- China

- /

- Electronic Equipment and Components

- /

- SZSE:300811

Exploring High Growth Tech Stocks To Watch This February 2025

Reviewed by Simply Wall St

As global markets navigate a period of volatility marked by fluctuating corporate earnings and competitive pressures in the AI sector, the technology-oriented Nasdaq Composite has faced notable challenges. Despite these headwinds, identifying high growth tech stocks requires an understanding of how companies adapt to evolving market dynamics and leverage innovations to sustain momentum.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Pharma Mar | 23.24% | 44.74% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1232 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Zhejiang Meorient Commerce Exhibition (SZSE:300795)

Simply Wall St Growth Rating: ★★★★★★

Overview: Zhejiang Meorient Commerce Exhibition Inc. specializes in organizing trade exhibitions and events, with a market capitalization of CN¥4.45 billion.

Operations: Zhejiang Meorient Commerce Exhibition Inc. generates revenue primarily through organizing trade exhibitions and events. The company's business model focuses on facilitating international trade by hosting large-scale events that connect global buyers and suppliers, contributing significantly to its financial performance.

Zhejiang Meorient Commerce Exhibition, despite its recent exclusion from the S&P Global BMI Index, shows promising financial trends with an expected annual revenue growth rate of 26.7% and earnings growth forecast at 31.9% per year, outpacing the Chinese market averages of 13.3% and 25%, respectively. With a robust return on equity projected at 30.8% in three years, the company's aggressive R&D investment strategy not only fuels innovation but also aligns with its substantial revenue and earnings acceleration. This strategic focus on development underscores its potential resilience and adaptability in a competitive tech landscape, suggesting a vibrant future if current trends persist.

POCO Holding (SZSE:300811)

Simply Wall St Growth Rating: ★★★★★☆

Overview: POCO Holding Co., Ltd. specializes in the development, production, and sale of alloy soft magnetic powder and cores along with related inductance components for electronic equipment users, with a market cap of CN¥14.95 billion.

Operations: The company generates revenue primarily from the sale of alloy soft magnetic powder and cores, as well as inductance components for electronic equipment. The business focuses on serving the downstream users in the electronics sector.

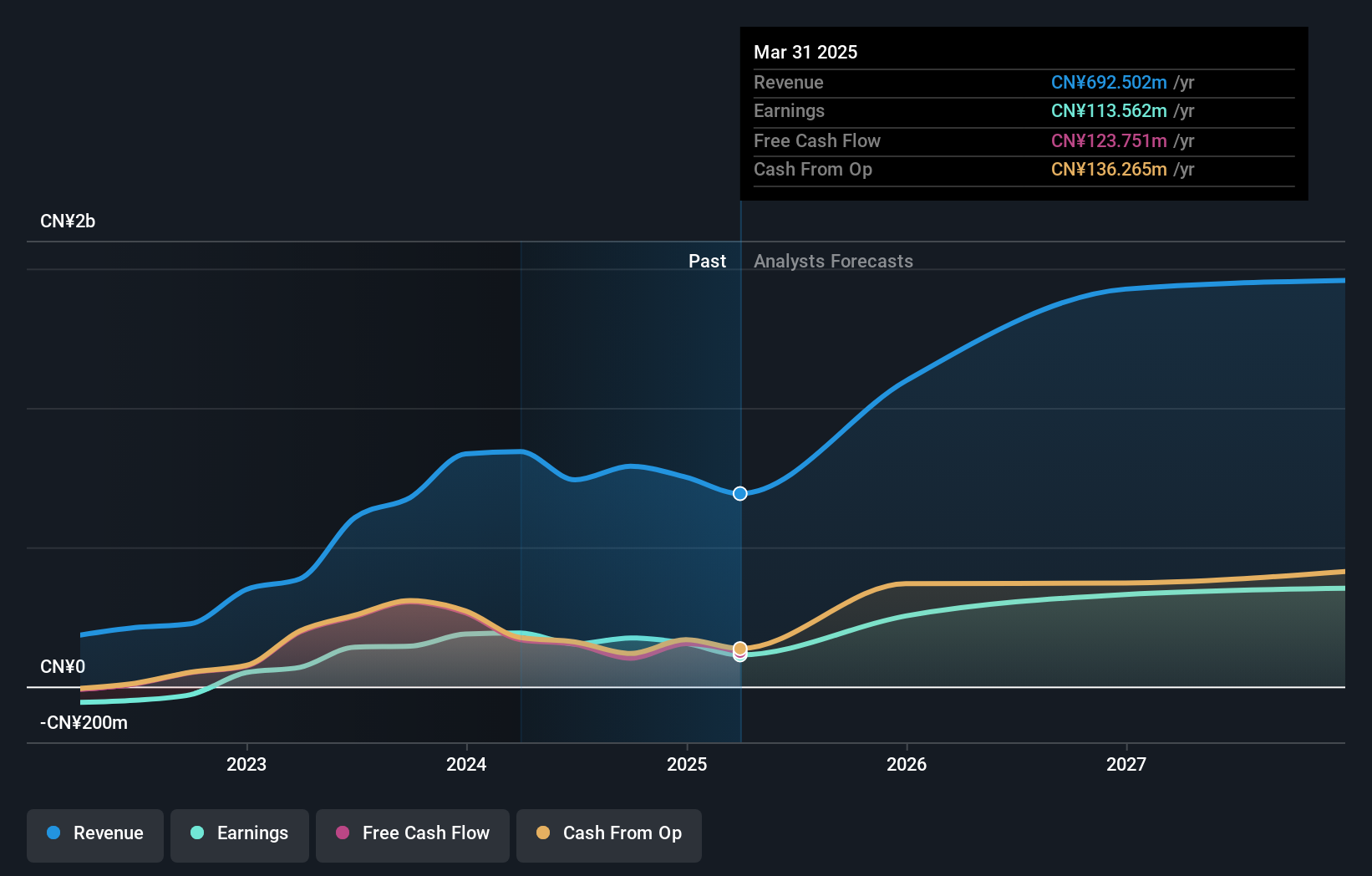

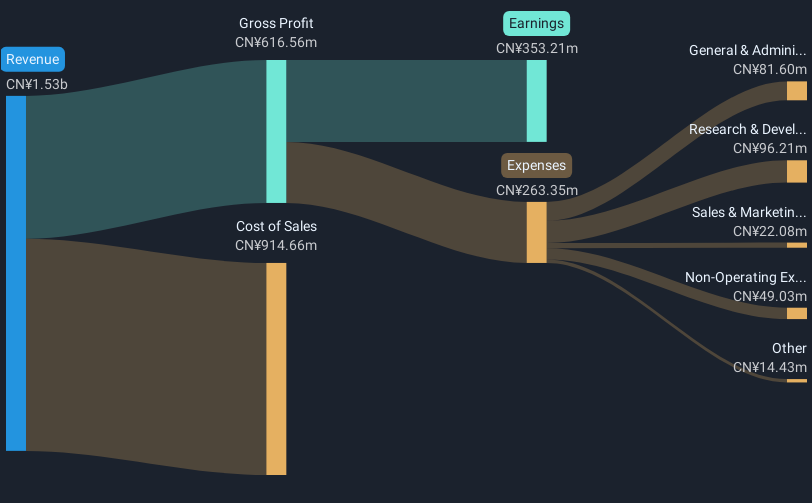

POCO Holding, with its 25.6% expected annual revenue growth and 26.6% earnings growth forecast, outstrips the broader CN market's averages significantly. This tech entity has channeled substantial funds into R&D, a move that not only highlights its commitment to innovation but also supports its robust financial trajectory—evident from a 41% earnings surge over the past year alone. By focusing on these strategic areas, POCO is well-positioned to maintain its competitive edge in a rapidly evolving tech landscape, potentially leading to sustained future growth.

- Click to explore a detailed breakdown of our findings in POCO Holding's health report.

Gain insights into POCO Holding's past trends and performance with our Past report.

Shenzhen Xinhao Photoelectricity Technology (SZSE:301051)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Xinhao Photoelectricity Technology Co., Ltd focuses on the research, development, manufacture, and sale of precision optical components and modules in China, with a market cap of CN¥4.48 billion.

Operations: Xinhao Photoelectricity specializes in producing precision optical components and modules, generating revenue primarily from the sale of these products within China. The company operates with a market capitalization of CN¥4.48 billion.

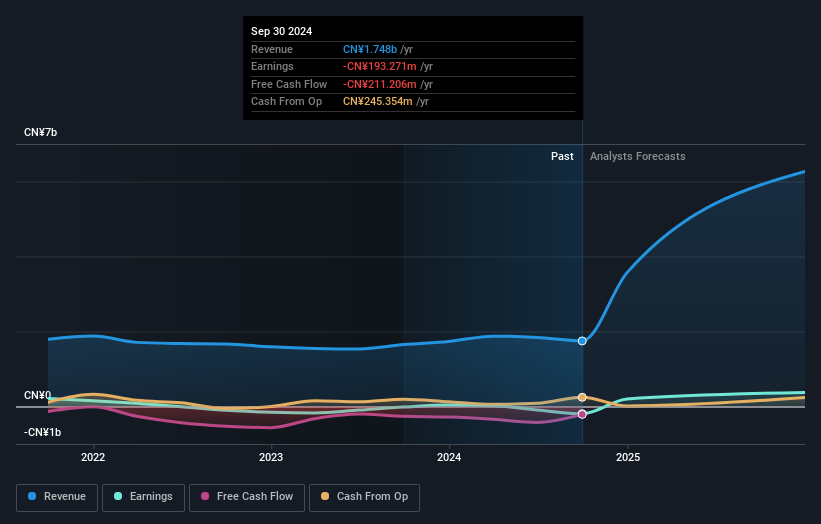

Shenzhen Xinhao Photoelectricity Technology is poised for significant growth, with an expected annual revenue increase of 86.8% and earnings forecast to surge by 146.1%. This acceleration is underpinned by strategic R&D investments, which are crucial as the company transitions towards profitability within three years. Recent shareholder meetings have focused on pivotal decisions like terminating a subsidiary merger and exploring financial leasing, indicating a proactive approach to refining its business operations and enhancing shareholder value in the dynamic tech sector.

- Delve into the full analysis health report here for a deeper understanding of Shenzhen Xinhao Photoelectricity Technology.

Understand Shenzhen Xinhao Photoelectricity Technology's track record by examining our Past report.

Where To Now?

- Get an in-depth perspective on all 1232 High Growth Tech and AI Stocks by using our screener here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300811

POCO Holding

Develops, produces, and sells alloy soft magnetic powder, and alloy soft magnetic core and related inductance components for the downstream users of electricity electronic equipment.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives