- China

- /

- Electronic Equipment and Components

- /

- SZSE:301123

YD Electronic Technology Co.,Ltd.'s (SZSE:301123) Shares Leap 29% Yet They're Still Not Telling The Full Story

The YD Electronic Technology Co.,Ltd. (SZSE:301123) share price has done very well over the last month, posting an excellent gain of 29%. The last 30 days bring the annual gain to a very sharp 29%.

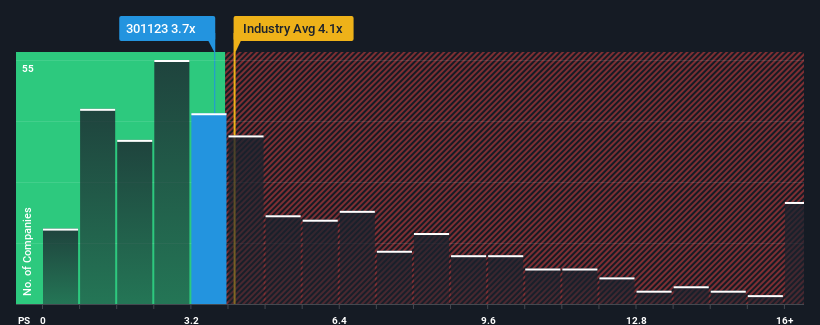

Although its price has surged higher, it's still not a stretch to say that YD Electronic TechnologyLtd's price-to-sales (or "P/S") ratio of 3.7x right now seems quite "middle-of-the-road" compared to the Electronic industry in China, where the median P/S ratio is around 4.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for YD Electronic TechnologyLtd

What Does YD Electronic TechnologyLtd's P/S Mean For Shareholders?

Recent times haven't been great for YD Electronic TechnologyLtd as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Keen to find out how analysts think YD Electronic TechnologyLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like YD Electronic TechnologyLtd's to be considered reasonable.

Retrospectively, the last year delivered a decent 7.0% gain to the company's revenues. Revenue has also lifted 14% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to climb by 49% during the coming year according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 26%, which is noticeably less attractive.

With this in consideration, we find it intriguing that YD Electronic TechnologyLtd's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On YD Electronic TechnologyLtd's P/S

YD Electronic TechnologyLtd's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, YD Electronic TechnologyLtd's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 4 warning signs for YD Electronic TechnologyLtd (1 doesn't sit too well with us!) that we have uncovered.

If you're unsure about the strength of YD Electronic TechnologyLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301123

YD Electronic TechnologyLtd

Engages in the research and development, production, and sale of FPC boards, connector components, LED backlight modules, and other precision electronic components in China.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives