- South Korea

- /

- Interactive Media and Services

- /

- KOSE:A035720

August 2025's Asian Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As of August 2025, Asian markets are experiencing a period of cautious optimism, buoyed by easing trade tensions and hopes for economic stability amid fluctuating global inflation rates. In this environment, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between company leadership and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Techwing (KOSDAQ:A089030) | 19.1% | 68% |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Shanghai Huace Navigation Technology (SZSE:300627) | 24.3% | 24.3% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 98.7% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 42.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 12.8% | 43.7% |

Here's a peek at a few of the choices from the screener.

Kakao (KOSE:A035720)

Simply Wall St Growth Rating: ★★★★☆☆

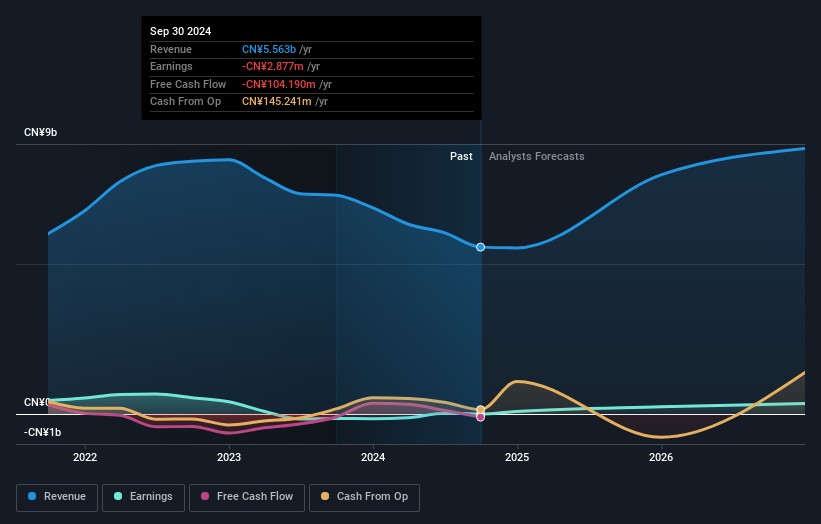

Overview: Kakao Corp. operates mobile and online platforms in South Korea, with a market cap of approximately ₩28.52 trillion.

Operations: Kakao's revenue segments include Kakao Co., Ltd. at ₩2.62 billion, Kakao piccoma corp. at ₩573.36 million, Kakao Games Co., Ltd. at ₩780.83 million, Kakao Mobility Co., Ltd. at ₩678.57 million, SM Entertainment Co., Ltd. at ₩997.56 million, Kakao Entertainment Co., Ltd. at ₩1.73 billion, and Kakao Pay Co., Ltd.at ₩801.79 million.

Insider Ownership: 13.8%

Earnings Growth Forecast: 30.3% p.a.

Kakao's earnings are forecast to grow significantly at 30.4% annually, outpacing the Korean market's 22.4%. Despite its high volatility and low return on equity forecast of 6.4%, Kakao has recently become profitable, though large one-off items affect its financial results. The recent private placement of convertible bonds worth over ₩50 billion indicates strong institutional interest but no substantial insider trading activity in the past three months was noted.

- Navigate through the intricacies of Kakao with our comprehensive analyst estimates report here.

- Our valuation report here indicates Kakao may be overvalued.

Jiangsu Huahong Technology (SZSE:002645)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Huahong Technology Co., Ltd. operates in the research, development, manufacturing, marketing, and servicing of renewable resource processing equipment both in China and internationally, with a market cap of CN¥10.38 billion.

Operations: Jiangsu Huahong Technology Co., Ltd. generates its revenue primarily from the research, development, manufacturing, marketing, and servicing of renewable resource processing equipment within China and on an international scale.

Insider Ownership: 18.1%

Earnings Growth Forecast: 120% p.a.

Jiangsu Huahong Technology's revenue is projected to grow 22.5% annually, surpassing the Chinese market's average growth rate. Earnings are expected to increase significantly by 120% per year, with profitability anticipated within three years, indicating robust growth potential. The stock trades at a good value relative to its peers and industry; however, it has experienced high share price volatility recently. No substantial insider trading activity has been reported in the past three months.

- Take a closer look at Jiangsu Huahong Technology's potential here in our earnings growth report.

- The analysis detailed in our Jiangsu Huahong Technology valuation report hints at an deflated share price compared to its estimated value.

Shenzhen Ampron Technology (SZSE:301413)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Ampron Technology Co., Ltd. focuses on the research, development, manufacture, sale, and service of sensors in China with a market cap of CN¥11.51 billion.

Operations: The company's revenue primarily comes from its Electronic Components & Parts segment, which generated CN¥1.02 billion.

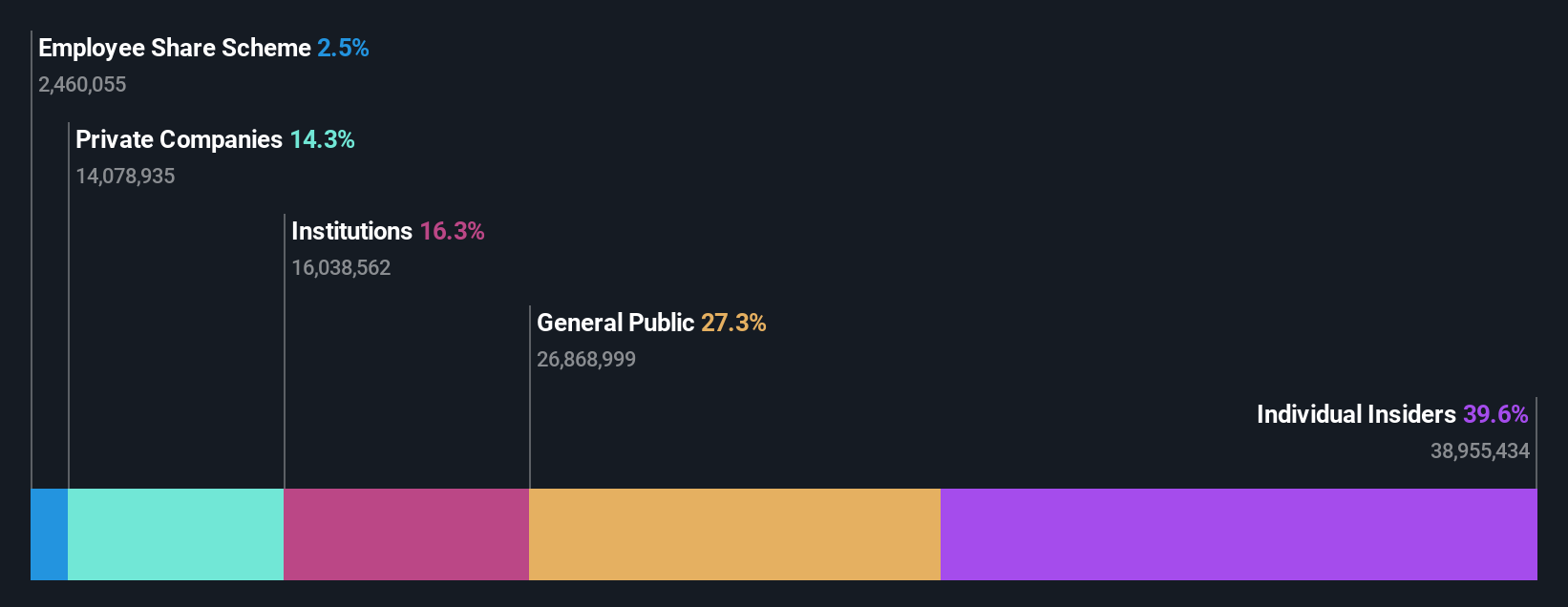

Insider Ownership: 39.6%

Earnings Growth Forecast: 24.5% p.a.

Shenzhen Ampron Technology is positioned for significant growth, with earnings expected to rise 24.5% annually over the next three years, outpacing the Chinese market's average of 24.1%. Revenue is forecast to grow at 19.8% per year, which is faster than the market but below a high-growth benchmark. Despite this potential, its share price has been highly volatile recently and insider trading activity remains minimal in recent months.

- Delve into the full analysis future growth report here for a deeper understanding of Shenzhen Ampron Technology.

- Our valuation report unveils the possibility Shenzhen Ampron Technology's shares may be trading at a premium.

Where To Now?

- Access the full spectrum of 591 Fast Growing Asian Companies With High Insider Ownership by clicking on this link.

- Looking For Alternative Opportunities? The end of cancer? These 26 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kakao might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A035720

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives