Discovering Undiscovered Gems with Growth Potential In January 2025

Reviewed by Simply Wall St

As global markets continue to navigate a landscape marked by stronger-than-expected U.S. labor market data and persistent inflation concerns, small-cap stocks have notably underperformed, with the Russell 2000 Index slipping into correction territory. Amidst this backdrop of economic uncertainty and fluctuating indices, identifying stocks with untapped potential requires a keen eye for companies that demonstrate robust fundamentals and resilience in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Ditto (Thailand) Public Company Limited focuses on distributing data and document management solutions in Thailand, with a market capitalization of THB9.99 billion.

Operations: Ditto generates revenue primarily from three segments: Technology Engineering Services (THB1.07 billion), Data and Document Management Solutions (THB692.38 million), and Photocopiers, Printers, and Technology Products (THB475.38 million). The company has a market capitalization of THB9.99 billion.

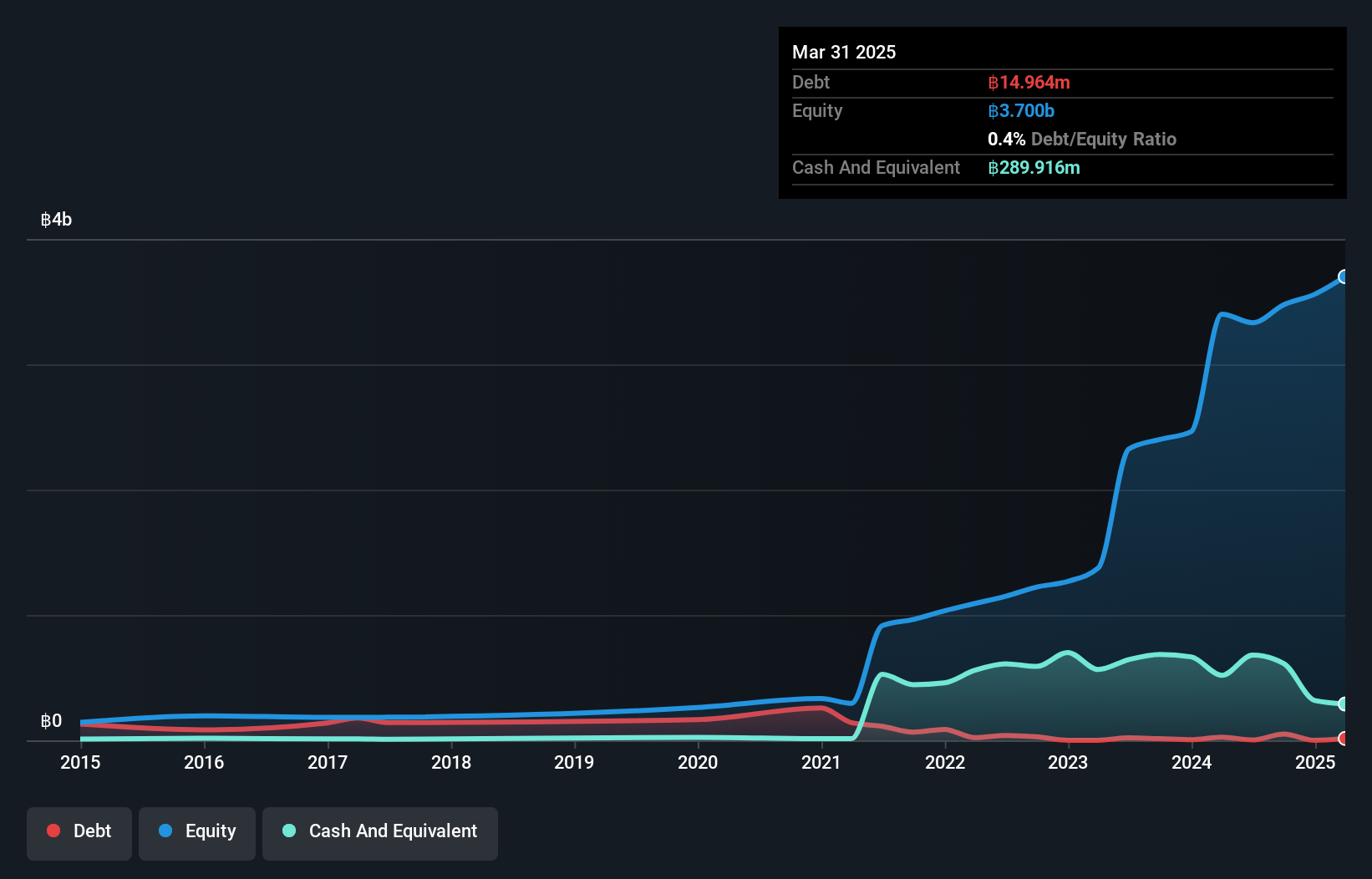

Ditto (Thailand) has shown remarkable progress, with its debt to equity ratio plummeting from 64% to 1.4% over the past five years, indicating strong financial management. The company is trading at a value perceived to be 27.1% below its fair market estimate, suggesting potential undervaluation in the market. Over the last year, Ditto's earnings surged by an impressive 38.6%, outpacing the electronic industry’s growth of 7.1%. Recent reports reveal a net income increase for Q3 to THB 138 million from THB 97 million last year, demonstrating robust performance and profitability prospects ahead.

Guangdong New Grand Long Packing (SZSE:002836)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangdong New Grand Long Packing Co., Ltd. operates in the packaging industry and has a market cap of CN¥1.84 billion.

Operations: The company generates revenue primarily from its packaging operations. It has a market capitalization of CN¥1.84 billion, reflecting its scale in the industry.

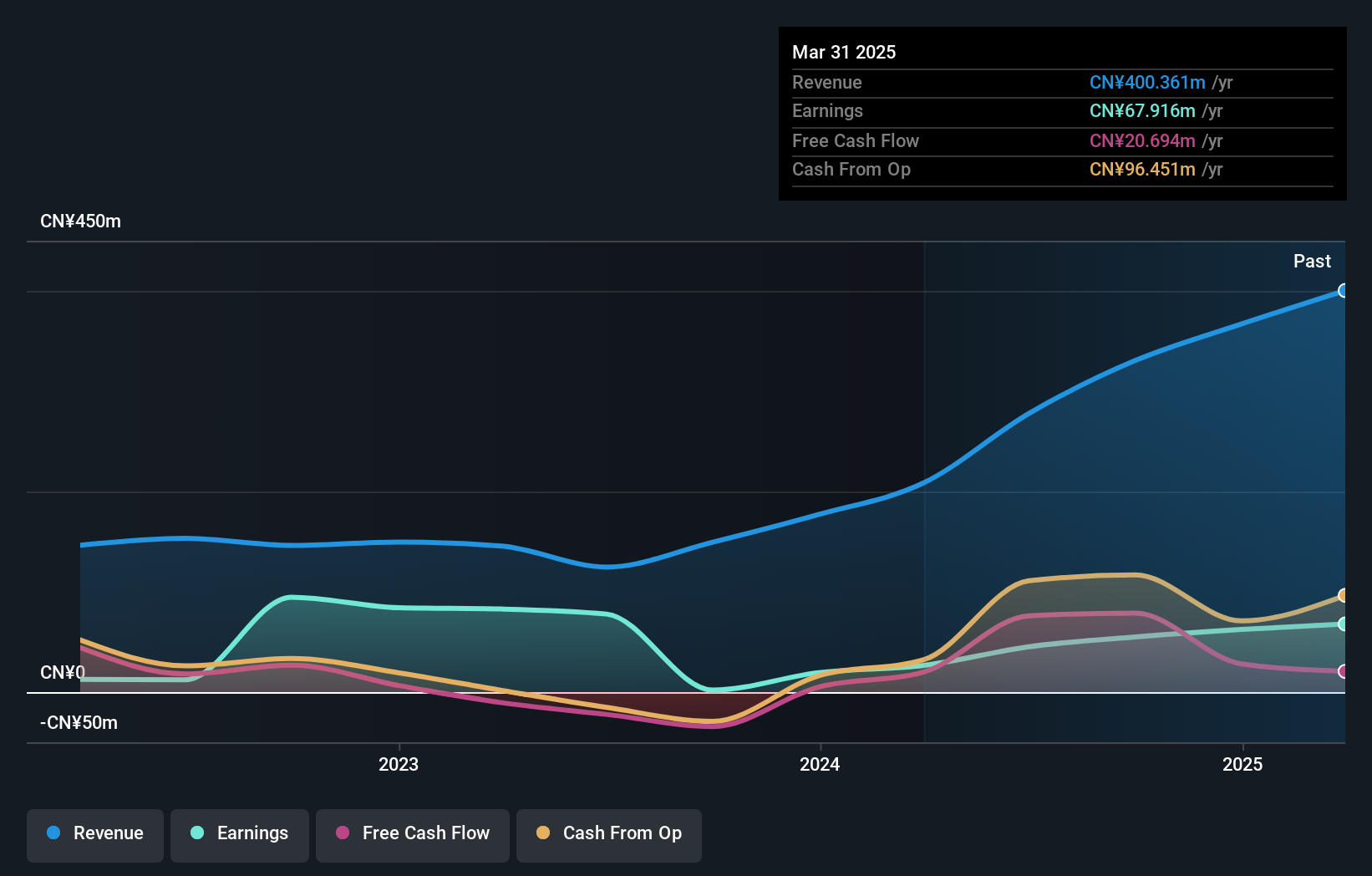

Guangdong New Grand Long Packing, a promising entity in the packaging sector, showcases impressive growth with earnings surging by 2549.8% over the past year, outpacing the industry average of 18.4%. The company reported sales of CNY 264.44 million for the first nine months of 2024, a significant rise from CNY 111.02 million in the previous year. Net income also jumped to CNY 45.77 million from CNY 10.21 million last year, reflecting strong operational performance and high-quality earnings without debt concerns due to its debt-free status for five years now compared to a previous ratio of 17.7%.

Ningbo Jianan ElectronicsLtd (SZSE:300880)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Jianan Electronics Co., Ltd is involved in the research, development, production, and sale of smart energy meters, data collection systems, and metering infrastructure in China with a market cap of CN¥4.21 billion.

Operations: Ningbo Jianan Electronics generates revenue primarily from smart energy meters and related systems. The company has experienced fluctuations in its cost structure, impacting its net profit margin, which was recorded at 12.5% in the latest period.

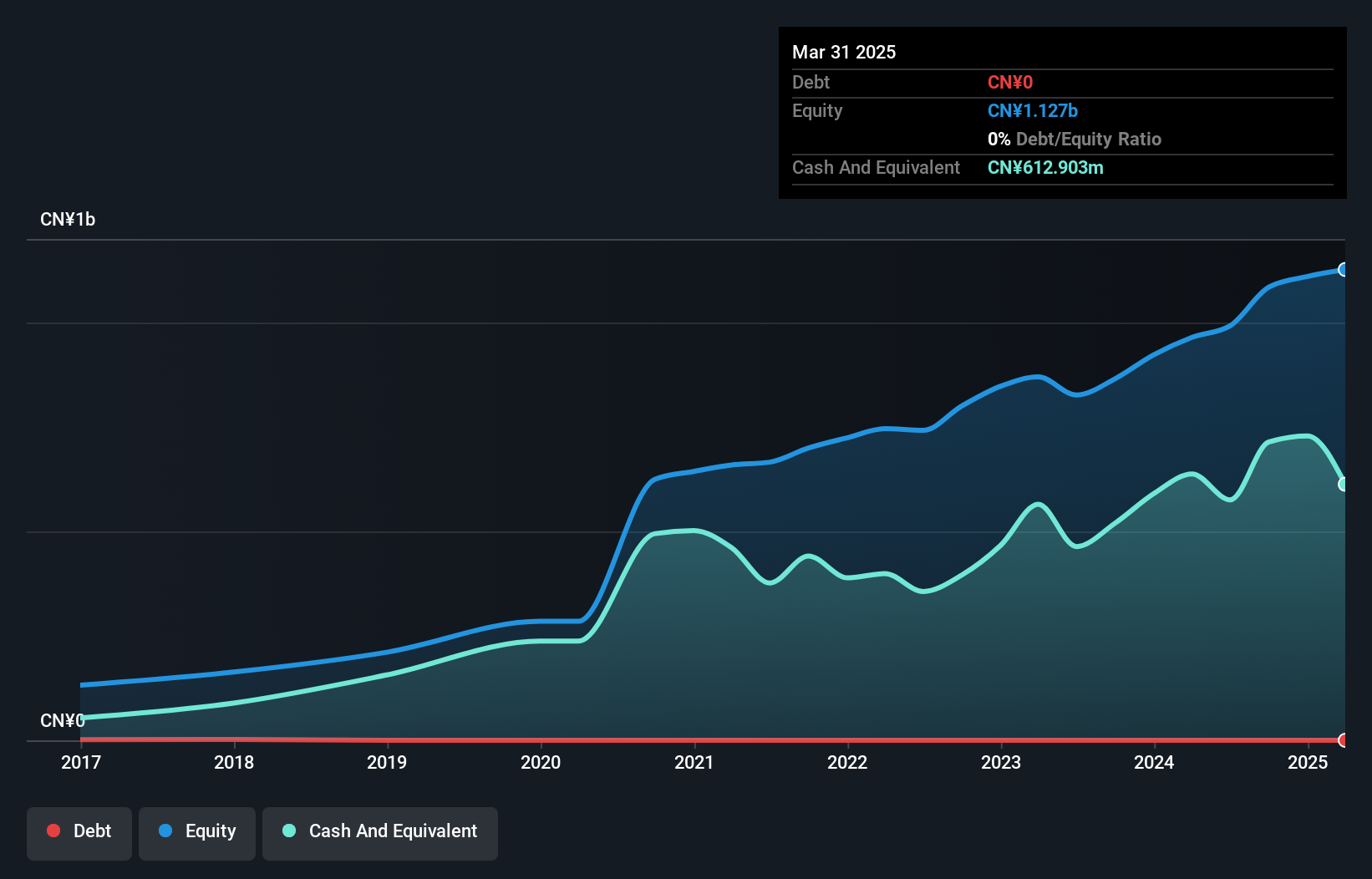

Ningbo Jianan Electronics, a smaller player in the electronics sector, showcases impressive financial health with no debt on its books and earnings growth of 58.6% over the past year, outpacing the industry average of 1.8%. Trading at nearly 22% below its estimated fair value suggests potential undervaluation. Recent earnings reported sales of CNY 783 million for nine months ending September 2024, up from CNY 605 million a year earlier, with net income rising to CNY 172 million from CNY 106 million. The company’s free cash flow remains positive, indicating robust operational efficiency amidst competitive market dynamics.

Make It Happen

- Navigate through the entire inventory of 4627 Undiscovered Gems With Strong Fundamentals here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002836

Guangdong New Grand Long Packing

Guangdong New Grand Long Packing Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives