As global markets navigate a complex landscape marked by economic uncertainties and shifts in monetary policies, Asian tech stocks are capturing attention with their potential for high growth amid evolving market dynamics. In this environment, identifying promising stocks involves assessing factors such as innovation capacity, market adaptability, and resilience to broader economic trends.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.78% | 30.84% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Guomai Technologies (SZSE:002093)

Simply Wall St Growth Rating: ★★★★☆☆

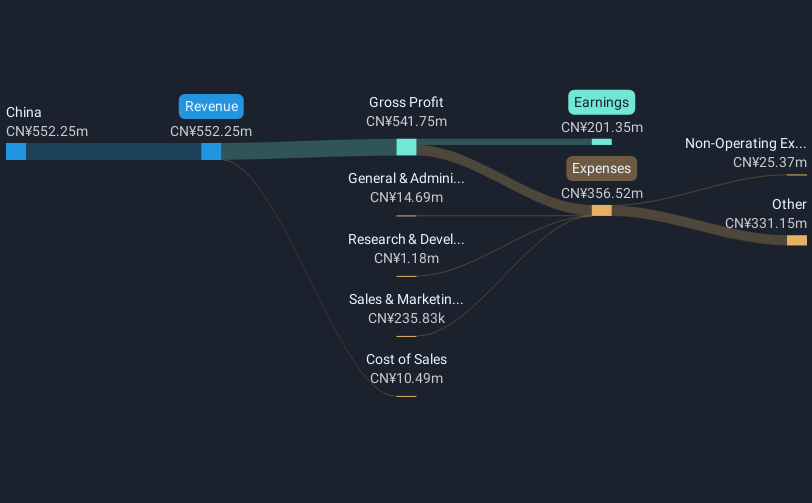

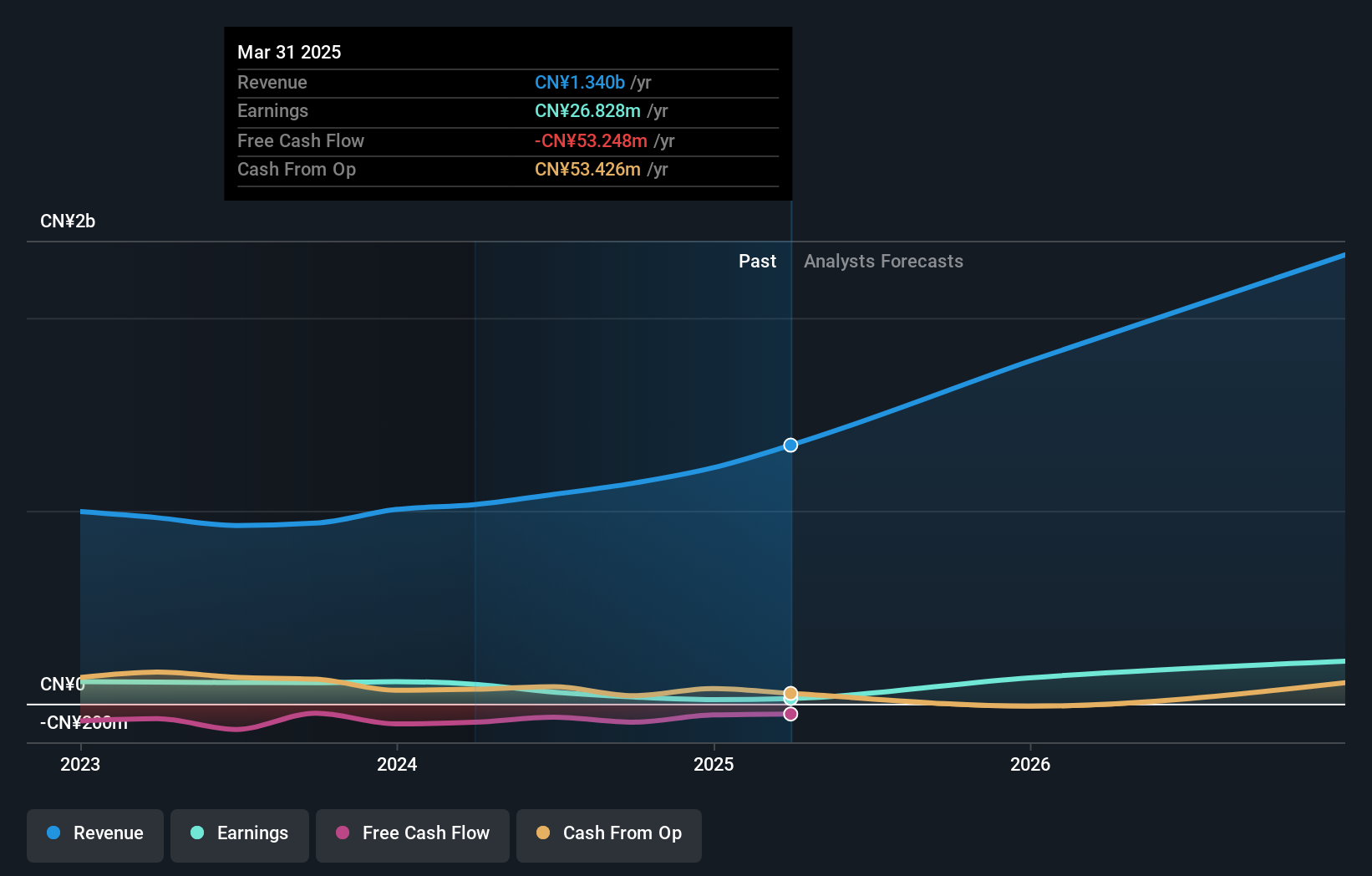

Overview: Guomai Technologies, Inc. operates in China offering internet of things technology services, consulting and design services, science park operation and development services, along with education services, with a market capitalization of approximately CN¥11.17 billion.

Operations: The company generates revenue from its education industry segment, contributing CN¥382.69 million.

Guomai Technologies has demonstrated robust growth with a notable 90.4% increase in earnings over the past year, outpacing the IT industry's average decline of 8.7%. This surge is supported by a significant rise in half-year revenues to CNY 249.96 million from CNY 223.61 million, alongside a doubling of net income to CNY 151.38 million. The company's strategic focus on innovation is evident from its R&D investments, aligning with industry trends towards enhanced technological capabilities and market responsiveness. Despite forecasts suggesting an underperformance in earnings growth relative to the broader Chinese market at 20.7% annually versus 26.7%, Guomai’s revenue growth projection excels at an annual rate of 23%, surpassing the market average of 14.1%. This positions Guomai well within Asia’s competitive tech landscape, leveraging recent dividend affirmations and increases to bolster shareholder returns amidst its expansion trajectory.

- Navigate through the intricacies of Guomai Technologies with our comprehensive health report here.

Examine Guomai Technologies' past performance report to understand how it has performed in the past.

Shenzhen Bromake New Material (SZSE:301387)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Bromake New Material Co., Ltd. is involved in the research, development, production, and sale of consumer electronics protective and functional products with a market capitalization of CN¥4.46 billion.

Operations: Shenzhen Bromake focuses on the consumer electronics sector, generating revenue primarily from electronic components and parts, totaling CN¥1.47 billion.

Shenzhen Bromake New Material has recently amended its bylaws and increased registered capital, signaling strategic restructuring to enhance market agility. This aligns with its impressive half-year earnings report showing a revenue jump from CNY 501.8 million to CNY 749.88 million, and a pivot from a net loss to a profit of CNY 23.22 million. With an annual revenue growth forecast at 30.7% and earnings expected to surge by 84.6%, Bromake is outpacing the broader Chinese market's growth rates significantly, positioning itself as an emergent force in Asia’s high-tech materials sector despite some operational challenges reflected in fluctuating profit margins year-over-year.

Kohoku KogyoLTD (TSE:6524)

Simply Wall St Growth Rating: ★★★★☆☆

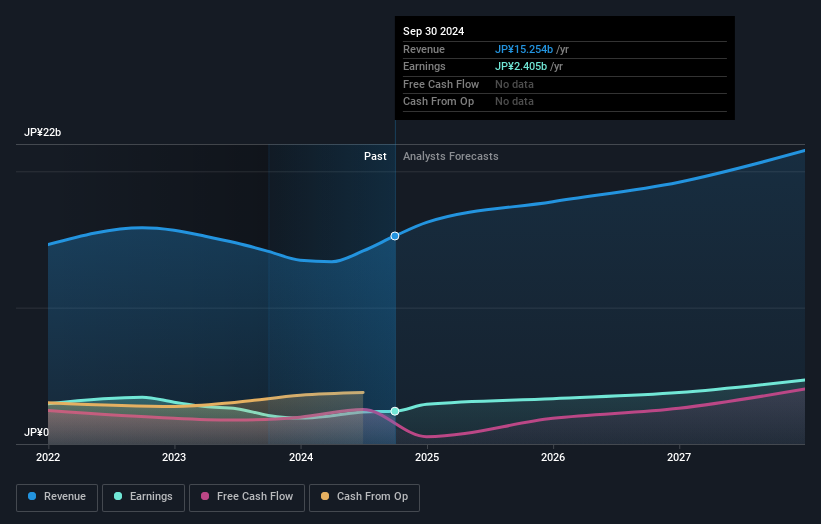

Overview: Kohoku Kogyo CO., LTD. is engaged in the manufacturing and sale of lead terminals for aluminum electrolytic capacitors, optical components and devices for optical fiber communication networks, and precision components using quartz glass materials across various regions including Japan, China, the rest of Asia, England, and the United States; it has a market capitalization of ¥88.08 billion.

Operations: Kohoku Kogyo specializes in producing lead terminals for aluminum electrolytic capacitors, optical components for fiber communication networks, and precision quartz glass components. The company operates across several key markets including Japan, China, Asia, England, and the United States.

Despite a challenging environment, Kohoku Kogyo CO., LTD. has shown resilience with its recent strategic adjustments. The company's revised earnings guidance reflects a cautious yet improving scenario, as it navigates through market fluctuations and currency impacts, notably in the European automotive and undersea cable sectors. With an expected annual revenue growth of 11.4% and earnings forecast to climb by 30%, Kohoku Kogyo is adapting swiftly to shifting market demands while managing operational challenges like impairment losses which totaled JPY 310 million this semi-annual period. This adaptability is crucial for maintaining competitiveness in Asia's dynamic tech landscape, especially as it moves past temporary setbacks in customer orders and foreign exchange losses.

- Click to explore a detailed breakdown of our findings in Kohoku KogyoLTD's health report.

Understand Kohoku KogyoLTD's track record by examining our Past report.

Next Steps

- Dive into all 185 of the Asian High Growth Tech and AI Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002093

Guomai Technologies

Offers internet of things technology services, internet of things consulting and design services, internet of things science park operation and development services, and education services in China.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026