- China

- /

- Communications

- /

- SHSE:603083

CIG Shanghai And 2 Other Promising Small Caps In Asia

Reviewed by Simply Wall St

As global markets navigate a landscape marked by new tariffs and mixed economic signals, the Asian indices have shown resilience, with China's Shanghai Composite Index rising over 1% amid hopes for additional stimulus. In this environment, small-cap stocks in Asia present intriguing opportunities for investors seeking growth potential outside of the more volatile large-cap sector. Identifying promising small caps involves looking for companies with strong fundamentals and unique market positions that can thrive despite broader market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Allmed Medical ProductsLtd | 20.96% | -1.35% | -31.57% | ★★★★★★ |

| Guangzhou Devotion Thermal Technology | 7.05% | -5.25% | 19.74% | ★★★★★★ |

| Zhejiang Haisen Pharmaceutical | NA | 4.06% | 9.83% | ★★★★★★ |

| Anji Foodstuff | NA | 9.26% | -13.65% | ★★★★★★ |

| TCM Biotech International | 2.98% | 5.76% | -0.13% | ★★★★★★ |

| Suzhou Longjie Special Fiber | 1.49% | 12.26% | -16.14% | ★★★★★☆ |

| Lungyen Life Service | 5.26% | 1.68% | -3.57% | ★★★★★☆ |

| Huasi Holding | 16.28% | 5.13% | 20.61% | ★★★★★☆ |

| Guangdong Sanhe Pile | 76.56% | -2.58% | -32.76% | ★★★★☆☆ |

| JinXianDai Information IndustryLtd | 16.46% | -0.60% | -32.74% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

CIG Shanghai (SHSE:603083)

Simply Wall St Value Rating: ★★★★★★

Overview: CIG Shanghai Co., Ltd. focuses on the research, development, production, and sale of edge computing, industrial interconnection, and high-speed optical module products both in China and internationally with a market cap of CN¥14.09 billion.

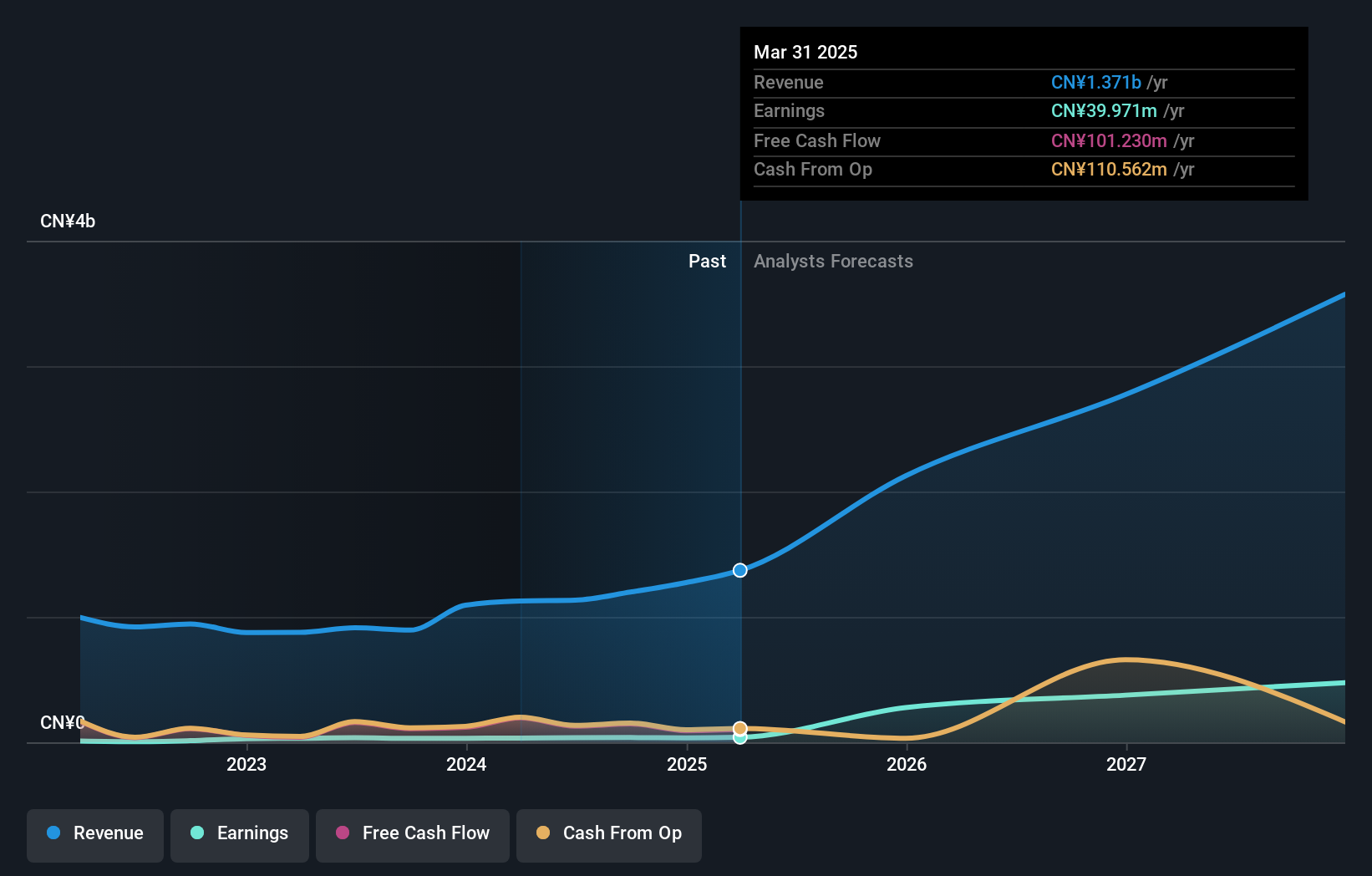

Operations: CIG Shanghai generates revenue primarily from the computer, communications, and other electronic equipment manufacturing segment, which accounted for CN¥3.70 billion. The company's financial performance is influenced by its ability to manage costs within this segment effectively.

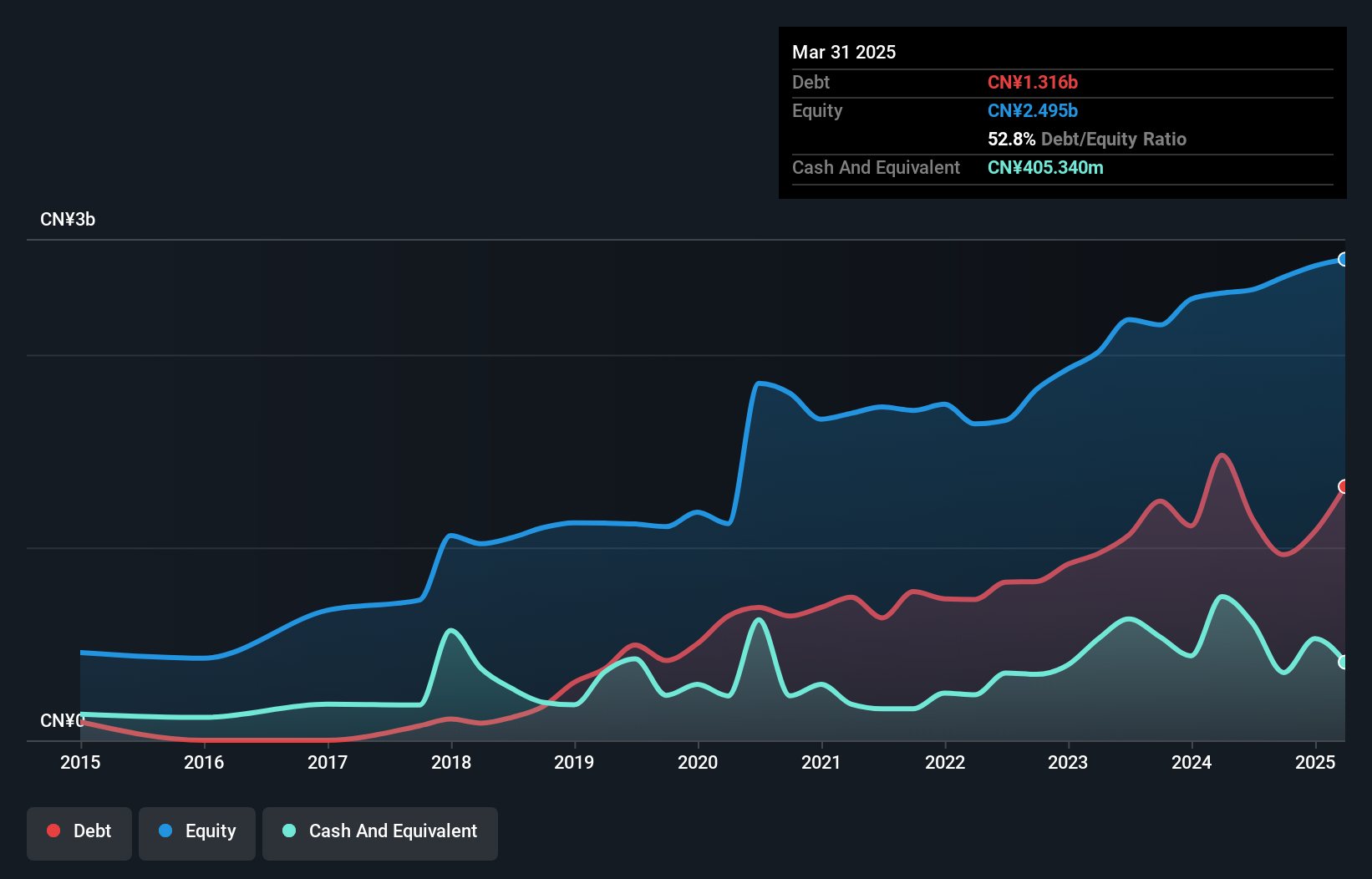

CIG Shanghai, a smaller player in the communications sector, has shown impressive earnings growth of 247.8% over the past year, significantly outpacing the industry average of 8.8%. The company's debt situation seems manageable with a net debt to equity ratio at a satisfactory 36.5%, down from 57.3% five years ago. Despite its high-quality earnings and well-covered interest payments (45.4x EBIT), CIG's share price has been highly volatile recently. In Q1 2025, sales reached ¥893 million, up from ¥850 million last year, with net income rising to ¥31 million from ¥26 million previously.

- Click to explore a detailed breakdown of our findings in CIG Shanghai's health report.

Assess CIG Shanghai's past performance with our detailed historical performance reports.

Shanghai Cooltech Power (SZSE:300153)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Cooltech Power Co., Ltd. manufactures and sells power generation equipment in China with a market cap of CN¥10.82 billion.

Operations: The company generates revenue primarily from the sale of power generation equipment. It has a market capitalization of CN¥10.82 billion, indicating its significant presence in the industry.

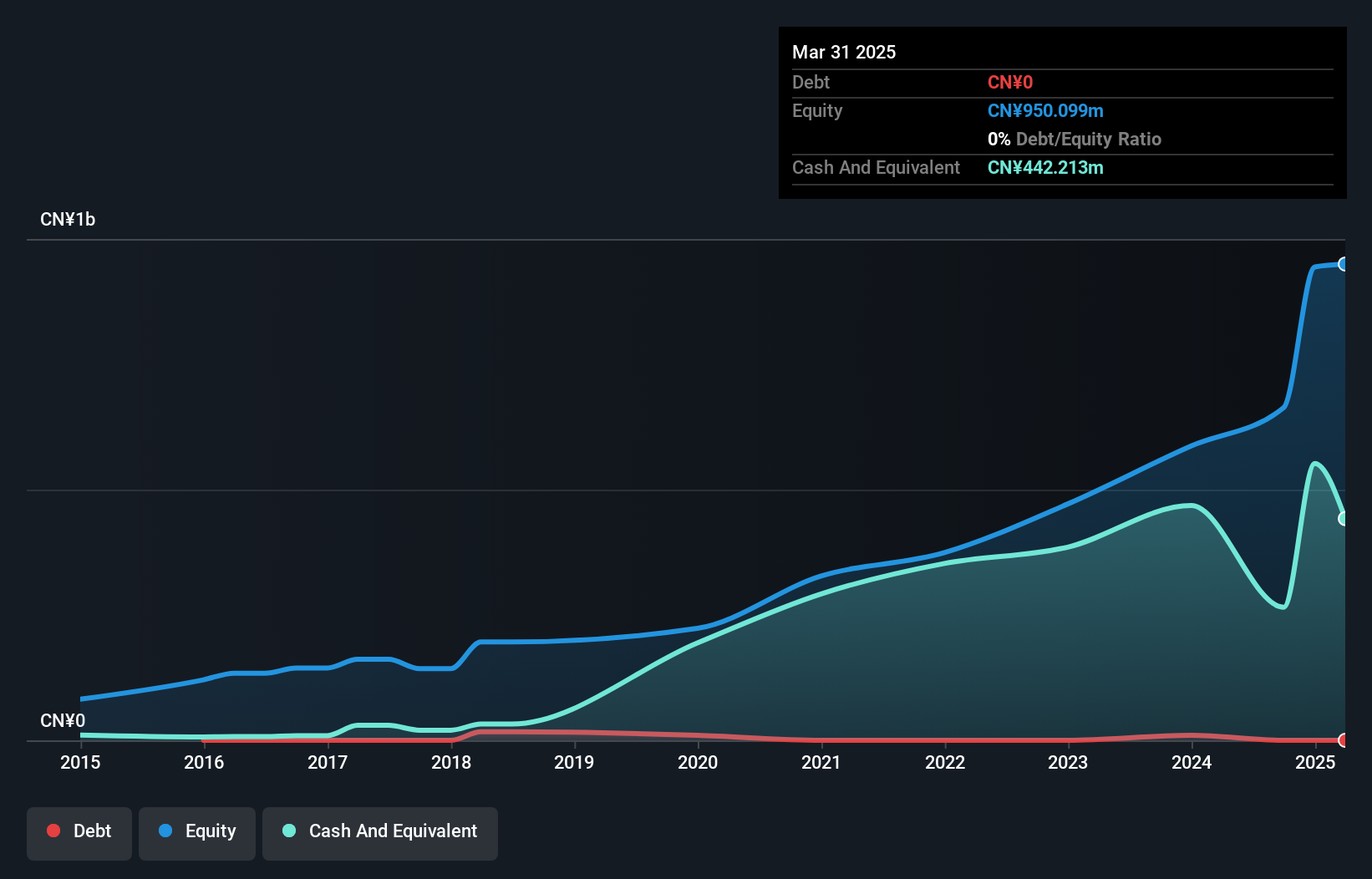

Shanghai Cooltech Power has been on an upward trajectory, with earnings growing 19.4% over the past year, outpacing the Electrical industry’s -1.2%. The company reported a net income of CNY 13.86 million for Q1 2025, up from CNY 8.89 million in the previous year, reflecting its robust performance and high-quality earnings profile. Over five years, it reduced its debt-to-equity ratio from 24.8% to 13.9%, showcasing improved financial health with more cash than total debt on hand. Despite recent share price volatility, Cooltech's strategic moves like expanding business scope signal potential for future growth amid solid financial footing.

- Click here to discover the nuances of Shanghai Cooltech Power with our detailed analytical health report.

Gain insights into Shanghai Cooltech Power's past trends and performance with our Past report.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. (SZSE:301556) specializes in agricultural technology solutions and has a market capitalization of CN¥8.76 billion.

Operations: Zhejiang Top Cloud-agri Technology generates revenue through its agricultural technology solutions. The company's market capitalization is CN¥8.76 billion.

Zhejiang Top Cloud-agri Technology, a nimble player in the tech space, showcases robust financial health with no debt and high-quality earnings. Over the past year, its earnings grew by 4.8%, outpacing the Electronic industry's 2.9% growth rate, reflecting strong operational performance. The company also reported positive free cash flow of CNY 80.96 million as of March 2025, suggesting effective cash management despite capital expenditures of CNY 20.47 million during the same period. Recently approved dividends and amendments to its articles indicate proactive governance and shareholder engagement strategies that could enhance future value creation prospects.

- Take a closer look at Zhejiang Top Cloud-agri TechnologyLtd's potential here in our health report.

Learn about Zhejiang Top Cloud-agri TechnologyLtd's historical performance.

Seize The Opportunity

- Delve into our full catalog of 2611 Asian Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603083

CIG Shanghai

Engages in the research and development, production, and sale of edge computing, industrial interconnection, and high-speed optical module products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives