- China

- /

- Communications

- /

- SHSE:603496

High Growth Tech Stocks None Leads These 3 Promising Picks

Reviewed by Simply Wall St

Amidst a backdrop of U.S. indexes approaching record highs and smaller-cap stocks outperforming, the global markets are showing broad-based gains despite geopolitical tensions and policy uncertainties. With a strong labor market and positive housing data fueling optimism, investors are keenly focused on tech stocks that demonstrate robust growth potential in this dynamic environment. In the current climate, a good stock is often characterized by its ability to leverage technological advancements while navigating economic fluctuations effectively.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Waystream Holding | 22.16% | 113.25% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.49% | ★★★★★★ |

| Pharma Mar | 25.97% | 56.89% | ★★★★★★ |

| CD Projekt | 21.17% | 29.59% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 65.73% | 103.55% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1283 stocks from our High Growth Tech and AI Stocks screener.

Here's a peek at a few of the choices from the screener.

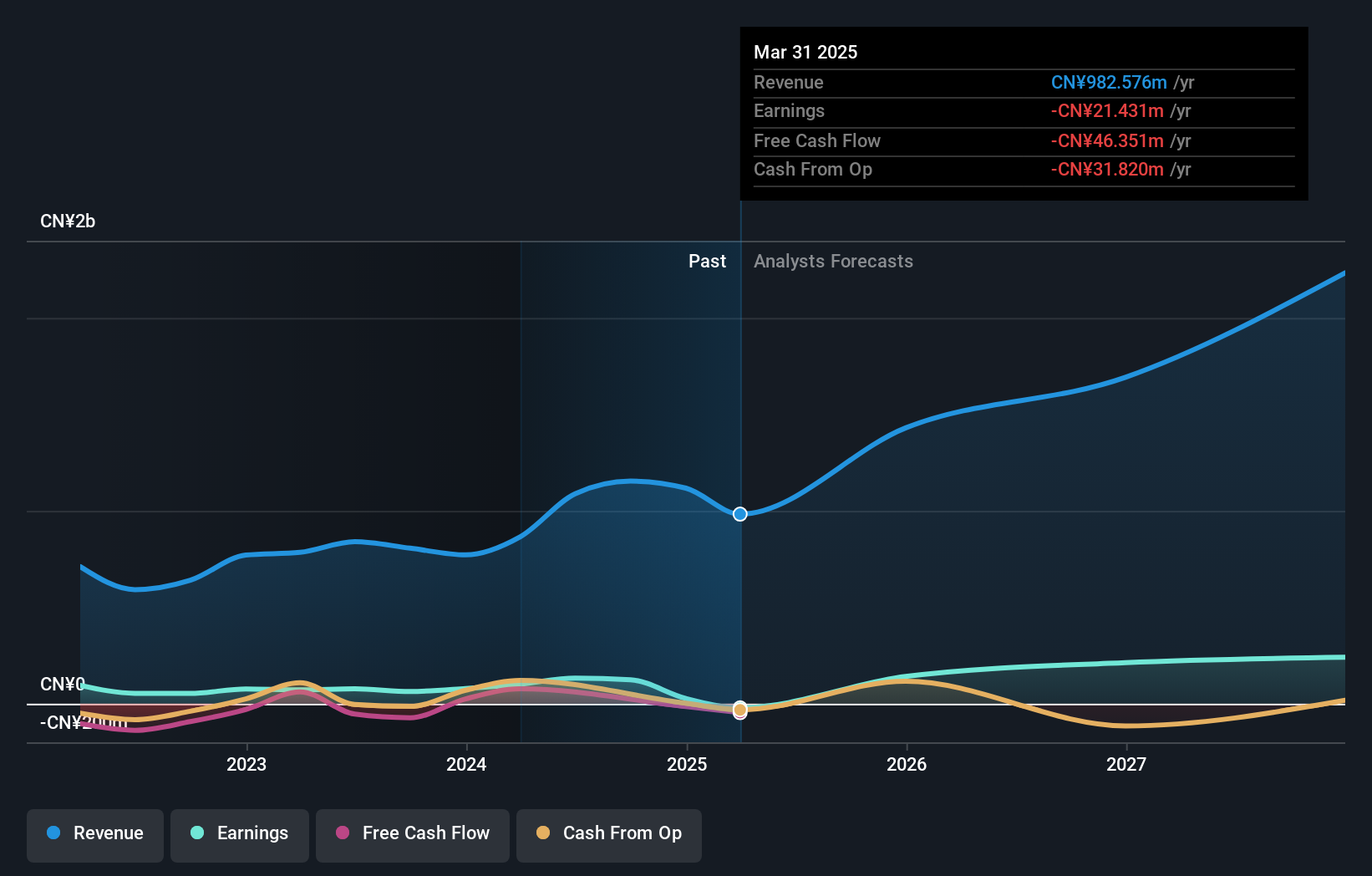

EmbedWay Technologies (Shanghai) (SHSE:603496)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: EmbedWay Technologies (Shanghai) Corporation operates as a network visibility infrastructure and intelligent system platform vendor in China with a market cap of CN¥7.98 billion.

Operations: The company generates revenue primarily from the Computer, Communication, and Other Electronic Equipment Manufacturing segment, amounting to CN¥1.15 billion.

EmbedWay Technologies (Shanghai) has demonstrated a robust performance with its recent earnings surge, reflecting a significant increase in sales from CNY 498.37 million to CNY 880.94 million year-over-year and doubling net income to CNY 78.28 million. This growth trajectory is supported by an aggressive R&D investment strategy, aligning with an anticipated revenue growth of 18.3% annually, outpacing the Chinese market's average of 13.8%. Moreover, the company's strategic inclusion in the S&P Global BMI Index underscores its expanding influence and potential in high-growth sectors, despite forecasts suggesting a modest Return on Equity of 13.9% in three years’ time.

Shenzhen Sunway Communication (SZSE:300136)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Sunway Communication Co., Ltd. focuses on the research, development, manufacture, and sale of antennas, wireless charging modules, precision connectors and cables, passive components, and EMC/EMI solutions both in China and internationally with a market cap of CN¥23.92 billion.

Operations: Sunway Communication generates revenue primarily from its electronic components segment, amounting to CN¥8.35 billion. The company engages in international markets, focusing on advanced communication technologies and solutions.

Shenzhen Sunway Communication has been capitalizing on robust market dynamics, evidenced by a 14.3% increase in revenue to CNY 6.39 billion this year from CNY 5.59 billion last year, alongside an earnings growth forecast of 31.9% per annum. This performance is underpinned by significant R&D investments which reflect in their recent presentations at Electronica Europe 2024, showcasing their commitment to innovation and market expansion. Despite a volatile share price recently, the company's strategic maneuvers and consistent revenue uptick suggest it is adeptly navigating the competitive tech landscape, further highlighted by its proactive share repurchases totaling CNY 268 million this September.

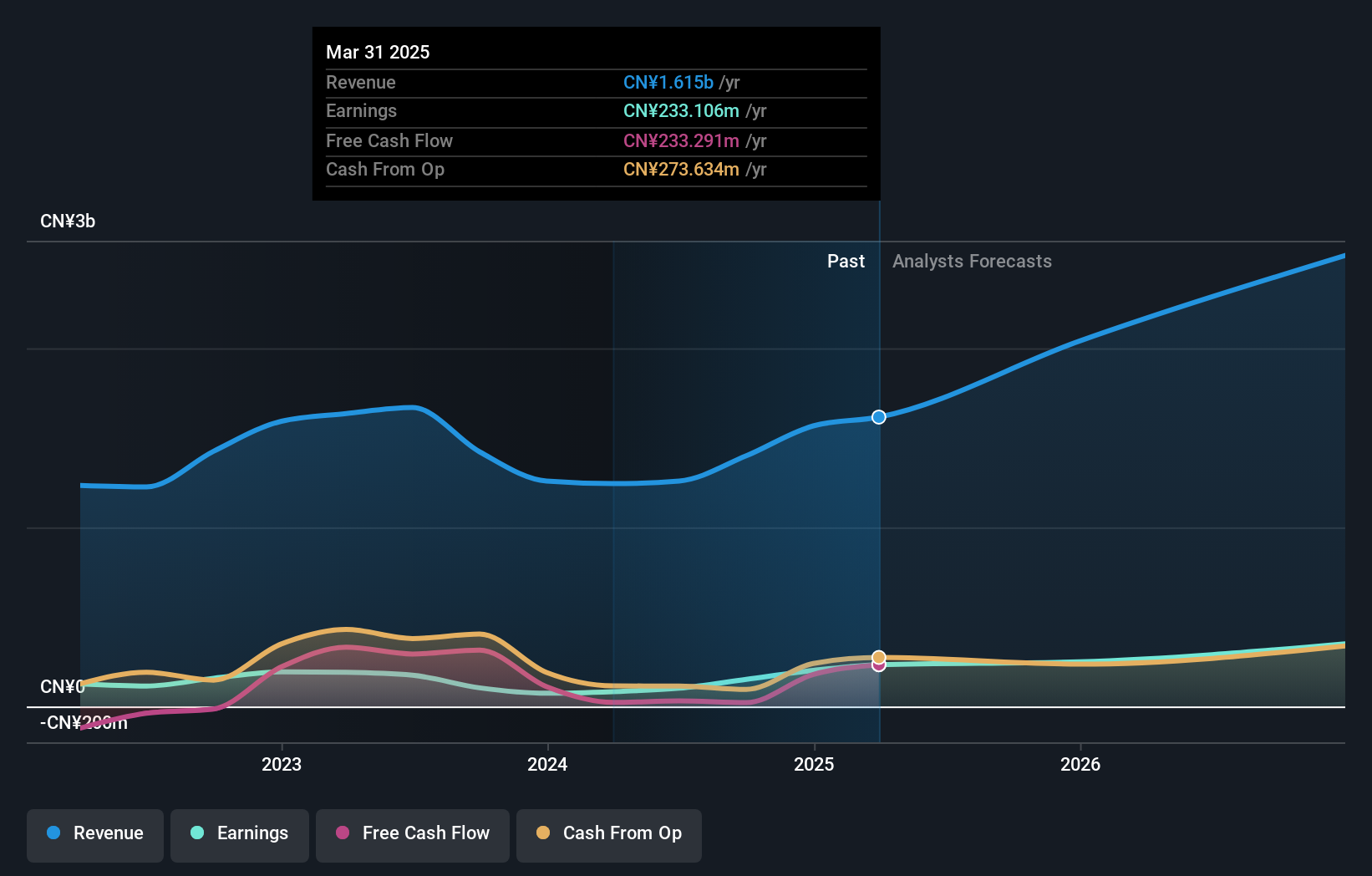

Jones Tech (SZSE:300684)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jones Tech PLC offers materials solutions for intelligent electronic equipment across Asia, Europe, and America, with a market capitalization of CN¥6.20 billion.

Operations: Jones Tech PLC specializes in providing materials solutions for intelligent electronic equipment across various regions, including Asia, Europe, and America. The company operates with a market capitalization of approximately CN¥6.20 billion.

Jones Tech has demonstrated a robust performance with a 14.8% increase in revenue year-over-year, reaching CNY 1.10 billion, and a significant leap in net income to CNY 132.06 million from CNY 54.34 million previously. This growth trajectory is supported by an aggressive R&D strategy, investing heavily to fuel innovations that keep it competitive in the fast-evolving tech landscape. Moreover, the company's strategic share repurchases, totaling CNY 15.41 million this year, underscore its confidence in sustained growth amidst market fluctuations. With earnings projected to grow at an impressive rate of 35.8% annually—outpacing the broader Chinese market's forecast of 26.2%—Jones Tech is well-positioned to capitalize on emerging technological trends and expand its market footprint effectively.

- Navigate through the intricacies of Jones Tech with our comprehensive health report here.

Gain insights into Jones Tech's past trends and performance with our Past report.

Summing It All Up

- Access the full spectrum of 1283 High Growth Tech and AI Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if EmbedWay Technologies (Shanghai) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603496

EmbedWay Technologies (Shanghai)

Operates as a network visibility infrastructure and intelligent system platform vendor in China.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives