As global markets experience a positive shift with easing trade tensions and better-than-expected earnings, Asian tech stocks are drawing increased attention from investors looking to capitalize on the region's innovative potential. In such a dynamic environment, identifying high-growth tech stocks involves focusing on companies that demonstrate strong adaptability and resilience amid evolving economic landscapes.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| China Leadshine Technology | 21.16% | 26.09% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Beijing Fourth Paradigm Technology (SEHK:6682)

Simply Wall St Growth Rating: ★★★★☆☆

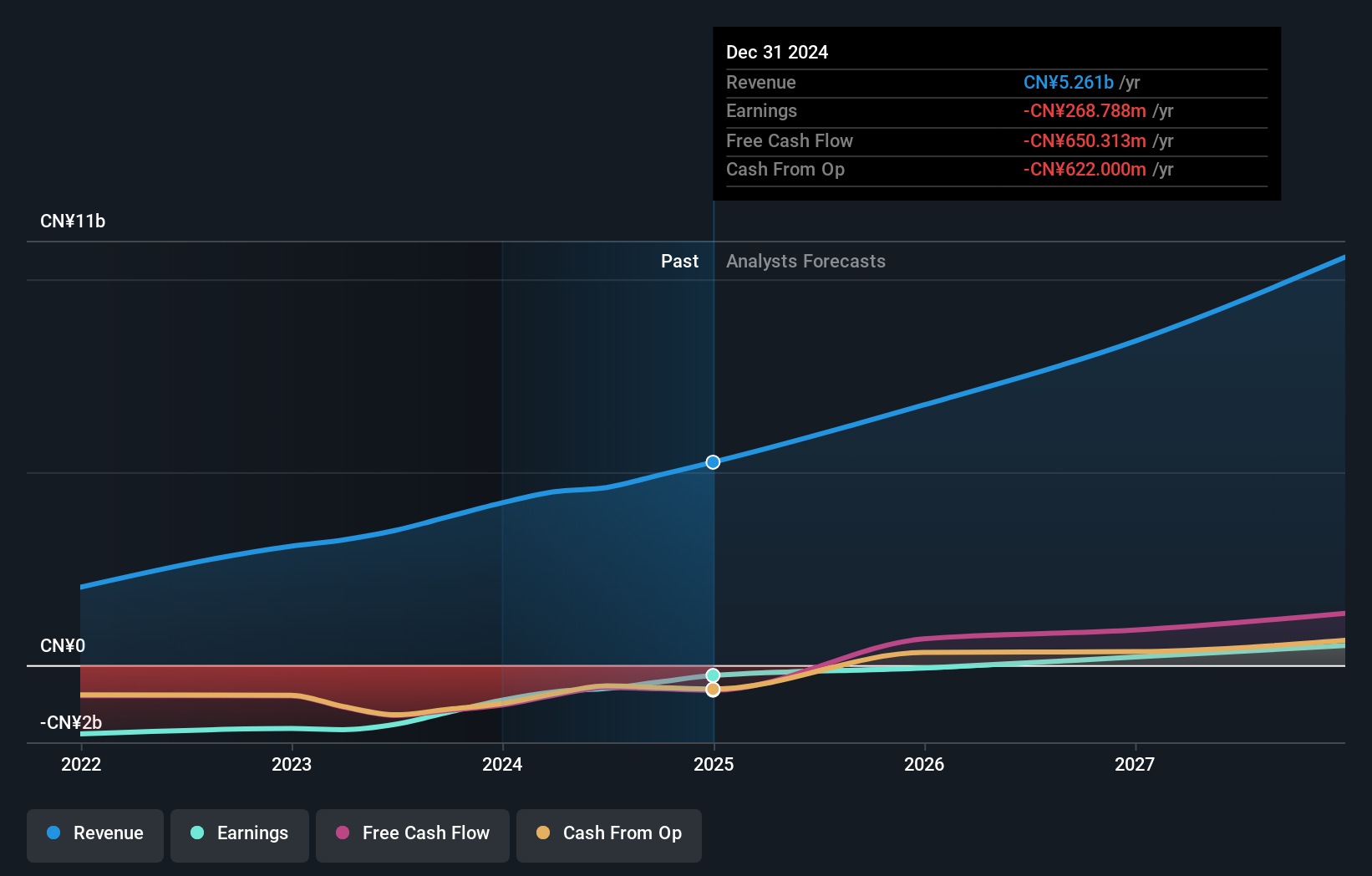

Overview: Beijing Fourth Paradigm Technology Co., Ltd. is an investment holding company that offers platform-centric artificial intelligence solutions in the People's Republic of China, with a market capitalization of approximately HK$20.18 billion.

Operations: The company generates revenue through its AI solutions, with the Sage Ai Platform contributing CN¥3.68 billion, followed by Shift Intelligent Solutions at CN¥1.02 billion and Sagegpt Aigs Services at CN¥562.50 million.

Beijing Fourth Paradigm Technology, a key participant in Asia's tech sector, has shown robust signs of growth and resilience. Despite a volatile share price over the past three months, the company's revenue is expected to climb by 18.8% annually, outpacing Hong Kong's market average of 8.6%. Notably, after a significant reduction in net loss from CNY 908.72 million to CNY 268.79 million year-over-year and an earnings forecast predicting profitability within three years, the firm is poised for a promising future. Recent governance enhancements further underscore its commitment to strong corporate practices which are likely to bolster investor confidence and operational efficiency moving forward.

- Get an in-depth perspective on Beijing Fourth Paradigm Technology's performance by reading our health report here.

Learn about Beijing Fourth Paradigm Technology's historical performance.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

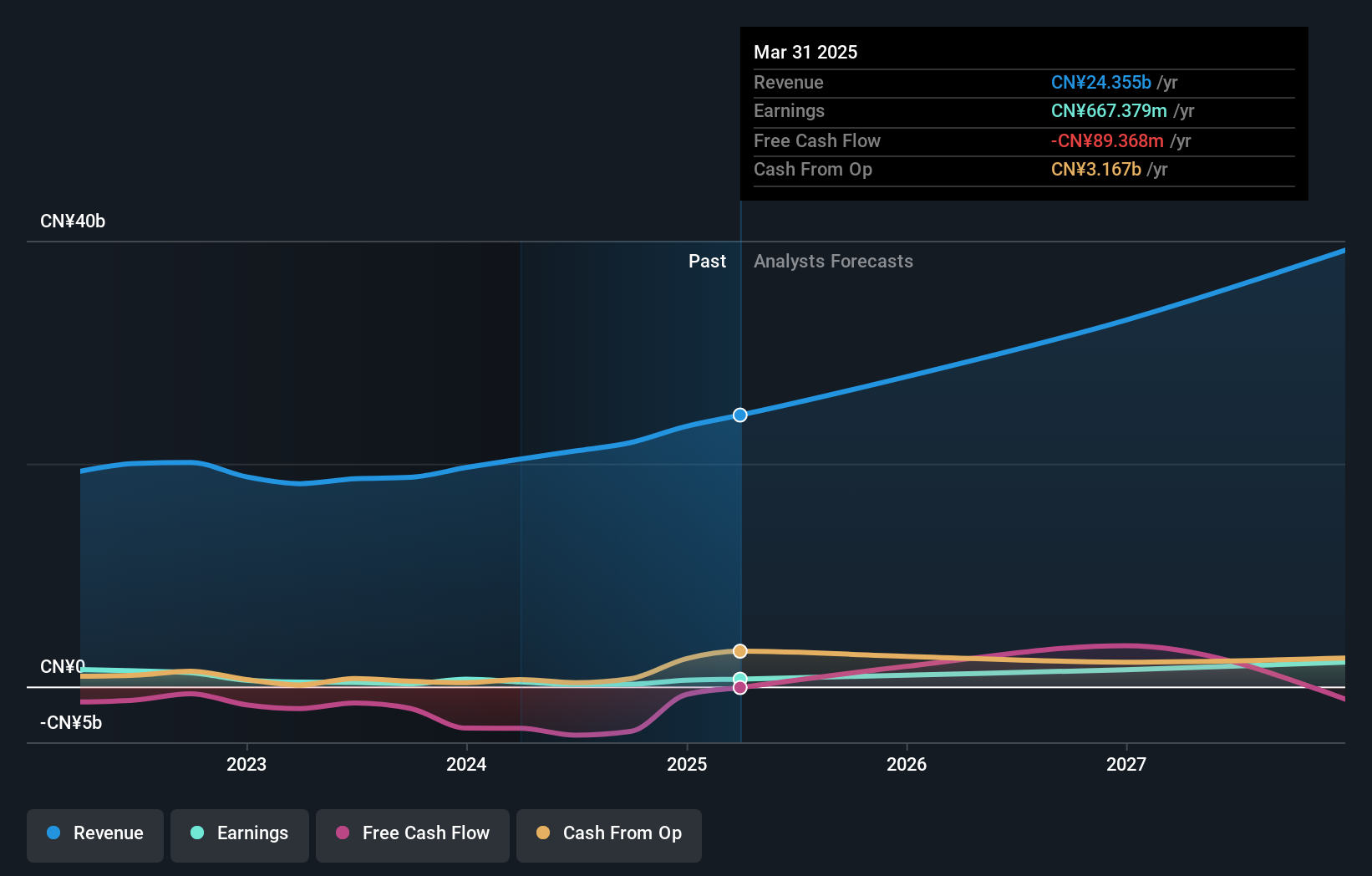

Overview: iFLYTEK CO., LTD. provides artificial intelligence (AI) technology services in China, with a market capitalization of CN¥108.09 billion.

Operations: iFLYTEK CO., LTD. specializes in AI technology services, focusing on voice recognition and language processing solutions. The company generates revenue primarily through software sales, licensing, and related services.

iFLYTEK CO., LTD, amid a dynamic tech landscape in Asia, is making notable strides with its innovative AI solutions. Recently, the company reported a significant year-over-year revenue increase to CNY 4.66 billion from CNY 3.65 billion, marking a growth of approximately 28%. This surge is backed by their latest product launch—Spark WallEX—a smart space management system that has piqued interest in the Middle Eastern markets for its integration capabilities and offline functionality, vital for regions with developing infrastructure. Moreover, iFLYTEK's commitment to enhancing shareholder value was evident with their recent dividend announcement of CNY 1 per ten shares. These developments reflect iFLYTEK’s potential to adapt and thrive in the rapidly evolving tech sector while addressing niche market needs effectively.

- Delve into the full analysis health report here for a deeper understanding of iFLYTEKLTD.

Understand iFLYTEKLTD's track record by examining our Past report.

Shenzhen Longsys Electronics (SZSE:301308)

Simply Wall St Growth Rating: ★★★★☆☆

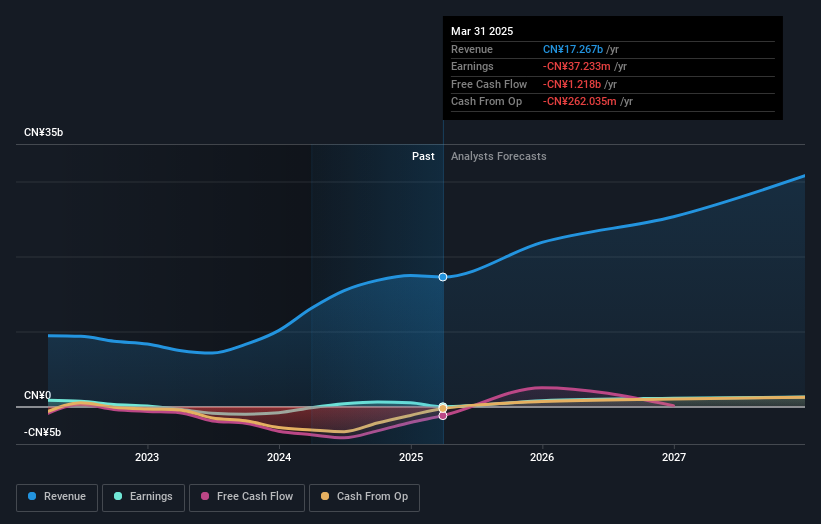

Overview: Shenzhen Longsys Electronics Co., Ltd. focuses on the global research, development, manufacture, and sale of memory storage products and has a market cap of CN¥32.41 billion.

Operations: Longsys Electronics specializes in the development and production of memory storage products for a global market. The company generates revenue through the sale of these products, with significant investment in research and development to innovate within the industry.

In the rapidly evolving tech landscape of Asia, Shenzhen Longsys Electronics stands out with its strategic pivot towards automotive and industrial-grade storage solutions. The company's recent earnings report for Q1 2025 showed a downturn with sales dropping to CNY 4.26 billion from CNY 4.45 billion year-over-year, alongside a shift from a net income of CNY 384.1 million to a net loss of CNY 151.81 million; however, this period also marked significant R&D investments aimed at diversifying and strengthening its product lineup in high-demand sectors like smart vehicles and AI-powered applications. At Auto Shanghai 2025, Longsys introduced cutting-edge products such as automotive-grade eMMC and UFS solutions that comply with stringent AEC-Q100 standards—critical for next-gen ADAS systems—highlighting its commitment to innovation and quality in specialized markets. These efforts are set against projected annual revenue growth of 19.8% and profit growth forecasts at an impressive rate of approximately 60%, signaling potential recovery and robust future performance driven by strategic market adaptations.

- Click here and access our complete health analysis report to understand the dynamics of Shenzhen Longsys Electronics.

Gain insights into Shenzhen Longsys Electronics' past trends and performance with our Past report.

Where To Now?

- Investigate our full lineup of 478 Asian High Growth Tech and AI Stocks right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade iFLYTEKLTD, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives