- China

- /

- Electronic Equipment and Components

- /

- SZSE:300880

Do Ningbo Jianan ElectronicsLtd's (SZSE:300880) Earnings Warrant Your Attention?

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Ningbo Jianan ElectronicsLtd (SZSE:300880). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Ningbo Jianan ElectronicsLtd

How Fast Is Ningbo Jianan ElectronicsLtd Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Ningbo Jianan ElectronicsLtd has grown EPS by 21% per year, compound, in the last three years. If growth like this continues on into the future, then shareholders will have plenty to smile about.

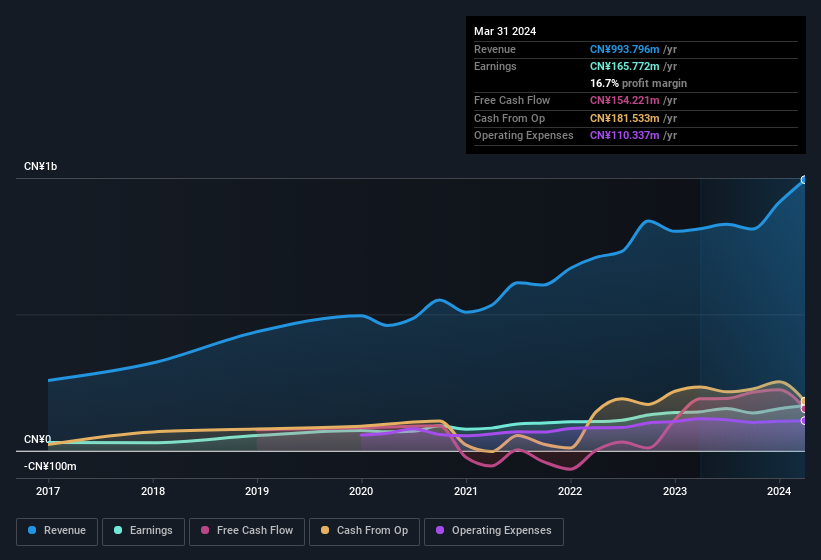

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. On the one hand, Ningbo Jianan ElectronicsLtd's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Ningbo Jianan ElectronicsLtd's balance sheet strength, before getting too excited.

Are Ningbo Jianan ElectronicsLtd Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. For companies with market capitalisations between CN¥1.4b and CN¥5.8b, like Ningbo Jianan ElectronicsLtd, the median CEO pay is around CN¥831k.

Ningbo Jianan ElectronicsLtd offered total compensation worth CN¥731k to its CEO in the year to December 2022. That is actually below the median for CEO's of similarly sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Ningbo Jianan ElectronicsLtd Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Ningbo Jianan ElectronicsLtd's strong EPS growth. With swiftly growing earnings, the best days may still be to come, and the modest CEO pay suggests the company is careful with cash. So this stock is well worth an addition to your watchlist as it has the potential to provide great value to shareholders. It is worth noting though that we have found 2 warning signs for Ningbo Jianan ElectronicsLtd that you need to take into consideration.

Although Ningbo Jianan ElectronicsLtd certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Ningbo Jianan ElectronicsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300880

Ningbo Jianan ElectronicsLtd

Engages in the research, development, production, and sale of smart energy meters, data collection systems, and metering infrastructure in China.

Excellent balance sheet and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.