David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Fibocom Wireless Inc. (SZSE:300638) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Fibocom Wireless

How Much Debt Does Fibocom Wireless Carry?

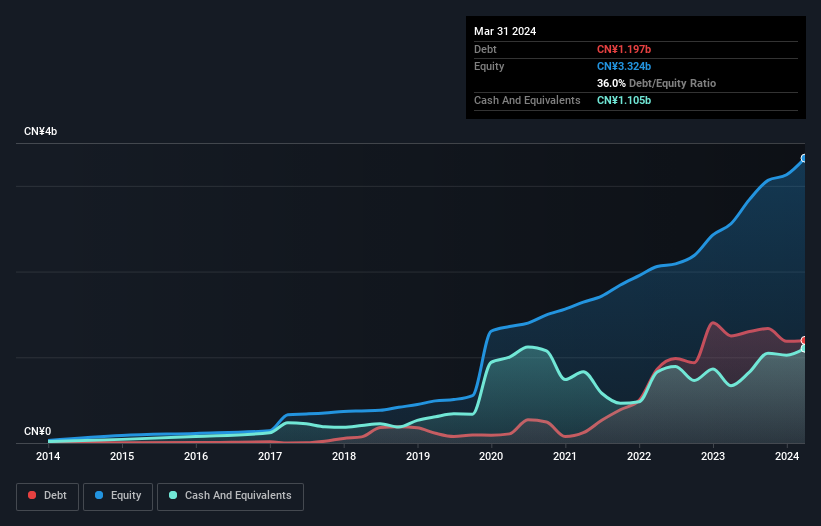

As you can see below, Fibocom Wireless had CN¥1.20b of debt at March 2024, down from CN¥1.25b a year prior. On the flip side, it has CN¥1.11b in cash leading to net debt of about CN¥91.9m.

How Strong Is Fibocom Wireless' Balance Sheet?

We can see from the most recent balance sheet that Fibocom Wireless had liabilities of CN¥3.21b falling due within a year, and liabilities of CN¥745.0m due beyond that. On the other hand, it had cash of CN¥1.11b and CN¥2.73b worth of receivables due within a year. So its liabilities total CN¥119.4m more than the combination of its cash and short-term receivables.

This state of affairs indicates that Fibocom Wireless' balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥11.5b company is short on cash, but still worth keeping an eye on the balance sheet. But either way, Fibocom Wireless has virtually no net debt, so it's fair to say it does not have a heavy debt load!

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Fibocom Wireless's net debt is only 0.12 times its EBITDA. And its EBIT covers its interest expense a whopping 93.6 times over. So we're pretty relaxed about its super-conservative use of debt. On top of that, Fibocom Wireless grew its EBIT by 79% over the last twelve months, and that growth will make it easier to handle its debt. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Fibocom Wireless can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of that EBIT is backed by free cash flow. In the last three years, Fibocom Wireless basically broke even on a free cash flow basis. While many companies do operate at break-even, we prefer see substantial free cash flow, especially if a it already has dead.

Our View

Happily, Fibocom Wireless's impressive interest cover implies it has the upper hand on its debt. But we must concede we find its conversion of EBIT to free cash flow has the opposite effect. When we consider the range of factors above, it looks like Fibocom Wireless is pretty sensible with its use of debt. While that brings some risk, it can also enhance returns for shareholders. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for Fibocom Wireless that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300638

Fibocom Wireless

Designs, develops, and sells wireless communication modules and communication solutions in China and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026