- China

- /

- Electronic Equipment and Components

- /

- SZSE:301421

Why Investors Shouldn't Be Surprised By Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd.'s (SZSE:301421) 31% Share Price Surge

Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd. (SZSE:301421) shares have continued their recent momentum with a 31% gain in the last month alone. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 10% over that time.

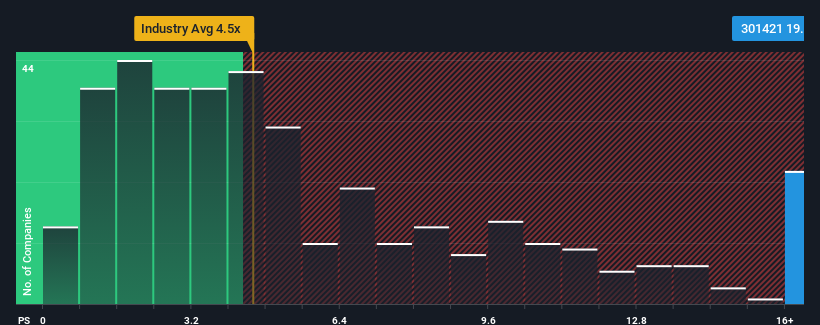

Following the firm bounce in price, Nanjing Wavelength Opto-Electronic Science & TechnologyLtd may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 19.5x, when you consider almost half of the companies in the Electronic industry in China have P/S ratios under 4.5x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

View our latest analysis for Nanjing Wavelength Opto-Electronic Science & TechnologyLtd

What Does Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S Mean For Shareholders?

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nanjing Wavelength Opto-Electronic Science & TechnologyLtd.Is There Enough Revenue Growth Forecasted For Nanjing Wavelength Opto-Electronic Science & TechnologyLtd?

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.4% last year. Revenue has also lifted 23% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the sole analyst covering the company suggest revenue should grow by 32% over the next year. That's shaping up to be materially higher than the 27% growth forecast for the broader industry.

With this information, we can see why Nanjing Wavelength Opto-Electronic Science & TechnologyLtd is trading at such a high P/S compared to the industry. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's P/S has grown nicely over the last month thanks to a handy boost in the share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Nanjing Wavelength Opto-Electronic Science & TechnologyLtd's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Nanjing Wavelength Opto-Electronic Science & TechnologyLtd (at least 2 which are a bit concerning), and understanding them should be part of your investment process.

If these risks are making you reconsider your opinion on Nanjing Wavelength Opto-Electronic Science & TechnologyLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nanjing Wavelength Opto-Electronic Science & TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301421

Nanjing Wavelength Opto-Electronic Science & TechnologyLtd

Nanjing Wavelength Opto-Electronic Science & Technology Co.,Ltd.

Excellent balance sheet with slight risk.

Market Insights

Community Narratives