- China

- /

- Tech Hardware

- /

- SZSE:301503

Uncovering None And Two Other Hidden Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mix of economic indicators, including declining consumer confidence and manufacturing orders in the U.S., investors are keenly observing the performance of small-cap stocks amid broader market fluctuations. While major indices like the Nasdaq Composite have shown resilience, uncovering hidden gems within smaller companies can offer unique opportunities for diversification and growth potential. In this context, identifying a good stock often involves looking for those with strong fundamentals that may thrive despite current economic challenges or shifting market sentiments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Formula Systems (1985) | 37.70% | 9.99% | 13.08% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Likhami Consulting | NA | 1.68% | -12.74% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Y.D. More Investments | 69.32% | 30.27% | 27.89% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Grupo Profuturo. de (BMV:GPROFUT *)

Simply Wall St Value Rating: ★★★★☆☆

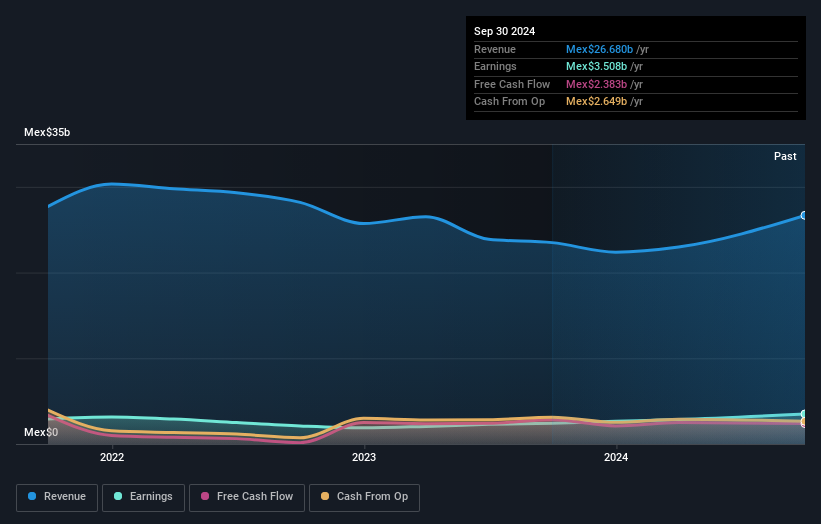

Overview: Grupo Profuturo, S.A.B. de C.V. operates in Mexico, focusing on managing loans and pension and retirement funds, with a market capitalization of MX$28.51 billion.

Operations: Grupo Profuturo's revenue streams primarily derive from managing loans and pension and retirement funds. The company has a market capitalization of MX$28.51 billion, reflecting its significant presence in the financial sector in Mexico.

Grupo Profuturo stands out with a notable earnings growth of 44.2% over the past year, surpassing the Capital Markets industry average of 6.7%. The company reported net income of MXN 2.48 billion for the first nine months of 2024, up from MXN 1.62 billion in the same period last year, reflecting strong performance. Its price-to-earnings ratio is a favorable 8.5x compared to the market's 11.6x, suggesting potential value for investors. Despite an increase in debt to equity from 13% to nearly 39% over five years, interest payments are well-covered at a healthy EBIT coverage ratio of 10x.

- Dive into the specifics of Grupo Profuturo. de here with our thorough health report.

Evaluate Grupo Profuturo. de's historical performance by accessing our past performance report.

Changzhou Tenglong AutoPartsCo.Ltd (SHSE:603158)

Simply Wall St Value Rating: ★★★★★☆

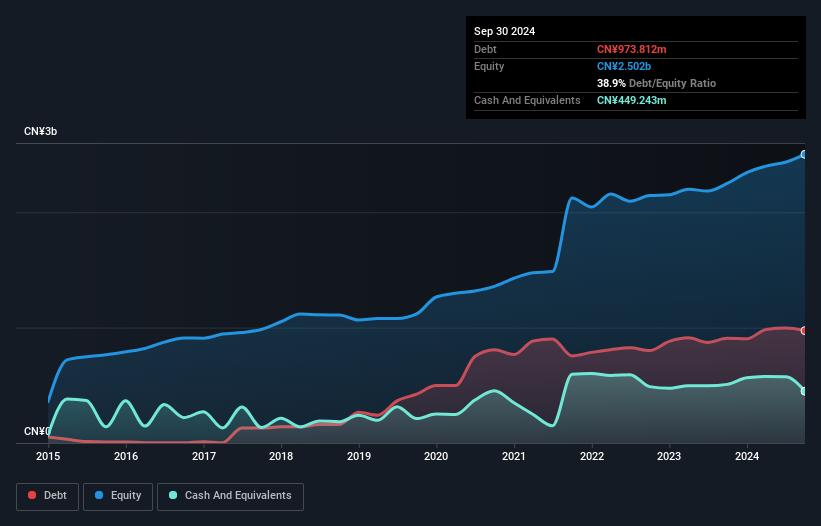

Overview: Changzhou Tenglong AutoPartsCo., Ltd. engages in the research, development, manufacturing, and sale of auto parts both in China and internationally with a market capitalization of CN¥4.01 billion.

Operations: The company generates revenue through the sale of auto parts in China and international markets. It has a market capitalization of CN¥4.01 billion, indicating its size within the industry.

Changzhou Tenglong AutoPartsCo. stands out with impressive earnings growth of 83% over the past year, surpassing the industry average of 10%. The company is trading at a favorable price-to-earnings ratio of 13.8x, significantly lower than the CN market's 36.1x, suggesting good relative value. Despite a slight increase in its debt to equity ratio from 37.8% to 38.9% over five years, it remains satisfactory at 21%. Recent financials reveal net income jumped to CNY236 million from CNY140 million year-on-year for nine months ending September, reflecting robust performance and potential for future growth.

- Click to explore a detailed breakdown of our findings in Changzhou Tenglong AutoPartsCo.Ltd's health report.

Understand Changzhou Tenglong AutoPartsCo.Ltd's track record by examining our Past report.

G.Tech Technology (SZSE:301503)

Simply Wall St Value Rating: ★★★★★★

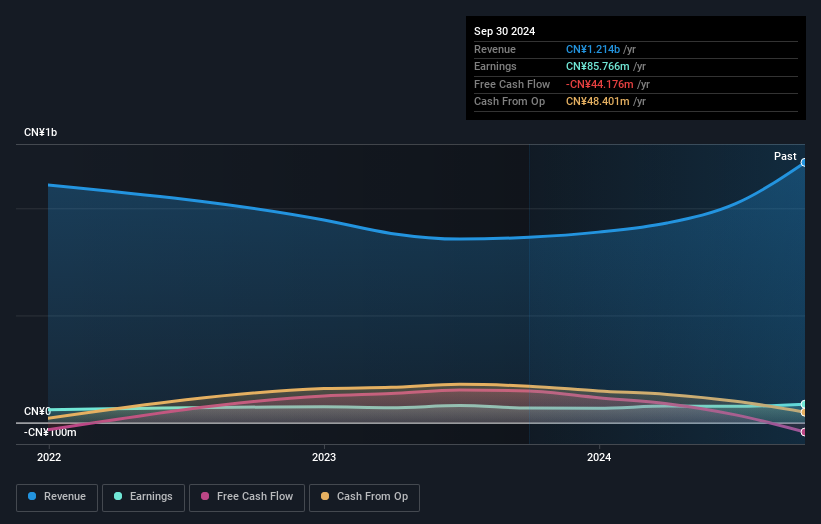

Overview: G.Tech Technology Ltd. is a company that develops, manufactures, and sells computer peripheral products in China with a market capitalization of CN¥2.87 billion.

Operations: G.Tech Technology generates revenue primarily from its computer peripherals segment, amounting to CN¥1.21 billion.

G.Tech Technology seems to be an intriguing player in the tech space with a price-to-earnings ratio of 33.5x, which is below the CN market average of 36.1x, indicating potential value for investors. The company has demonstrated robust earnings growth of 26.3% over the past year, surpassing the industry’s -0.7%. Despite being debt-free and having high-quality non-cash earnings, G.Tech faces challenges with negative free cash flow as of late 2024 (CNY -44 million). Recent board changes might influence strategic direction following their December EGM where new directors and supervisors were elected.

- Navigate through the intricacies of G.Tech Technology with our comprehensive health report here.

Assess G.Tech Technology's past performance with our detailed historical performance reports.

Next Steps

- Dive into all 4628 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301503

G.Tech Technology

Develops, manufactures, and sells computer peripheral products in China.

Flawless balance sheet with acceptable track record.