- China

- /

- Tech Hardware

- /

- SZSE:300857

Asian Growth Stocks With Insider Ownership Up To 31%

Reviewed by Simply Wall St

As global markets navigate a period of economic uncertainty, with mixed signals from major economies like the U.S. and China, investors are increasingly looking towards Asia for opportunities in growth stocks. In this environment, companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those who know the business best, potentially aligning their interests closely with shareholders'.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Vuno (KOSDAQ:A338220) | 15.6% | 113.4% |

| Techwing (KOSDAQ:A089030) | 19.1% | 64.4% |

| Sineng ElectricLtd (SZSE:300827) | 36.2% | 27.6% |

| Seers Technology (KOSDAQ:A458870) | 34.1% | 84.6% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 33.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.9% | 91.9% |

| AprilBioLtd (KOSDAQ:A397030) | 31% | 87.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

CanSino Biologics (SEHK:6185)

Simply Wall St Growth Rating: ★★★★★☆

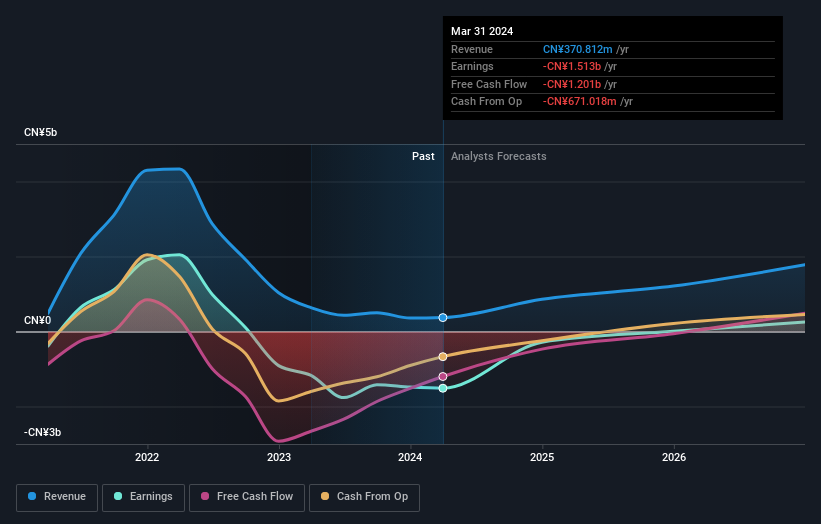

Overview: CanSino Biologics Inc. develops, manufactures, and commercializes vaccines in the People's Republic of China with a market cap of HK$17.80 billion.

Operations: The company generates revenue primarily from the research and development of vaccine products for human use, amounting to CN¥925.24 million.

Insider Ownership: 31.3%

CanSino Biologics shows potential as a growth company with high insider ownership in Asia. The company's revenue is forecast to grow at 28.9% annually, surpassing the Hong Kong market average. Recent earnings indicate improved financial performance, with a significant reduction in net loss from CNY 225.37 million to CNY 13.49 million year-on-year for the half-year ended June 2025. Despite no substantial insider buying recently, the launch of new vaccines like PCV13i and clinical trials for innovative products could enhance its market position and product portfolio significantly.

- Navigate through the intricacies of CanSino Biologics with our comprehensive analyst estimates report here.

- The analysis detailed in our CanSino Biologics valuation report hints at an deflated share price compared to its estimated value.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★☆

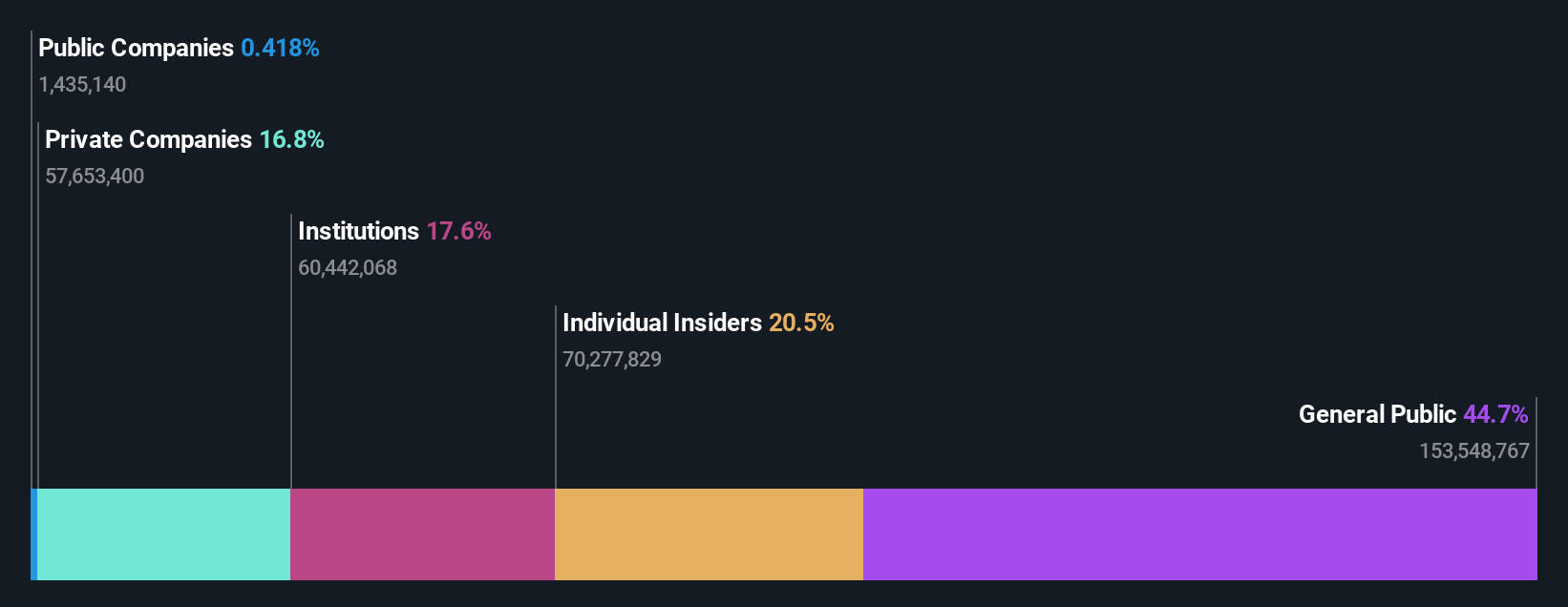

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating in China and internationally, with a market cap of CN¥39.81 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates its revenue primarily from the provision of wireless IoT products both domestically and abroad.

Insider Ownership: 20.5%

Sharetronic Data Technology demonstrates potential in Asia with high insider ownership. Its earnings are forecast to grow significantly above the market average, at 34.19% annually, while revenue is expected to rise by 23% per year. Recent amendments to the company's articles of association may signal strategic shifts. Despite a volatile share price and debt concerns, its price-to-earnings ratio of 52x remains below the tech industry average, suggesting relative value within its sector.

- Get an in-depth perspective on Sharetronic Data Technology's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Sharetronic Data Technology is trading beyond its estimated value.

PARK24 (TSE:4666)

Simply Wall St Growth Rating: ★★★★☆☆

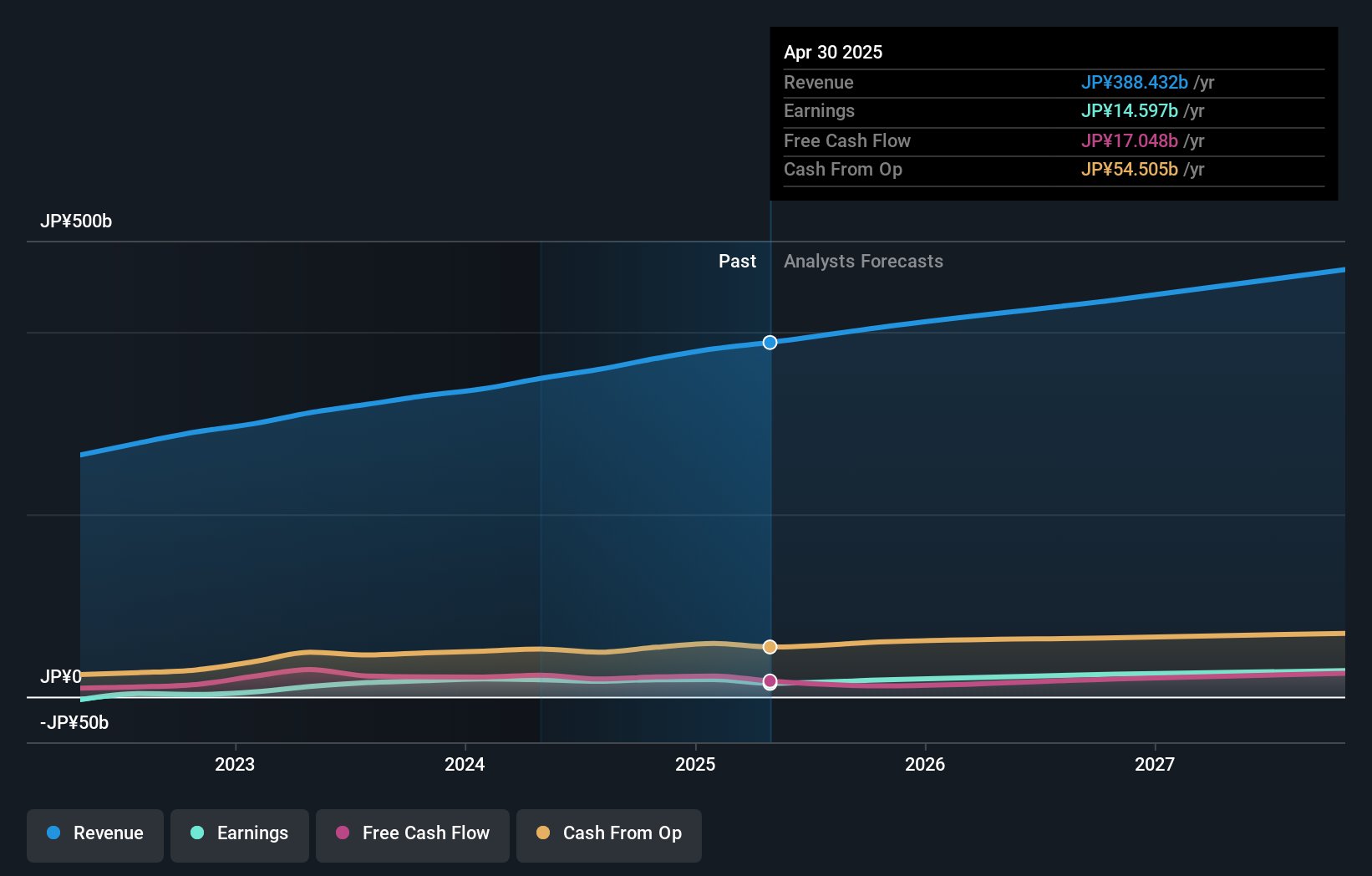

Overview: PARK24 Co., Ltd. operates and manages parking facilities both in Japan and internationally, with a market cap of ¥368.22 billion.

Operations: The company's revenue is derived from three segments: Mobility Business at ¥119.73 million, Parking Business Japan at ¥190.53 million, and Parking Business International at ¥84.76 million.

Insider Ownership: 10.5%

PARK24, with high insider ownership, is projected to grow earnings at 18.63% annually, outpacing the Japanese market. Despite a forecasted revenue growth of 6.4%, recent guidance revisions show a decrease in profit expectations due to an extraordinary loss from terminating a retirement benefit plan. Trading below fair value estimates by 32%, analysts expect a potential price increase of 24.6%. However, the company faces challenges with its high debt levels and revised earnings outlook.

- Click here to discover the nuances of PARK24 with our detailed analytical future growth report.

- In light of our recent valuation report, it seems possible that PARK24 is trading behind its estimated value.

Taking Advantage

- Gain an insight into the universe of 617 Fast Growing Asian Companies With High Insider Ownership by clicking here.

- Seeking Other Investments? These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300857

Sharetronic Data Technology

Operates as a provider of wireless IoT products in China and internationally.

High growth potential with acceptable track record.

Market Insights

Community Narratives