- France

- /

- Oil and Gas

- /

- ENXTPA:NAE

Uncovering 3 Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and softer-than-expected U.S. job growth, global markets experienced mixed reactions, with major indices like the S&P 500 showing resilience despite slight declines. Amidst these fluctuations, small-cap stocks in particular face unique challenges and opportunities as they navigate the broader economic landscape influenced by trade policies and manufacturing activity. In this context, identifying stocks with strong fundamentals, innovative potential, or niche market positions can be crucial for investors seeking promising opportunities. As we explore three undiscovered gems in the small-cap sector, it's important to consider how these companies might leverage current market dynamics to their advantage.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Oakworth Capital | 31.49% | 14.78% | 4.46% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| Inverfal PerúA | 31.20% | 10.56% | 17.83% | ★★★★★☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. refines, distributes, and markets oil products in France and internationally with a market cap of €1.55 billion.

Operations: Esso S.A.F. generates revenue primarily through its refining and distribution operations, amounting to €18.93 billion. The company's financial performance is influenced by the costs associated with these segments, impacting its overall profitability.

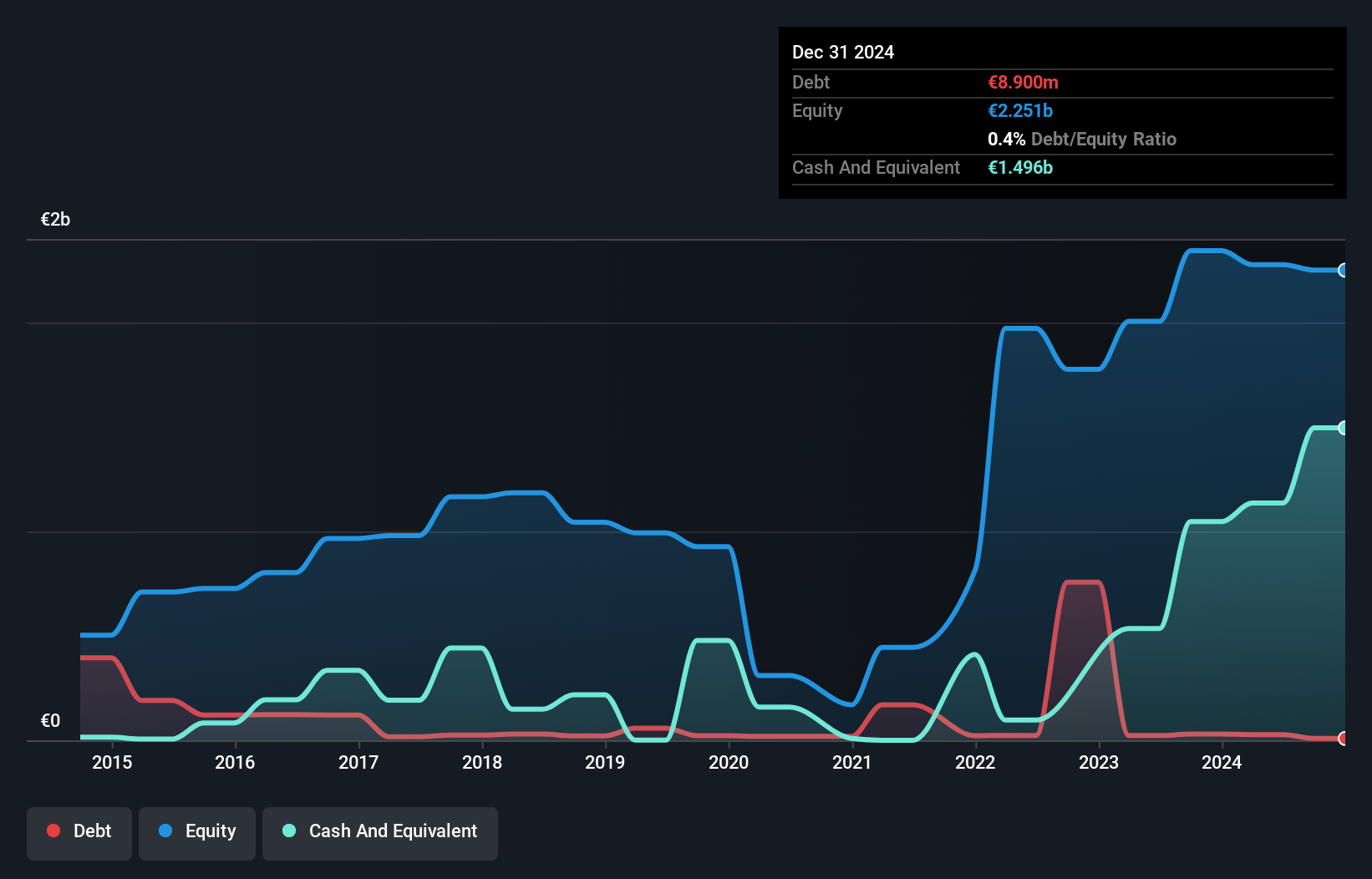

EssoF's financial landscape reveals a compelling story, with its debt to equity ratio dropping significantly from 5.8 to 1.2 over the past five years, indicating improved financial health. The company has become profitable this year, showcasing an impressive turnaround compared to the broader Oil and Gas industry which saw an earnings growth of -18.8%. Trading at a substantial discount of 96.6% below estimated fair value suggests potential undervaluation in the market. Additionally, EssoF's free cash flow is positive, further enhancing its appeal as it continues to cover interest payments comfortably with high-quality earnings reported recently.

- Dive into the specifics of EssoF here with our thorough health report.

Review our historical performance report to gain insights into EssoF's's past performance.

Jiangsu Zhengdan Chemical Industry (SZSE:300641)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Zhengdan Chemical Industry Co., Ltd. is a company engaged in the petrochemical industry, with a market capitalization of CN¥14.29 billion.

Operations: The company's primary revenue stream is from the petrochemical industry, generating CN¥3.07 billion.

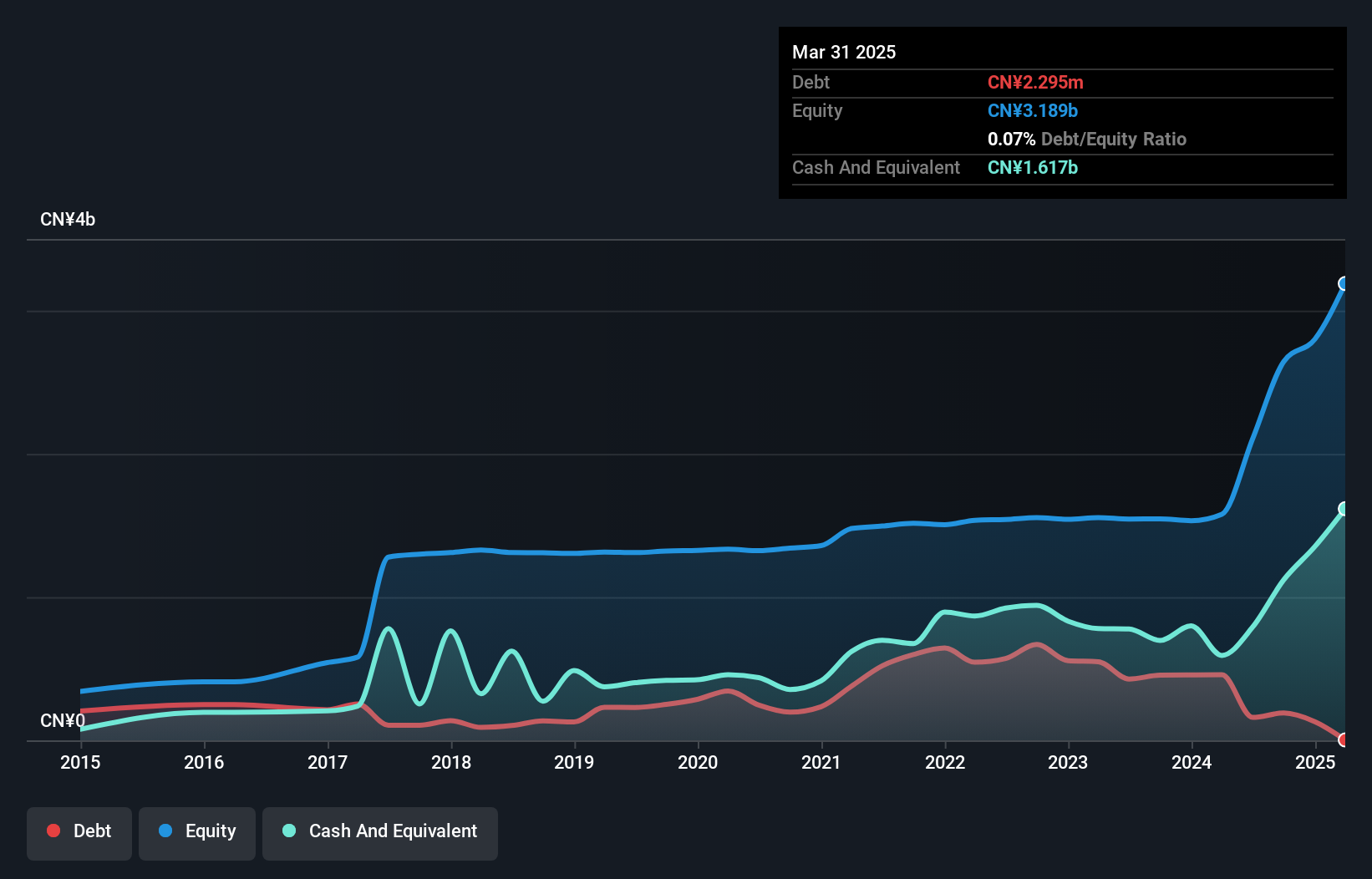

Jiangsu Zhengdan Chemical Industry, a nimble player in the chemicals sector, has shown impressive earnings growth of 8941.9% over the past year, outpacing its industry peers. The company’s debt-to-equity ratio has improved significantly from 19% to 7.2% in five years, indicating prudent financial management. With a price-to-earnings ratio of 17.7x, it appears undervalued compared to the broader CN market at 37.1x. Recent discussions around cash management and potential hedging strategies suggest an active approach to optimizing financial resources and mitigating risks amidst volatile conditions seen in recent months for its share price.

Jones Tech (SZSE:300684)

Simply Wall St Value Rating: ★★★★★★

Overview: Jones Tech PLC offers materials solutions for intelligent electronic equipment across Asia, Europe, and America with a market cap of CN¥7.96 billion.

Operations: Jones Tech derives its revenue from providing materials solutions for intelligent electronic equipment across various regions. The company has a market cap of CN¥7.96 billion, indicating its substantial presence in the industry.

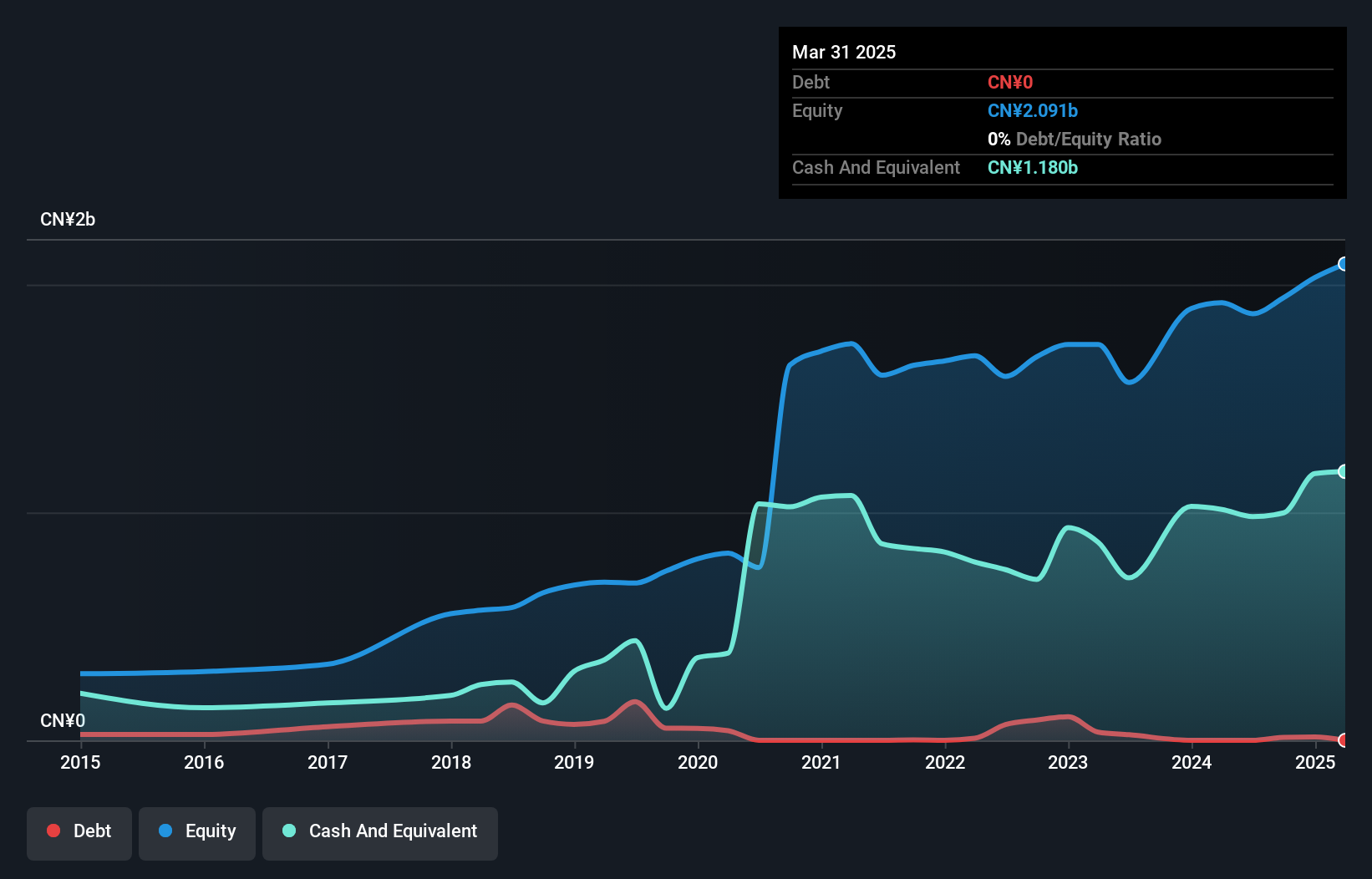

Jones Tech, a promising player in the electronics field, has demonstrated impressive earnings growth of 45.6% over the past year, outpacing the industry average of 3%. The company's financial health appears robust with more cash than total debt and a significantly reduced debt-to-equity ratio from 7.2 to 0.7 over five years. Despite high volatility in its share price recently, Jones Tech's profitability is not under threat due to strong interest coverage and positive free cash flow. Recent board changes and amendments to company bylaws suggest strategic shifts that might enhance governance and operational efficiency moving forward.

- Get an in-depth perspective on Jones Tech's performance by reading our health report here.

Explore historical data to track Jones Tech's performance over time in our Past section.

Key Takeaways

- Gain an insight into the universe of 4703 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if North Atlantic Energies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NAE

North Atlantic Energies

Distributes, and markets oil products in France and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)