- China

- /

- Electronic Equipment and Components

- /

- SZSE:300684

High Growth Tech Stocks Leading The Charge

Reviewed by Simply Wall St

As global markets navigate mixed economic signals, including a decline in U.S. consumer confidence and fluctuating stock indices, the technology sector remains a focal point for growth potential. In this environment, high-growth tech stocks that demonstrate strong innovation and adaptability are particularly noteworthy as they continue to capture investor interest amidst broader market uncertainty.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Jones Tech (SZSE:300684)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jones Tech PLC offers materials solutions for intelligent electronic equipment across Asia, Europe, and America with a market cap of CN¥7.26 billion.

Operations: Jones Tech PLC specializes in providing materials solutions for intelligent electronic equipment, generating revenue through its operations across Asia, Europe, and America. The company has a market capitalization of CN¥7.26 billion.

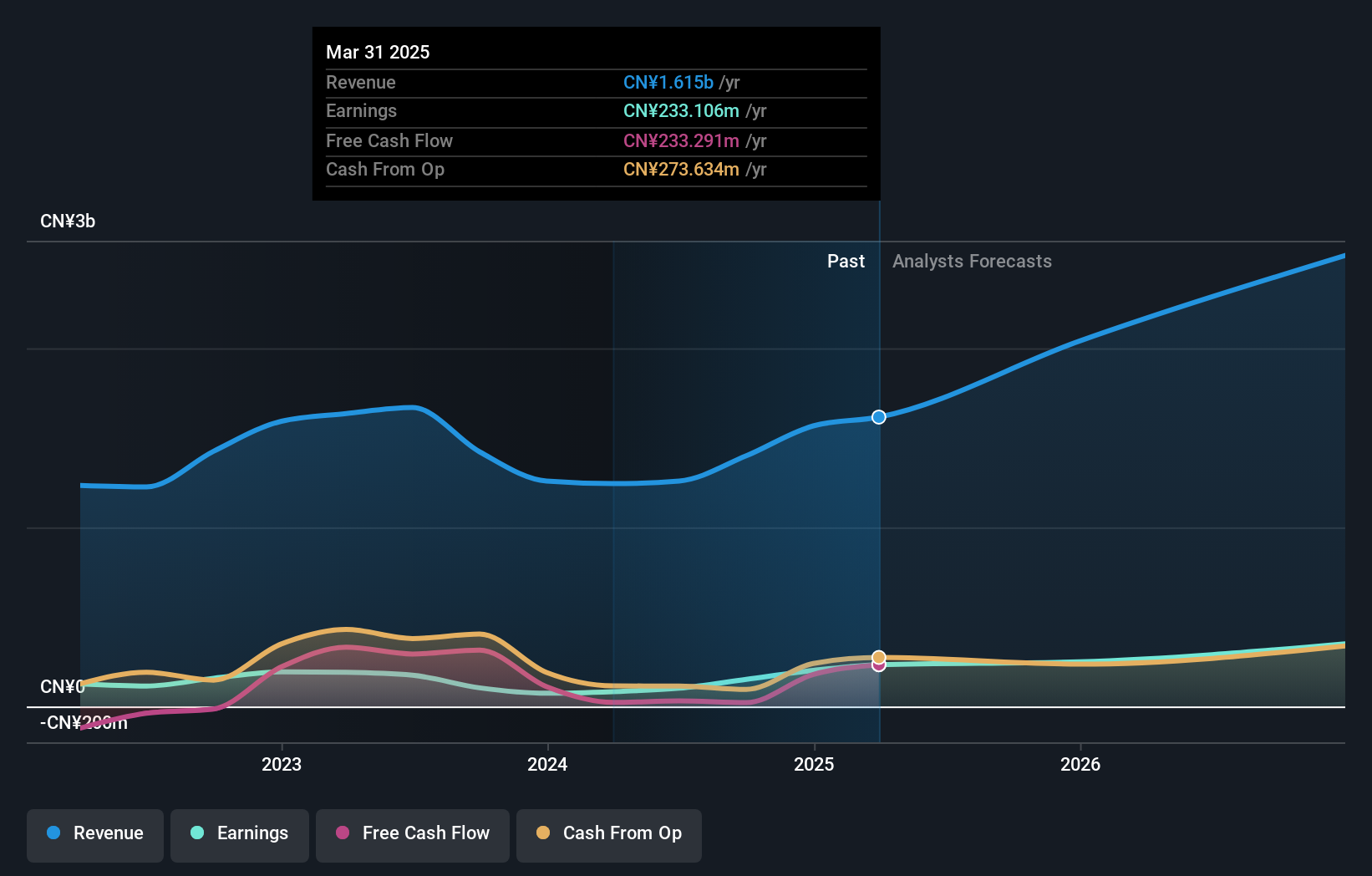

Jones Tech has demonstrated robust financial performance, with revenue soaring to CNY 1.1 billion, up from CNY 954.74 million the previous year, and net income more than doubling to CNY 132.06 million. This growth is underpinned by a significant R&D commitment, crucial for maintaining its competitive edge in a fast-evolving tech landscape. The company's earnings are expected to grow by an impressive 37.5% annually, outpacing the broader Chinese market's growth rate of 25.5%. Moreover, Jones Tech's strategic focus on innovative technologies has enabled it to exceed industry average earnings growth, positioning it well for sustained future expansion in high-demand electronic segments.

- Click here and access our complete health analysis report to understand the dynamics of Jones Tech.

Assess Jones Tech's past performance with our detailed historical performance reports.

Shenzhen Phoenix Telecom TechnologyLtd (SZSE:301191)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Phoenix Telecom Technology Co., Ltd. engages in the development and manufacturing of wireless communications equipment, with a market capitalization of CN¥6.78 billion.

Operations: The company's primary revenue stream comes from its wireless communications equipment segment, generating CN¥1.84 billion.

Shenzhen Phoenix Telecom TechnologyLtd has navigated a challenging year with a revenue decline to CNY 1.26 billion from CNY 1.49 billion, reflecting broader market pressures. Despite this, the company's net income remains robust at CNY 104.36 million, supported by its commitment to R&D which is essential for innovation in the competitive telecom sector. Looking ahead, earnings are expected to surge by 29.4% annually, outstripping the Chinese market projection of 25.5%, indicating potential resilience and growth opportunities in its technological advancements and market strategy.

Nayax (TASE:NYAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Nayax Ltd. is a fintech company that provides system and payment platforms for various retailers across the United States, Europe, the United Kingdom, Australia, Israel, and other global markets, with a market cap of ₪3.80 billion.

Operations: The fintech company generates revenue primarily from its Internet Software and Services segment, amounting to $291.65 million.

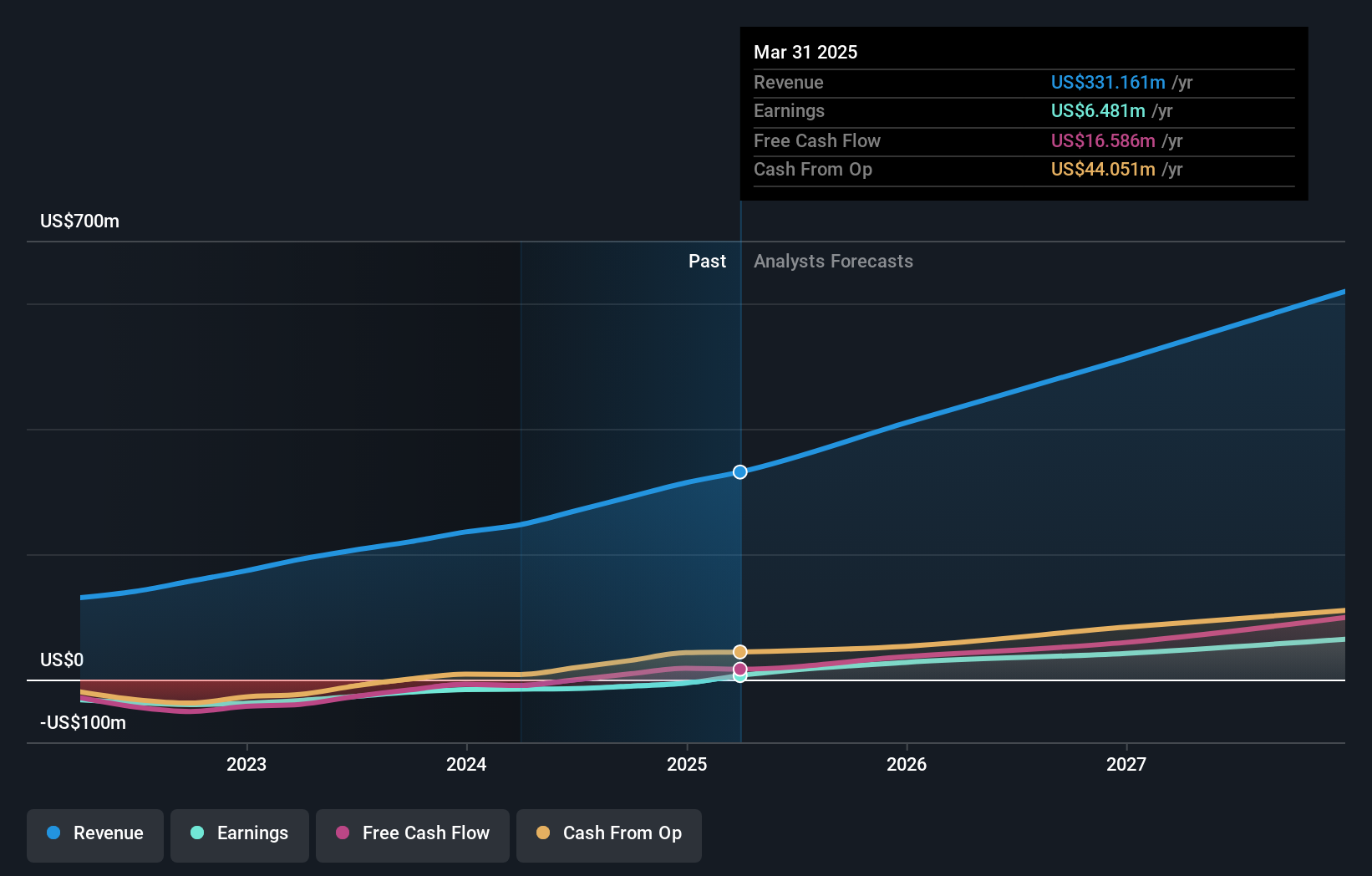

Nayax's strategic expansions and innovative product launches signal robust growth potential, especially with its recent entry into 40 new European markets and El Salvador, enhancing its global footprint in automated payment solutions. This expansion is supported by a significant 23% annual revenue growth and an impressive turnaround to profitability with earnings expected to surge by 122.6% annually. The company's commitment to R&D is evident from its investment in versatile retail solutions and self-service payment technologies, which not only streamline operations for clients but also adapt swiftly to evolving market demands. These initiatives position Nayax favorably within the tech landscape as it continues to capitalize on emerging market opportunities and drive forward the digital payment revolution.

- Take a closer look at Nayax's potential here in our health report.

Review our historical performance report to gain insights into Nayax's's past performance.

Where To Now?

- Access the full spectrum of 1270 High Growth Tech and AI Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300684

Jones Tech

Provides materials solutions for intelligent electronic equipment in Asia, Europe, and America.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives