- China

- /

- Electronic Equipment and Components

- /

- SZSE:301042

Undiscovered Gems Featuring 3 Top Small Caps with Strong Potential

Reviewed by Simply Wall St

In a week marked by mixed performances across major stock indexes, the Russell 2000 Index, which tracks small-cap stocks, saw a decline following its recent outperformance against larger-cap peers. Amidst this backdrop of diverging market trends and economic indicators like rebounding job growth in the U.S., investors are increasingly looking towards small-cap companies that exhibit resilience and adaptability as potential opportunities. Identifying promising stocks often involves assessing their ability to navigate current economic conditions while maintaining strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Teekay | NA | -3.71% | 60.91% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Compañía General de Electricidad | 1.98% | 9.75% | -4.52% | ★★★★☆☆ |

| Krom Bank Indonesia | NA | 40.04% | 35.44% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Hangzhou Seck Intelligent Technology (SZSE:300897)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Seck Intelligent Technology Co., Ltd. operates in the intelligent instrumentation manufacturing industry and has a market capitalization of CN¥2.58 billion.

Operations: Seck generates its revenue primarily from the intelligent instrumentation manufacturing industry, amounting to CN¥678.10 million.

Hangzhou Seck Intelligent Technology, a smaller player in the electronics industry, has shown impressive financial health with no debt compared to five years ago when its debt-to-equity ratio was 4.4%. The company reported earnings growth of 10.6% over the past year, outpacing the industry's 1.8% growth rate. Recently, it repurchased 1.15% of its shares for CNY 22.2 million as part of a buyback plan initiated in February 2024. Its price-to-earnings ratio stands at a competitive 26.7x against the broader Chinese market's average of 37.2x, suggesting potential value for investors seeking opportunities in this sector.

- Get an in-depth perspective on Hangzhou Seck Intelligent Technology's performance by reading our health report here.

Learn about Hangzhou Seck Intelligent Technology's historical performance.

Zhuhai Raysharp TechnologyLtd (SZSE:301042)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhuhai Raysharp Technology Co., Ltd focuses on the research, development, production, and sale of software and hardware for security video surveillance products, with a market capitalization of CN¥2.79 billion.

Operations: Zhuhai Raysharp Technology Co., Ltd derives its revenue primarily from the sale of software and hardware for security video surveillance products. The company's financial performance includes a market capitalization of CN¥2.79 billion, with specific revenue segments not detailed in the provided data.

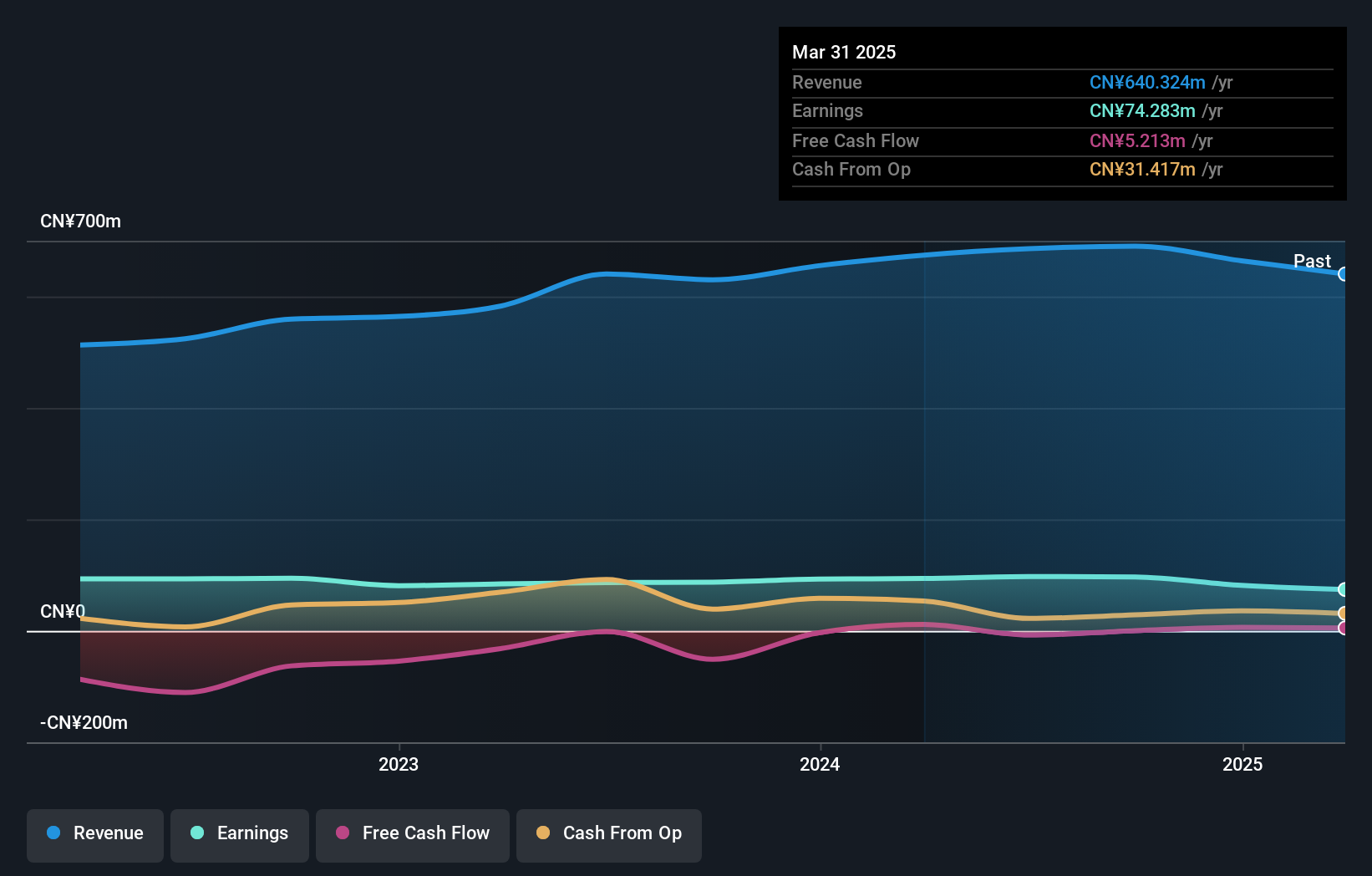

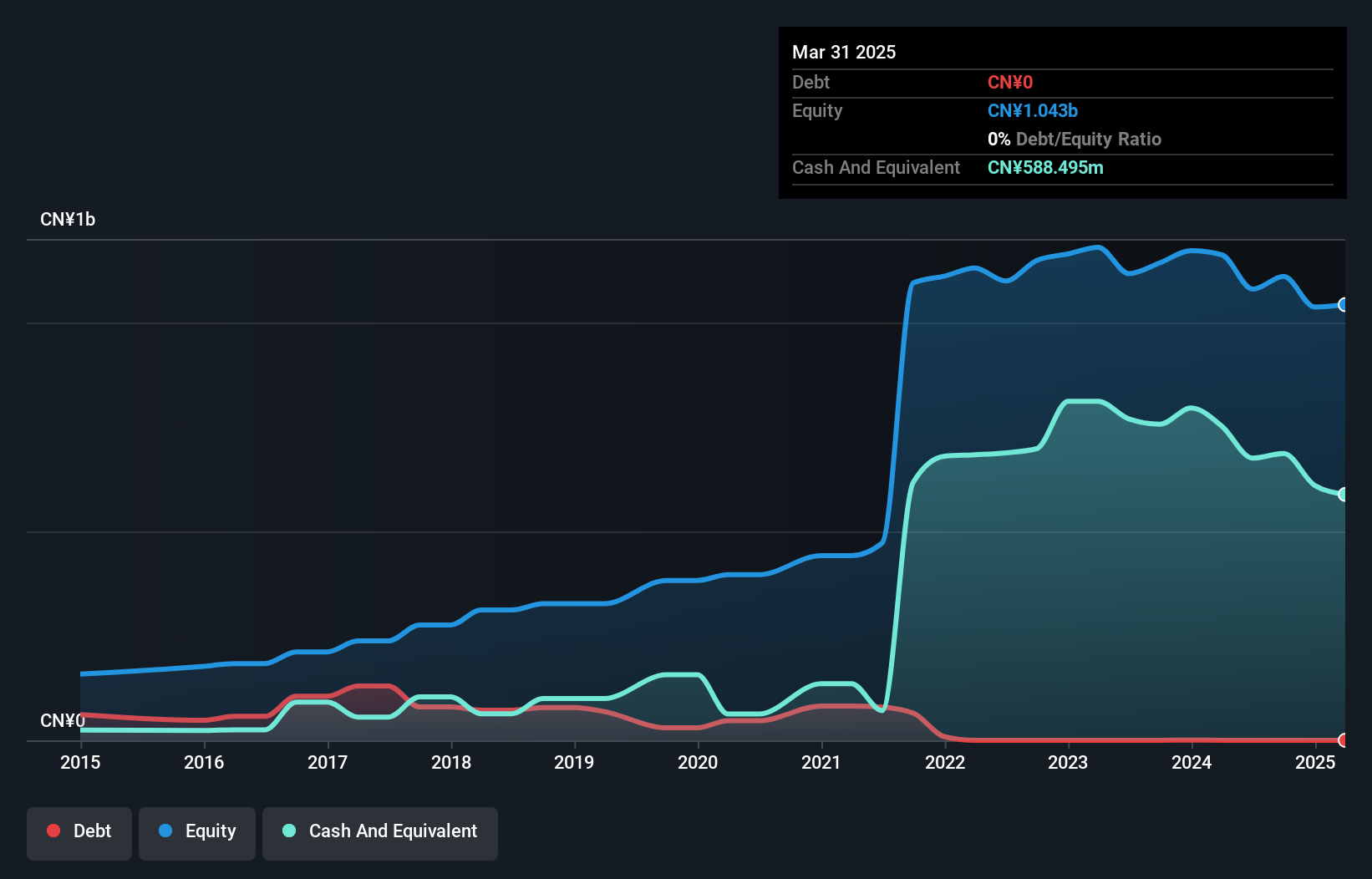

Zhuhai Raysharp Technology, a nimble player in the electronics sector, has demonstrated robust financial health with high-quality earnings and zero debt. Over the past year, its earnings surged by 33.8%, outpacing the industry's 1.8% growth rate. The company trades at a favorable price-to-earnings ratio of 27.3x compared to the CN market's 37.2x, indicating potential value for investors. Recent developments include a cash dividend of CNY 10 per ten shares for Q3 2024 and amendments to its articles of association approved at an extraordinary meeting on November 14th, reflecting proactive corporate governance adjustments.

Taiwan Steel Union (TWSE:6581)

Simply Wall St Value Rating: ★★★★★★

Overview: Taiwan Steel Union Co., Ltd. is engaged in the manufacturing and trading of zinc oxide and non-metallic mineral products in Taiwan, with a market capitalization of NT$13.19 billion.

Operations: Taiwan Steel Union generates revenue primarily from its core operations, amounting to NT$1.88 billion, with an additional contribution of NT$551.02 million from Taiwan Steel Resources Co., Ltd.

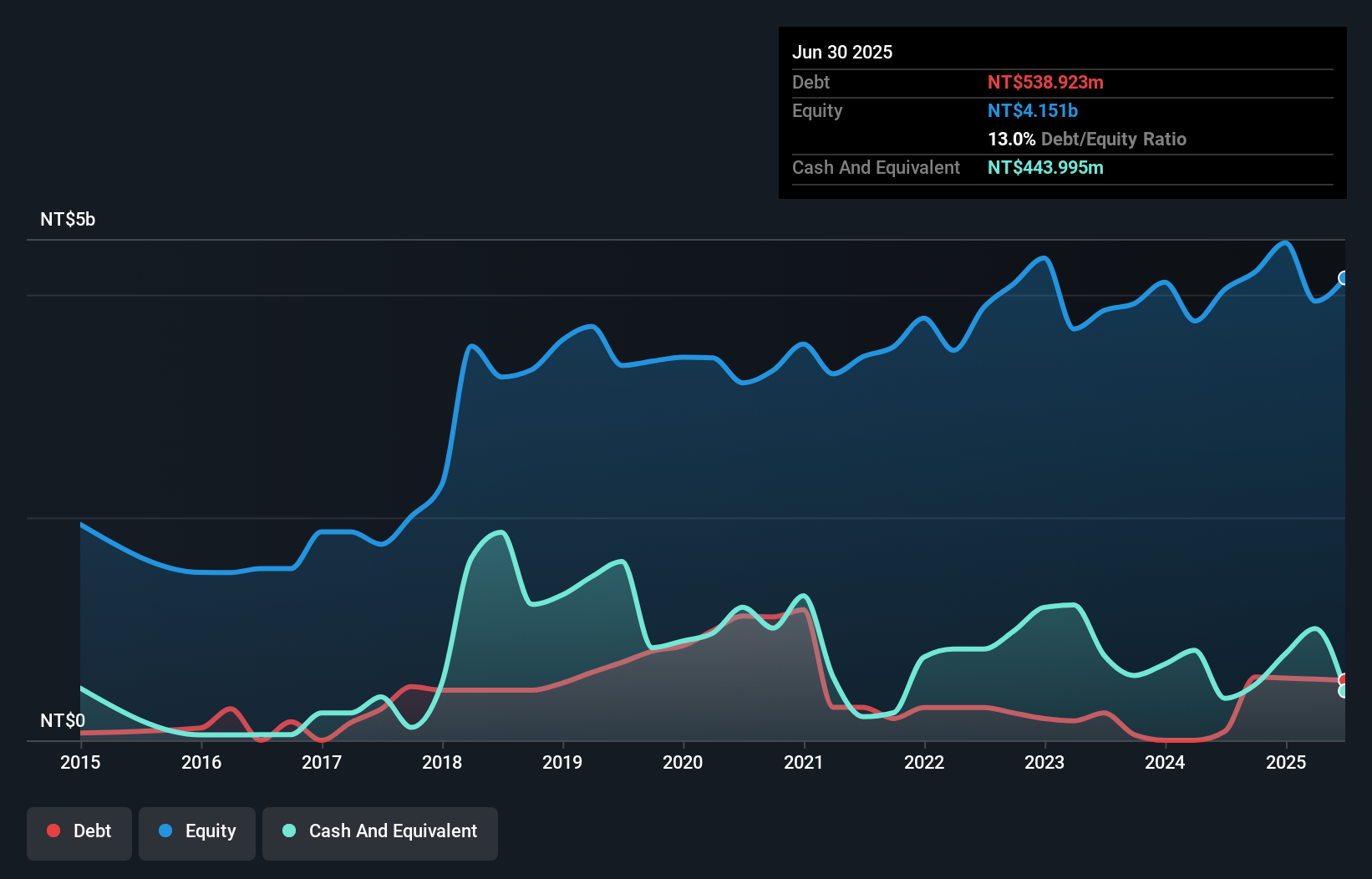

Taiwan Steel Union, a relatively small player in its industry, has shown impressive financial performance recently. Its earnings surged by 40.4% over the past year, outpacing the Chemicals industry's 14.3% growth rate. The company's debt to equity ratio improved significantly from 23.5% to 13.5% over five years, indicating better financial health and management of liabilities. Moreover, with a price-to-earnings ratio of 17.3x compared to the Taiwan market's average of 21.2x, it seems attractively valued for potential investors seeking growth opportunities in emerging markets like Taiwan's steel sector.

- Unlock comprehensive insights into our analysis of Taiwan Steel Union stock in this health report.

Explore historical data to track Taiwan Steel Union's performance over time in our Past section.

Seize The Opportunity

- Access the full spectrum of 4628 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhuhai Raysharp TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301042

Zhuhai Raysharp TechnologyLtd

Zhuhai RaySharp Technology Co.,Ltd engages in the research and development, production, and sale of software and hardware of security video surveillance products.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives