- China

- /

- Electronic Equipment and Components

- /

- SZSE:301275

Undiscovered Gems in Asia to Explore This March 2025

Reviewed by Simply Wall St

As global markets grapple with tariff fears and inflation concerns, Asian stocks have shown resilience amid a backdrop of economic growth targets and strategic fiscal policies. With the Chinese market advancing following stimulus signals and Japan's economy poised for potential wage-driven growth, investors are increasingly turning their attention to smaller-cap opportunities in Asia that may offer unique value propositions. In this dynamic environment, identifying stocks with strong fundamentals and innovative business models can be particularly rewarding for those looking to explore undiscovered gems in the region.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ruentex Interior Design | NA | 21.07% | 27.94% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Kyoritsu Electric | 7.58% | 3.45% | 12.53% | ★★★★★★ |

| ITE Tech | NA | 7.53% | 13.84% | ★★★★★★ |

| Saison Technology | NA | 0.96% | -11.65% | ★★★★★★ |

| Toyo Kanetsu K.K | 33.97% | 3.33% | 18.20% | ★★★★★☆ |

| Interactive Digital Technologies | 1.30% | 6.10% | 4.63% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Sinomag Technology | 46.22% | 16.92% | 3.72% | ★★★★★☆ |

| New Asia Construction & Development | 65.89% | 5.34% | 12.05% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

Southern Publishing and MediaLtd (SHSE:601900)

Simply Wall St Value Rating: ★★★★★☆

Overview: Southern Publishing and Media Co., Ltd. is a Chinese company engaged in the publishing industry with a market capitalization of approximately CN¥13.52 billion.

Operations: Southern Publishing and Media Co., Ltd. generates revenue primarily through its publishing operations. The company has a market capitalization of approximately CN¥13.52 billion.

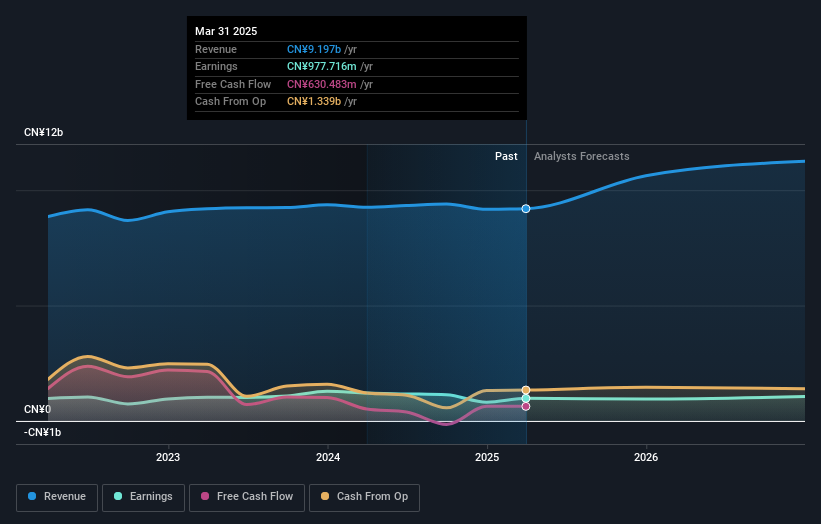

Southern Publishing and MediaLtd, a promising player in the media sector, has shown resilience with its earnings growing by 5% over the past year, outpacing the industry's -10.2%. With a price-to-earnings ratio of 11.9x, it trades at an attractive valuation compared to the broader CN market's 38.5x. Despite an increase in debt to equity from 3.4% to 15.2% over five years, it maintains more cash than total debt, suggesting financial stability. However, future earnings are expected to dip slightly by an average of 0.2% annually over three years, indicating cautious optimism for growth prospects.

Hanshow Technology (SZSE:301275)

Simply Wall St Value Rating: ★★★★★★

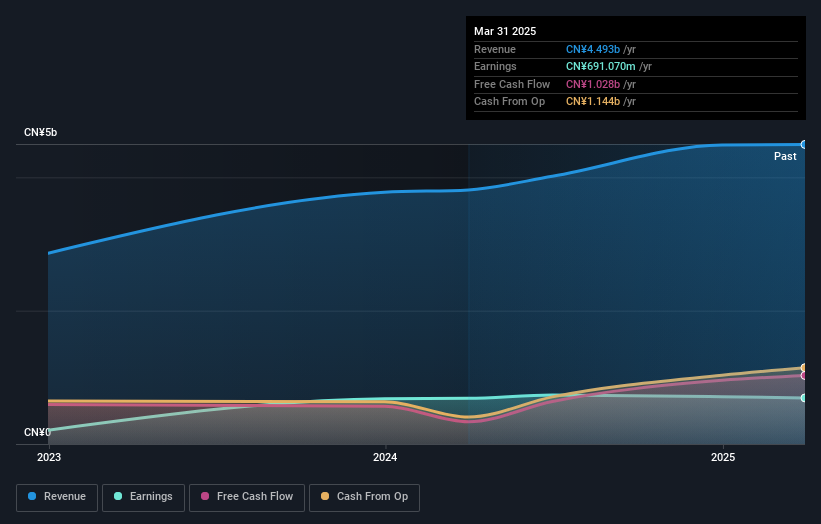

Overview: Hanshow Technology Co. Ltd specializes in electronic shelf labeling solutions and has a market cap of approximately CN¥10.44 billion.

Operations: Hanshow Technology generates revenue primarily from its electronic shelf labeling solutions. The company's financial performance is characterized by a focus on optimizing profit margins, with an emphasis on managing costs effectively.

Hanshow Technology has recently completed an IPO, raising CNY 1.16 billion, highlighting its growth potential in the retail tech space. The company reported sales of CNY 4.49 billion for 2024, up from CNY 3.78 billion the previous year, with net income rising to CNY 710 million from CNY 678 million. With no debt and a significant discount to estimated fair value at around 60%, Hanshow demonstrates financial health and value appeal. Its innovative ESL solutions continue driving retail transformation by enhancing operational efficiency and customer experience through real-time pricing updates and advanced digital integrations.

Zhejiang Sling Automobile Bearing (SZSE:301550)

Simply Wall St Value Rating: ★★★★★★

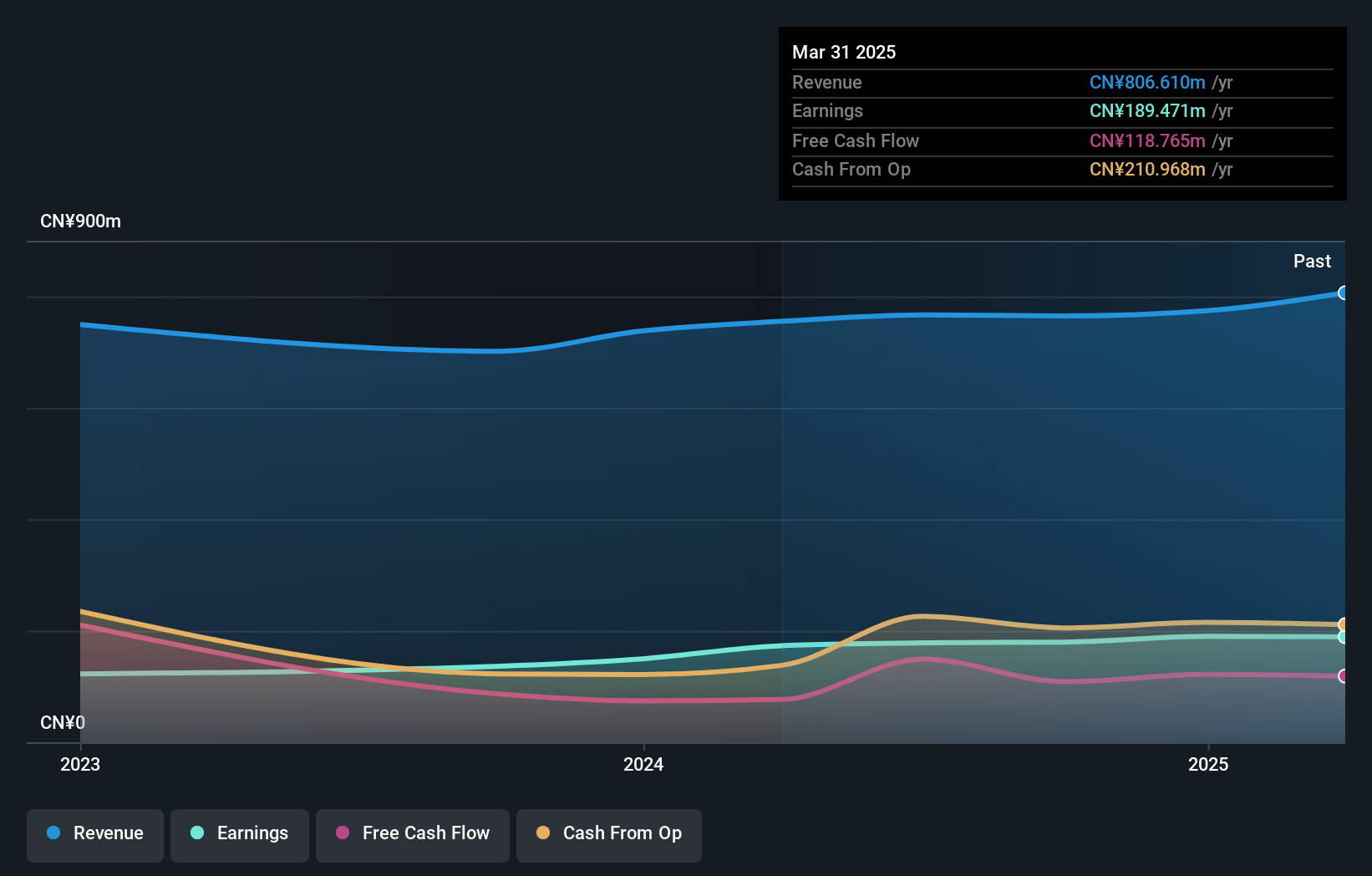

Overview: Zhejiang Sling Automobile Bearing Co., Ltd. operates in the automotive industry, focusing on the production of bearings for vehicles, with a market capitalization of CN¥14.13 billion.

Operations: Zhejiang Sling generates revenue primarily from the Auto Parts & Accessories segment, amounting to CN¥764.93 million.

Zhejiang Sling Automobile Bearing, a nimble player in the auto components sector, has shown impressive growth with earnings surging 31.7% over the past year, outpacing the industry’s 11%. This debt-free company has transitioned from a debt to equity ratio of 47.7% five years ago to zero today, reflecting strong financial management. Despite recent share price volatility, Sling's high-quality non-cash earnings and positive free cash flow position it well for future endeavors. The firm’s profitability suggests that its cash runway remains robust, offering potential stability amidst market fluctuations.

Make It Happen

- Unlock our comprehensive list of 2588 Asian Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hanshow Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301275

Hanshow Technology

Hanshow Technology Co. Ltd provides electronic shelf labeling solutions.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives