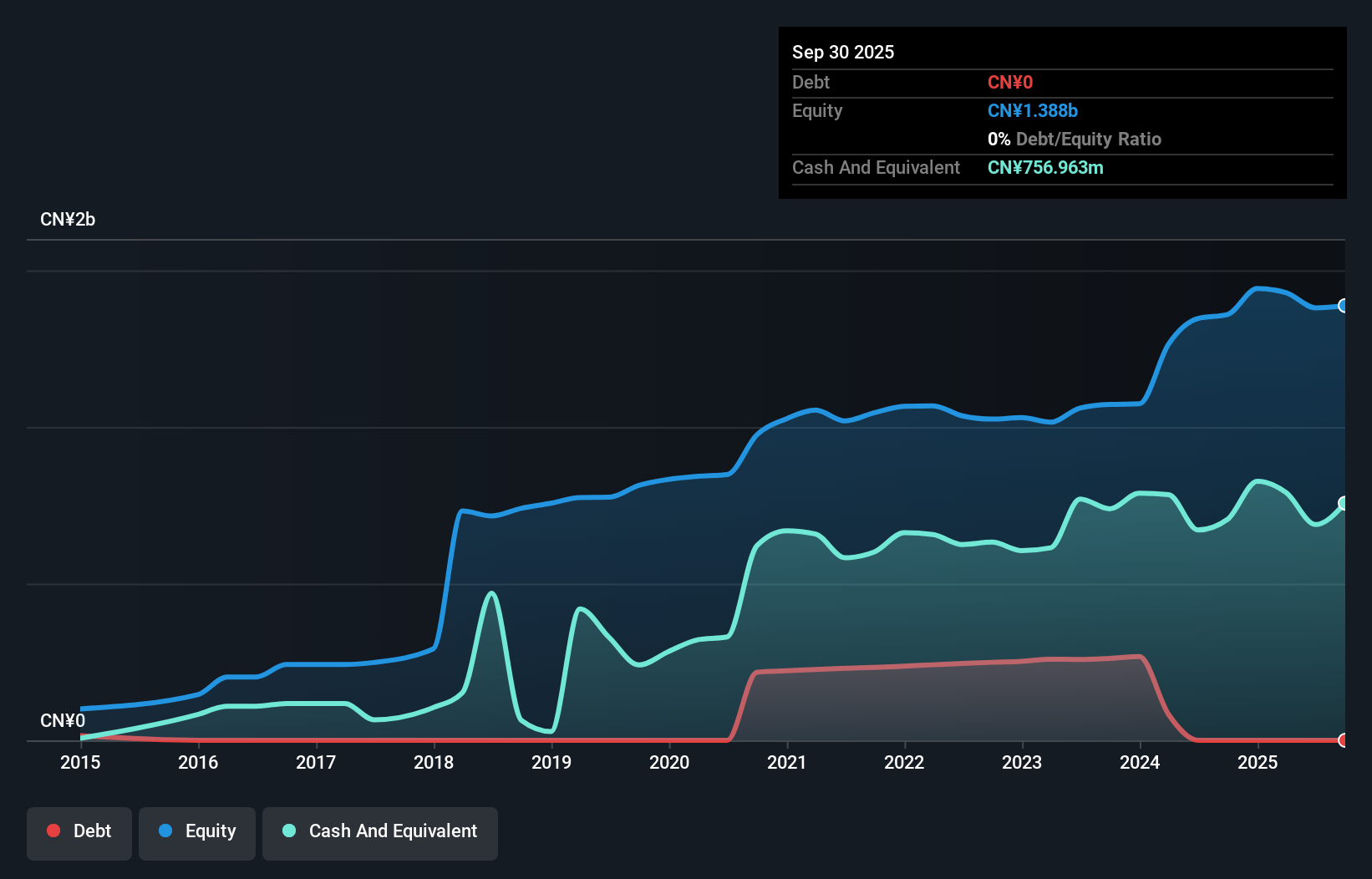

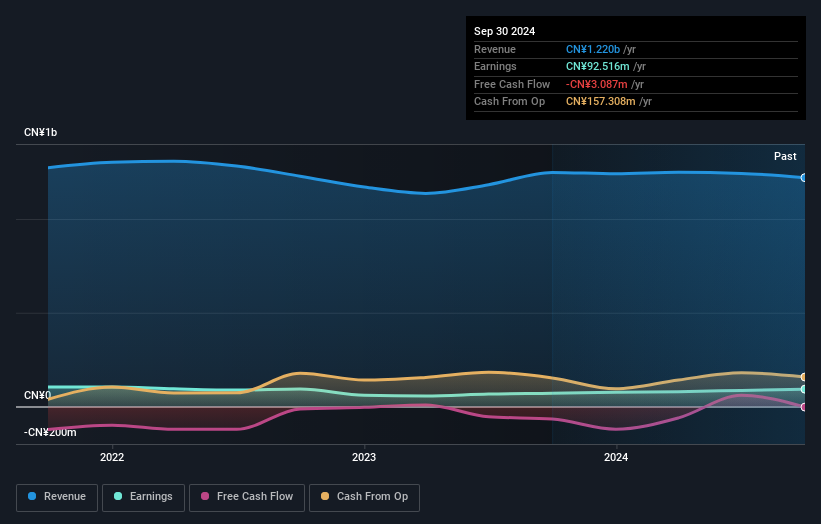

Beijing Tricolor Technology, a smaller player in the electronics sector, has shown impressive earnings growth of 188.4% over the past year, outpacing the industry's 1.9%. The firm reported net income of CNY 51.51 million for nine months ending September 2024, up from CNY 11.59 million a year ago, reflecting its high-quality earnings despite sales dipping to CNY 326.52 million from CNY 337.34 million last year. With no debt and positive free cash flow, Beijing Tricolor seems well-positioned financially; however, recent shareholder dilution and volatile share prices may warrant caution moving forward.

- Take a closer look at Beijing Tricolor Technology's potential here in our health report.

Understand Beijing Tricolor Technology's track record by examining our Past report.

Shenglan Technology (SZSE:300843)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenglan Technology Co., Ltd. engages in the research, development, manufacturing, and sale of electronic connectors, wire harness components, and precision components globally with a market capitalization of CN¥5.69 billion.

Operations: Shenglan Technology generates revenue primarily through the sale of electronic connectors, wire harness components, and precision components. The company's financial performance is characterized by its gross profit margin trend, which has shown notable variations over recent periods.

Shenglan Technology, a smaller player in the tech space, has shown mixed financial performance recently. Its earnings grew by 31% over the past year, outpacing the industry growth of 2%. However, its debt to equity ratio has risen from 0% to 22% over five years. Despite this leverage increase, Shenglan's interest coverage remains solid. The company reported net income of CNY 87.69 million for nine months ending September 2024 compared to CNY 71.69 million last year and basic earnings per share rose from CNY 0.48 to CNY 0.58 in this period. Recent shareholder meetings indicate potential capital restructuring through convertible bonds issuance plans which may affect future returns and capital structure dynamics.

Flaircomm Microelectronics (SZSE:301600)

Simply Wall St Value Rating: ★★★★★★

Overview: Flaircomm Microelectronics, Inc. develops and sells wireless communication modules, embedded software, and turnkey system solutions for automotive and M2M applications in China with a market cap of CN¥13.98 billion.

Operations: Flaircomm generates revenue primarily from its wireless communications equipment segment, which recorded CN¥995.17 million. The company's financial performance includes a focus on managing costs to influence its overall profitability.

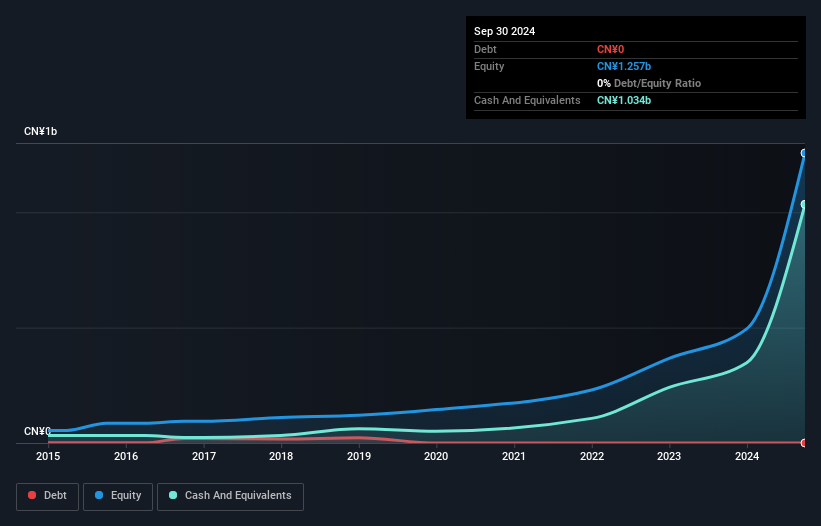

Flaircomm Microelectronics, a nimble player in the tech space, showcases robust financial health with no debt, contrasting its 4.2% debt to equity ratio from five years ago. Over the past year, earnings surged by 44.7%, outpacing the communications sector's -3% performance. This growth is reflected in their recent nine-month results showing sales of CNY 734.85 million and net income of CNY 134.87 million, up from CNY 552.83 million and CNY 93.19 million respectively last year. Despite high volatility in share price recently, Flaircomm's forecasted earnings growth of over 30% annually suggests promising potential ahead.

Next Steps

- Click here to access our complete index of 4628 Undiscovered Gems With Strong Fundamentals.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Tricolor Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603516

Beijing Tricolor Technology

Manufactures and sells professional audio and video products worldwide.

Flawless balance sheet with high growth potential.