- China

- /

- Electronic Equipment and Components

- /

- SZSE:300657

Is XiaMen HongXin Electron-tech GroupLtd (SZSE:300657) A Risky Investment?

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, XiaMen HongXin Electron-tech Group Co.,Ltd (SZSE:300657) does carry debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for XiaMen HongXin Electron-tech GroupLtd

What Is XiaMen HongXin Electron-tech GroupLtd's Net Debt?

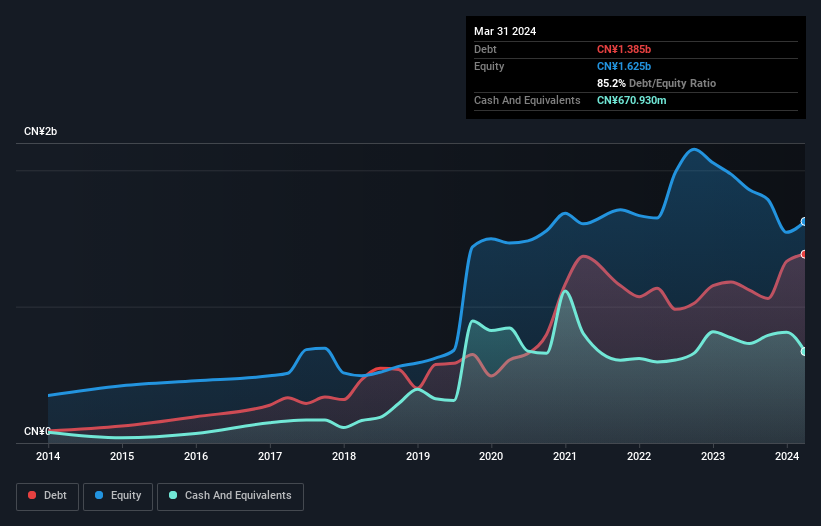

The image below, which you can click on for greater detail, shows that at March 2024 XiaMen HongXin Electron-tech GroupLtd had debt of CN¥1.38b, up from CN¥1.18b in one year. However, it does have CN¥670.9m in cash offsetting this, leading to net debt of about CN¥713.8m.

How Healthy Is XiaMen HongXin Electron-tech GroupLtd's Balance Sheet?

The latest balance sheet data shows that XiaMen HongXin Electron-tech GroupLtd had liabilities of CN¥3.29b due within a year, and liabilities of CN¥423.6m falling due after that. On the other hand, it had cash of CN¥670.9m and CN¥1.81b worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥1.23b.

Of course, XiaMen HongXin Electron-tech GroupLtd has a market capitalization of CN¥6.84b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since XiaMen HongXin Electron-tech GroupLtd will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

In the last year XiaMen HongXin Electron-tech GroupLtd wasn't profitable at an EBIT level, but managed to grow its revenue by 70%, to CN¥4.5b. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though XiaMen HongXin Electron-tech GroupLtd managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. To be specific the EBIT loss came in at CN¥173m. Considering that alongside the liabilities mentioned above does not give us much confidence that company should be using so much debt. Quite frankly we think the balance sheet is far from match-fit, although it could be improved with time. However, it doesn't help that it burned through CN¥76m of cash over the last year. So to be blunt we think it is risky. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 1 warning sign for XiaMen HongXin Electron-tech GroupLtd you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300657

Xiamen Hongxin Electronics Technology Group

Xiamen Hongxin Electronics Technology Group Inc.

Exceptional growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives