As we enter January 2025, global markets are experiencing a mixed landscape with U.S. consumer confidence dipping and major stock indexes showing moderate gains, particularly driven by large-cap growth stocks earlier in the week. Amid this backdrop, high-growth tech stocks remain a focal point for investors seeking opportunities in an environment where innovation and adaptability are key traits of companies that can thrive despite economic uncertainties.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| CD Projekt | 23.29% | 27.00% | ★★★★★★ |

| Medley | 22.38% | 31.67% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1263 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Vaisala Oyj (HLSE:VAIAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vaisala Oyj operates in the weather and environmental, as well as industrial measurement sectors, serving relevant markets with a market cap of €1.79 billion.

Operations: Vaisala generates revenue through its Industrial Measurements segment, contributing €219.40 million, and Weather and Environment segment, adding €325 million. The company's focus on these areas highlights its role in providing specialized measurement solutions to weather-related and industrial markets.

Vaisala Oyj, a Finnish company specializing in environmental and industrial measurement, is demonstrating robust growth with a projected annual revenue increase of 6% and earnings growth of 15.6%. This performance surpasses the broader Finnish market's expectations. The appointment of Lorenzo Gulli as EVP, Strategy and M&A underscores Vaisala's commitment to leveraging strategic acquisitions for accelerated growth. Additionally, their recent product launch, the MGP241 for CCUS transparency, highlights Vaisala’s innovative edge in critical environmental technologies—a sector poised for significant expansion given global decarbonization targets. With R&D expenses aligning closely with these strategic initiatives, Vaisala is well-positioned to capitalize on emerging opportunities in climate action technologies.

- Delve into the full analysis health report here for a deeper understanding of Vaisala Oyj.

Assess Vaisala Oyj's past performance with our detailed historical performance reports.

AcrobiosystemsLtd (SZSE:301080)

Simply Wall St Growth Rating: ★★★★☆☆

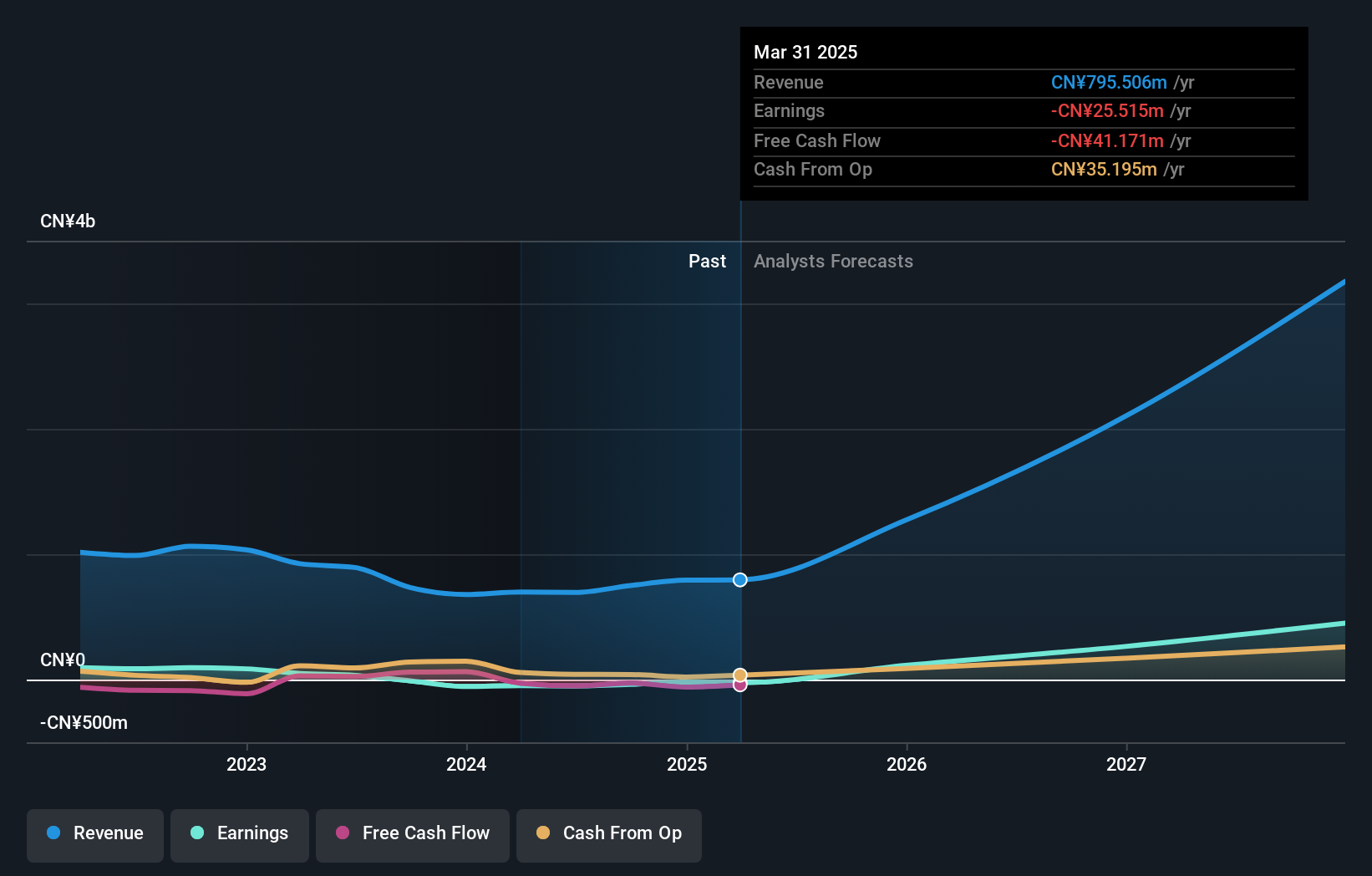

Overview: Acrobiosystems Co., Ltd. specializes in developing and manufacturing recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market capitalization of approximately CN¥5.48 billion.

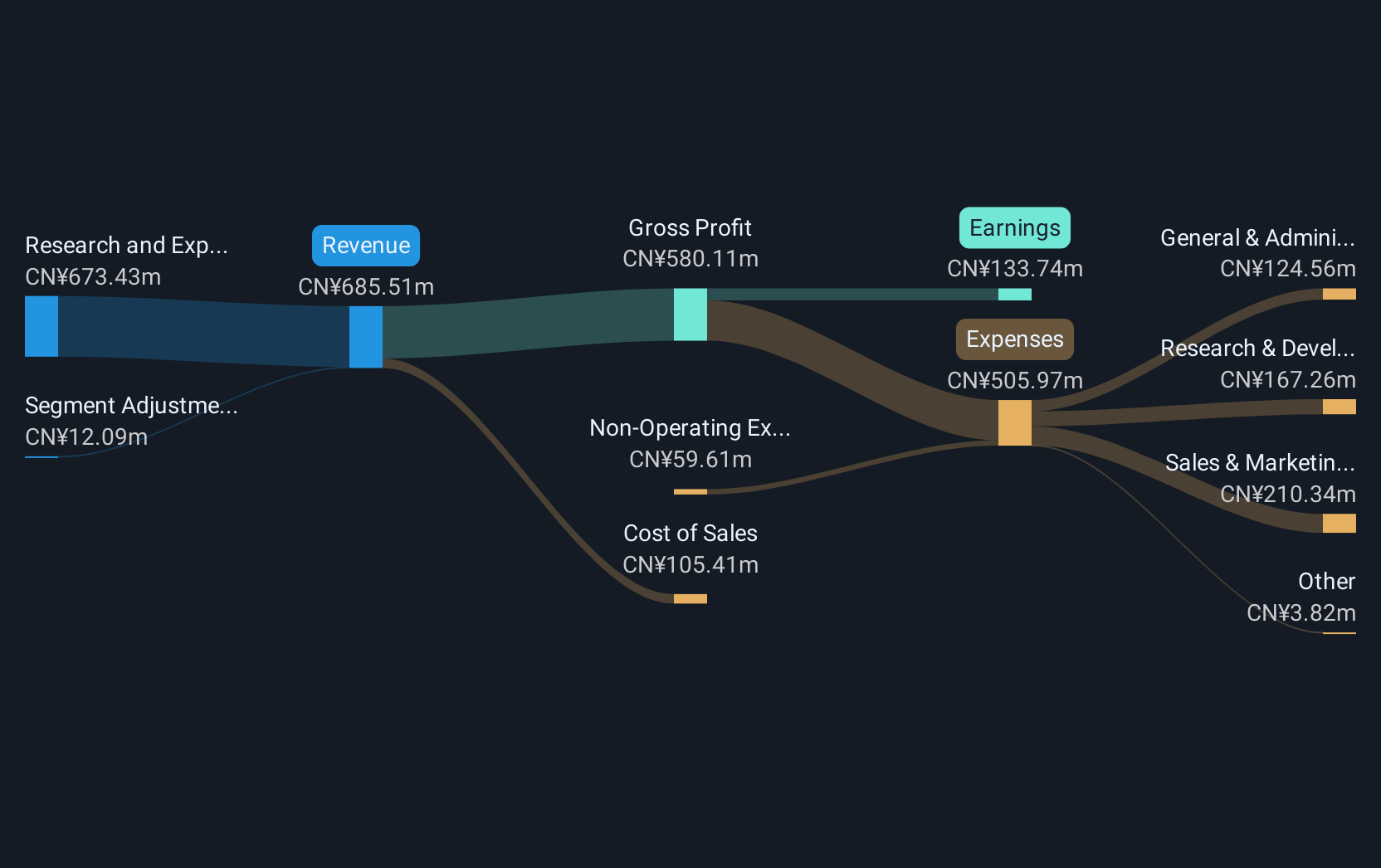

Operations: Acrobiosystems Co., Ltd. generates revenue primarily through its Research and Experimental Development segment, which accounted for approximately CN¥583.70 million. The company focuses on providing recombinant proteins, antibodies, and biological reagents to pharmaceutical and biotechnology sectors.

AcrobiosystemsLtd, amidst a challenging market, reported a robust annual revenue growth of 18.9%, significantly outpacing the CN market average of 13.6%. This performance is bolstered by an impressive forecasted earnings growth of 29.5% per year, which also exceeds the market's expectation of 25.2%. Despite a dip in net income from CNY 128.16 million to CNY 83.49 million over nine months, the company has committed to shareholder returns with a recent dividend announcement and launched a share repurchase program valued at CNY 40 million to buy back shares at no more than CNY 50 each—a strategic move to enhance shareholder value and reduce capital concurrently.

- Navigate through the intricacies of AcrobiosystemsLtd with our comprehensive health report here.

Explore historical data to track AcrobiosystemsLtd's performance over time in our Past section.

J.Pond Precision Technology (SZSE:301326)

Simply Wall St Growth Rating: ★★★★★☆

Overview: J.Pond Precision Technology Co., Ltd. is engaged in the manufacturing and sale of precision functional and structural parts, with a market capitalization of CN¥5.37 billion.

Operations: J.Pond Precision Technology focuses on producing and selling precision functional and structural parts, generating revenue primarily from electronic components and parts, amounting to CN¥750.14 million.

J.Pond Precision Technology has demonstrated a notable turnaround, with its recent earnings report showing a leap from a net loss of CNY 16.35 million to a net income of CNY 0.756 million in just nine months. This recovery is underscored by a significant revenue increase to CNY 593.68 million from CNY 521.74 million year-over-year, marking an annualized growth rate of 42.2%. Additionally, the company's strategic financial maneuvers include repurchasing shares worth CNY 10.99 million, enhancing shareholder value amidst its volatile share price performance over the past three months. These moves highlight J.Pond's aggressive steps towards stabilization and growth in the competitive tech sector, setting a foundation for potential profitability forecasted over the next three years with an expected earnings growth of 115.8% annually.

Taking Advantage

- Delve into our full catalog of 1263 High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301080

AcrobiosystemsLtd

Engages in the development and manufacture of recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies, and scientific research institutions.

Excellent balance sheet with reasonable growth potential.