- China

- /

- Electronic Equipment and Components

- /

- SZSE:300807

Zhengzhou Tiamaes Technology Co.,Ltd's (SZSE:300807) 38% Price Boost Is Out Of Tune With Revenues

Those holding Zhengzhou Tiamaes Technology Co.,Ltd (SZSE:300807) shares would be relieved that the share price has rebounded 38% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 5.1% over the last year.

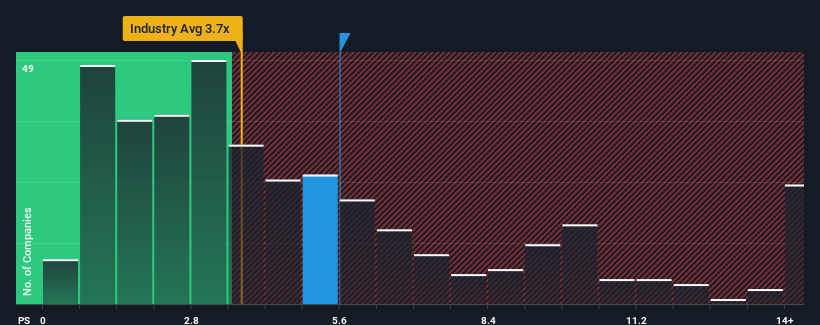

Following the firm bounce in price, given close to half the companies operating in China's Electronic industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider Zhengzhou Tiamaes TechnologyLtd as a stock to potentially avoid with its 5.6x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

View our latest analysis for Zhengzhou Tiamaes TechnologyLtd

What Does Zhengzhou Tiamaes TechnologyLtd's P/S Mean For Shareholders?

It looks like revenue growth has deserted Zhengzhou Tiamaes TechnologyLtd recently, which is not something to boast about. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. If not, then existing shareholders may be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Zhengzhou Tiamaes TechnologyLtd, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as high as Zhengzhou Tiamaes TechnologyLtd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 14% drop in revenue. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 25% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this information, we find it concerning that Zhengzhou Tiamaes TechnologyLtd is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Zhengzhou Tiamaes TechnologyLtd shares have taken a big step in a northerly direction, but its P/S is elevated as a result. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Zhengzhou Tiamaes TechnologyLtd currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 2 warning signs for Zhengzhou Tiamaes TechnologyLtd that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Zhengzhou Tiamaes Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300807

Zhengzhou Tiamaes Technology

Zhengzhou Tiamaes Technology Co., Ltd provides comprehensive solutions for urban bus operation, management, and services based on internet of vehicles technology in China.

Adequate balance sheet with minimal risk.

Market Insights

Community Narratives