- China

- /

- Electronic Equipment and Components

- /

- SZSE:300747

Asian Growth Companies With High Insider Ownership In May 2025

Reviewed by Simply Wall St

As of May 2025, Asian markets are navigating a complex landscape marked by ongoing trade discussions between major economies and policy shifts aimed at stabilizing growth. Amid this backdrop, investors are increasingly drawn to growth companies with substantial insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests, which can be particularly appealing in uncertain economic climates.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Laopu Gold (SEHK:6181) | 31.9% | 40.5% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.6% | 60.7% |

| giftee (TSE:4449) | 34.5% | 63.7% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

Here we highlight a subset of our preferred stocks from the screener.

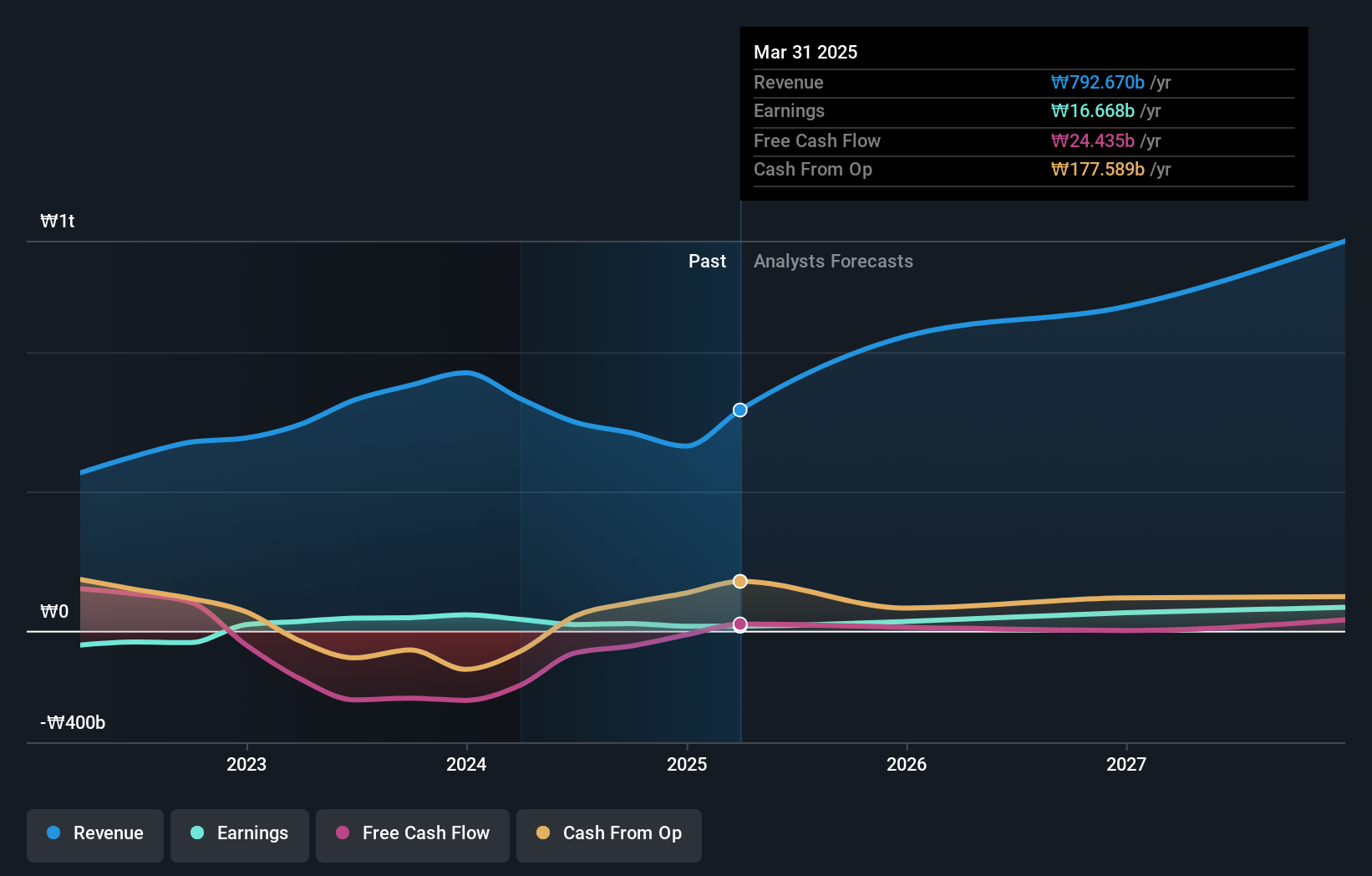

SK oceanplantLtd (KOSE:A100090)

Simply Wall St Growth Rating: ★★★★★☆

Overview: SK oceanplant Co., Ltd. operates in South Korea, focusing on the manufacturing of steel and stainless steel pipes, hull blocks, and shipbuilding equipment, with a market cap of ₩1.17 trillion.

Operations: The company's revenue primarily comes from its Shipbuilding/Marine segment, generating ₩771.30 billion, followed by the Steel Pipe Division with ₩14.20 billion.

Insider Ownership: 20.7%

Earnings Growth Forecast: 45% p.a.

SK oceanplant Ltd is trading at 57.6% below its estimated fair value, with earnings projected to grow significantly at 45% annually, outpacing the KR market's 20.6%. Despite this growth potential, recent financials show a decline in net income from ₩57.48 billion to ₩16.39 billion and a drop in profit margins from 6.2% to 2.5%. The share price has been highly volatile recently, and no substantial insider trading activity was reported over the past three months.

- Click here to discover the nuances of SK oceanplantLtd with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of SK oceanplantLtd shares in the market.

Xiaomi (SEHK:1810)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiaomi Corporation is an investment holding company that develops and sells smartphones in Mainland China and internationally, with a market cap of HK$1.31 trillion.

Operations: Xiaomi's revenue is primarily derived from its smartphones segment, which generated CN¥191.76 billion, followed by IoT and Lifestyle Products at CN¥104.10 billion, Internet Services contributing CN¥34.12 billion, and Smart EV and Other New Initiatives adding CN¥32.75 billion.

Insider Ownership: 32.8%

Earnings Growth Forecast: 21.8% p.a.

Xiaomi Corporation has demonstrated robust growth with earnings increasing by 35.4% over the past year and projected to grow at 21.82% annually, outpacing the Hong Kong market's average. The company recently completed a HK$42.6 billion follow-on equity offering, indicating strong capital market activity. Although trading below its estimated fair value by 21.9%, Xiaomi faces low return on equity forecasts in three years (18.8%). Insider buying has occurred without substantial volumes sold recently, reflecting confidence in future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Xiaomi.

- The analysis detailed in our Xiaomi valuation report hints at an inflated share price compared to its estimated value.

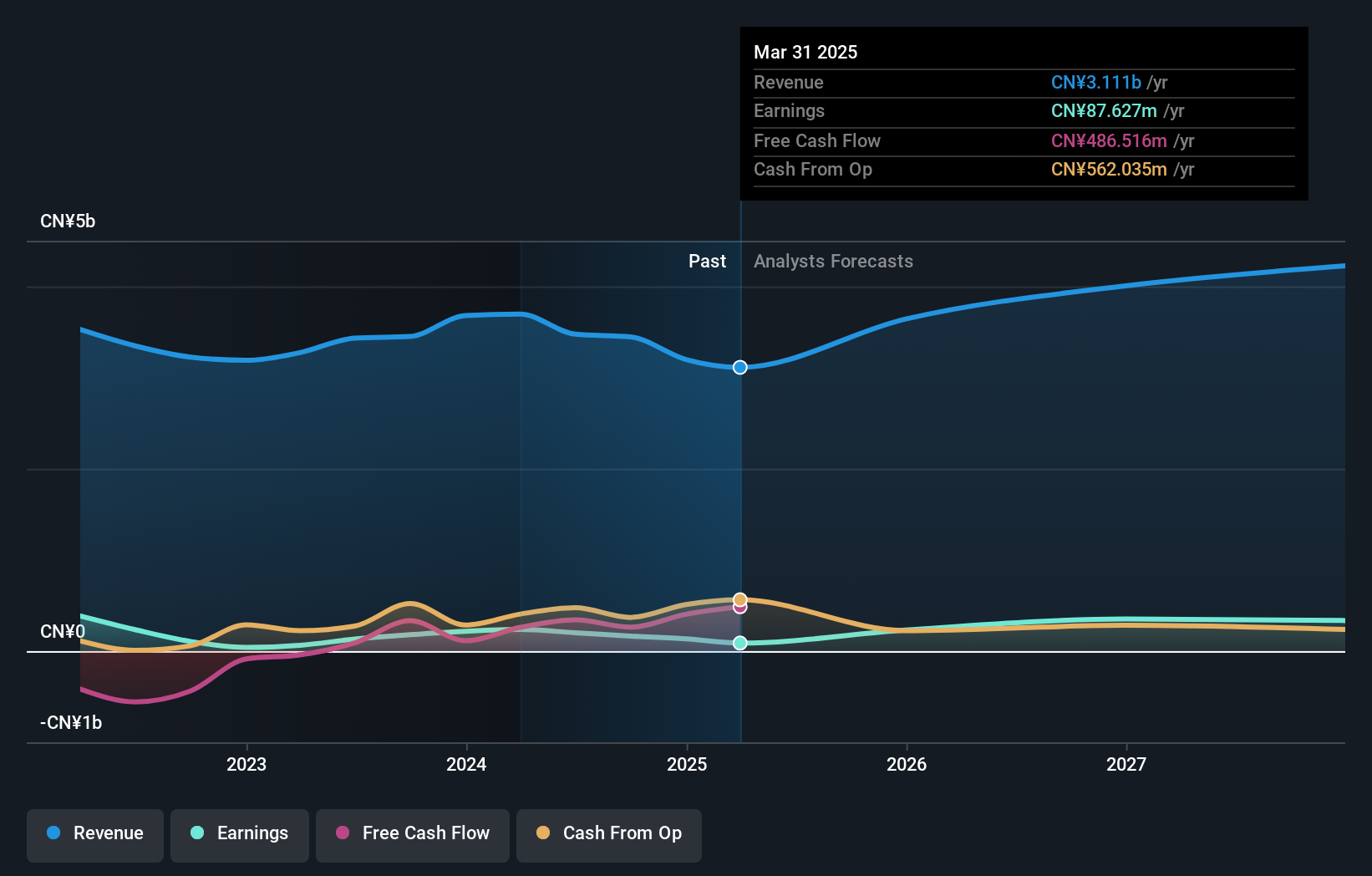

Wuhan Raycus Fiber Laser TechnologiesLtd (SZSE:300747)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wuhan Raycus Fiber Laser Technologies Co., Ltd. operates in the fiber laser industry, focusing on the research, development, and production of fiber lasers with a market cap of CN¥12.27 billion.

Operations: I'm sorry, but it seems that the revenue segment data is missing from the provided text. If you can provide that information, I would be happy to help summarize it for you.

Insider Ownership: 16.1%

Earnings Growth Forecast: 42.6% p.a.

Wuhan Raycus Fiber Laser Technologies exhibits growth potential with earnings forecasted to grow 42.63% annually, surpassing the Chinese market's average. Despite trading at a 35.8% discount to its estimated fair value, recent financials reveal declining profit margins and revenue compared to last year. The company's return on equity is projected to remain low at 8.4%. No significant insider trading activity has been reported recently, suggesting stability in insider sentiment regarding future performance.

- Unlock comprehensive insights into our analysis of Wuhan Raycus Fiber Laser TechnologiesLtd stock in this growth report.

- Our expertly prepared valuation report Wuhan Raycus Fiber Laser TechnologiesLtd implies its share price may be too high.

Seize The Opportunity

- Navigate through the entire inventory of 616 Fast Growing Asian Companies With High Insider Ownership here.

- Searching for a Fresh Perspective? The end of cancer? These 23 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Wuhan Raycus Fiber Laser TechnologiesLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300747

Wuhan Raycus Fiber Laser TechnologiesLtd

Wuhan Raycus Fiber Laser Technologies Co.,Ltd.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives