- China

- /

- Electronic Equipment and Components

- /

- SZSE:301045

Market Participants Recognise Talant Optronics (Suzhou) Co., Ltd.'s (SZSE:301045) Revenues Pushing Shares 36% Higher

Talant Optronics (Suzhou) Co., Ltd. (SZSE:301045) shares have had a really impressive month, gaining 36% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 11% in the last twelve months.

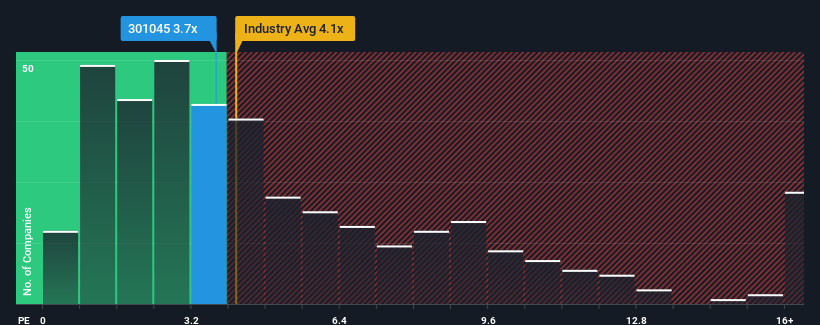

In spite of the firm bounce in price, there still wouldn't be many who think Talant Optronics (Suzhou)'s price-to-sales (or "P/S") ratio of 3.7x is worth a mention when the median P/S in China's Electronic industry is similar at about 4.1x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Talant Optronics (Suzhou)

How Has Talant Optronics (Suzhou) Performed Recently?

With revenue growth that's superior to most other companies of late, Talant Optronics (Suzhou) has been doing relatively well. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Keen to find out how analysts think Talant Optronics (Suzhou)'s future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Talant Optronics (Suzhou)'s is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company grew revenue by an impressive 20% last year. Still, revenue has fallen 23% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 27% over the next year. Meanwhile, the rest of the industry is forecast to expand by 27%, which is not materially different.

With this in mind, it makes sense that Talant Optronics (Suzhou)'s P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

Talant Optronics (Suzhou)'s stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've seen that Talant Optronics (Suzhou) maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Talant Optronics (Suzhou) that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Talant Optronics (Suzhou) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301045

Talant Optronics (Suzhou)

Engages in the research and development, production, and sale of photoelectric light guide plates and related components in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026