- China

- /

- Electronic Equipment and Components

- /

- SZSE:300684

Undiscovered Gems With Potential For December 2024

Reviewed by Simply Wall St

As global markets navigate a landscape of fluctuating interest rates and mixed economic indicators, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming larger counterparts like the S&P 500. Amidst this backdrop of cautious optimism and strategic adjustments by central banks worldwide, identifying potential in lesser-known stocks requires a keen eye for companies that demonstrate resilience and adaptability in changing market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

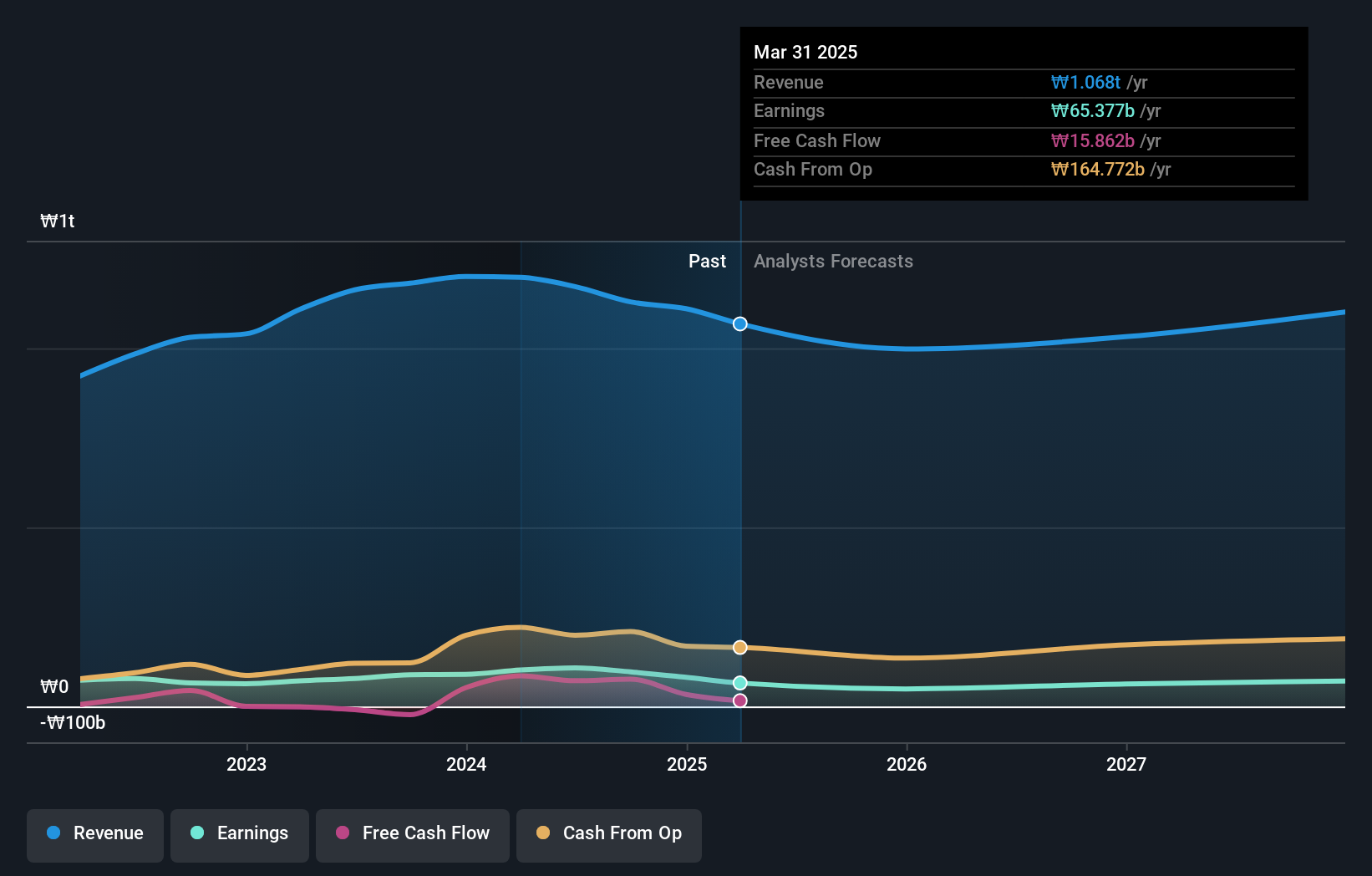

Asia CementLtd (KOSE:A183190)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Asia Cement Co., Ltd. is involved in the production and distribution of cement and ready-mixed concrete in South Korea, with a market capitalization of ₩400.38 billion.

Operations: The primary revenue stream for Asia Cement Co., Ltd. comes from its cement business, generating approximately ₩1.16 trillion. The company also earns revenue from other business activities amounting to ₩50.57 billion.

Asia Cement Co.,Ltd. seems to be an intriguing player in the industry with its net debt to equity ratio at 41.7%, which is high but has improved from 82.4% over five years, indicating better financial management. The company boasts high-quality earnings and positive free cash flow, suggesting solid operational efficiency despite a forecasted earnings decline of 1.1% annually for the next three years. Recent buyback activities worth KRW 2,553 million aim to enhance shareholder value, reflecting confidence in its undervalued stock trading at 94.4% below estimated fair value amidst robust EBIT coverage of interest payments at 6.8 times.

- Get an in-depth perspective on Asia CementLtd's performance by reading our health report here.

Understand Asia CementLtd's track record by examining our Past report.

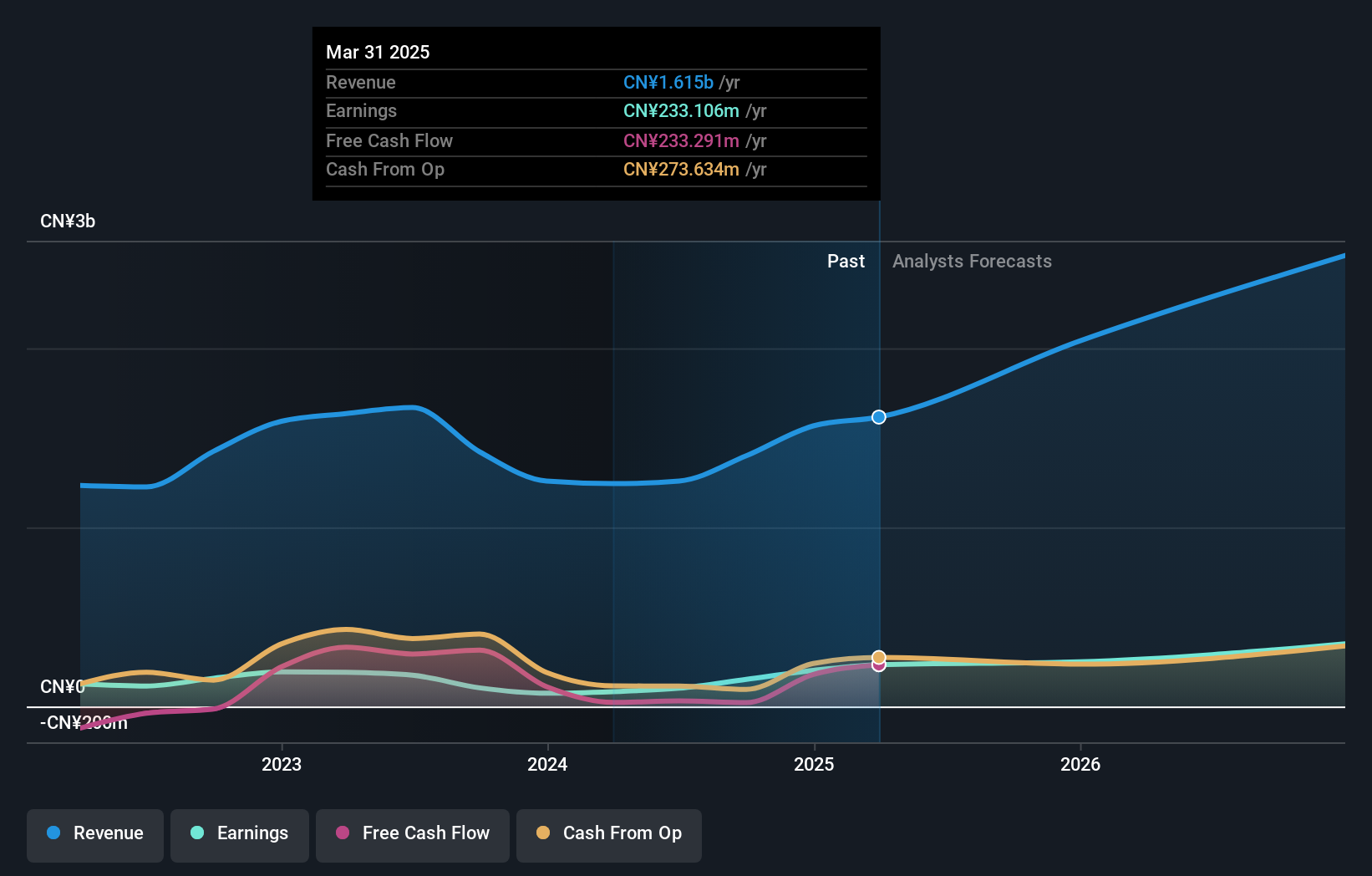

Jones Tech (SZSE:300684)

Simply Wall St Value Rating: ★★★★★★

Overview: Jones Tech PLC specializes in providing materials solutions for intelligent electronic equipment across Asia, Europe, and America with a market capitalization of CN¥6.89 billion.

Operations: Jones Tech generates revenue primarily from its materials solutions for intelligent electronic equipment. The company's financial performance is highlighted by a net profit margin of 15.2%, reflecting its efficiency in converting sales into actual profit.

Jones Tech, a promising player in the electronics sector, has shown robust financial health with its earnings growing by 45.6% over the past year, outpacing the industry average of 1.9%. The company boasts a favorable price-to-earnings ratio of 45.5x, which is below the industry norm of 47.8x, indicating potential undervaluation. Its net income for the first nine months of 2024 was CNY 132.06 million compared to CNY 54.34 million a year earlier, showcasing significant profitability improvements. Additionally, with more cash than total debt and positive free cash flow status, Jones Tech seems well-positioned for continued growth and stability in its market segment.

- Delve into the full analysis health report here for a deeper understanding of Jones Tech.

Gain insights into Jones Tech's past trends and performance with our Past report.

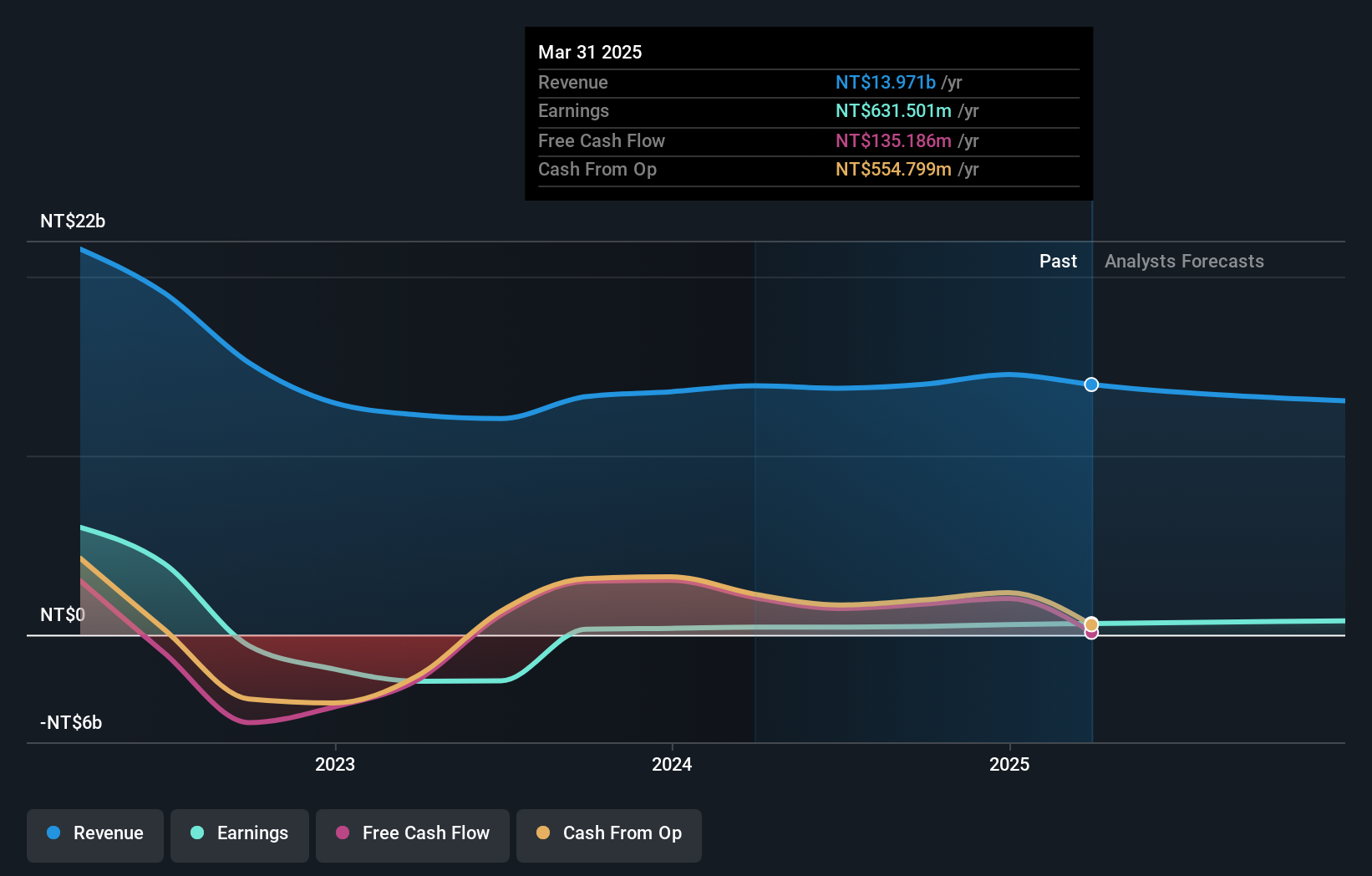

FocalTech Systems (TWSE:3545)

Simply Wall St Value Rating: ★★★★★☆

Overview: FocalTech Systems Co., Ltd. specializes in the research, design, development, manufacturing, and sale of human-machine interface solutions across Taiwan, China, and international markets with a market cap of NT$19.84 billion.

Operations: FocalTech's primary revenue stream is from selling and developing portable device-related ICs, generating NT$13.98 billion.

FocalTech Systems, a player in the semiconductor industry, has shown impressive earnings growth of 49.8% over the past year, outpacing the industry's 5.7%. The company reported third-quarter sales of TWD 3.81 billion and net income of TWD 168 million, reflecting solid performance compared to last year’s figures. Basic earnings per share increased to TWD 0.79 from TWD 0.61 a year ago. With high-quality past earnings and free cash flow positivity, FocalTech seems well-positioned within its niche market despite an increased debt-to-equity ratio from zero to 21.8% over five years, suggesting prudent financial management amidst growth ambitions.

Key Takeaways

- Unlock more gems! Our Undiscovered Gems With Strong Fundamentals screener has unearthed 4618 more companies for you to explore.Click here to unveil our expertly curated list of 4621 Undiscovered Gems With Strong Fundamentals.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300684

Jones Tech

Provides materials solutions for intelligent electronic equipment in Asia, Europe, and America.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives