- China

- /

- Electronic Equipment and Components

- /

- SZSE:300615

XDC Industries (Shenzhen) (SZSE:300615) shareholder returns have been decent, earning 40% in 1 year

These days it's easy to simply buy an index fund, and your returns should (roughly) match the market. But investors can boost returns by picking market-beating companies to own shares in. For example, the XDC Industries (Shenzhen) Limited (SZSE:300615) share price is up 39% in the last 1 year, clearly besting the market return of around 20% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! The longer term returns have not been as good, with the stock price only 7.6% higher than it was three years ago.

The past week has proven to be lucrative for XDC Industries (Shenzhen) investors, so let's see if fundamentals drove the company's one-year performance.

See our latest analysis for XDC Industries (Shenzhen)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over the last twelve months XDC Industries (Shenzhen) went from profitable to unprofitable. While this may prove temporary, we'd consider it a negative, so we would not have expected to see the share price up. It may be that the company has done well on other metrics.

We are skeptical of the suggestion that the 0.8% dividend yield would entice buyers to the stock. Unfortunately XDC Industries (Shenzhen)'s fell 70% over twelve months. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

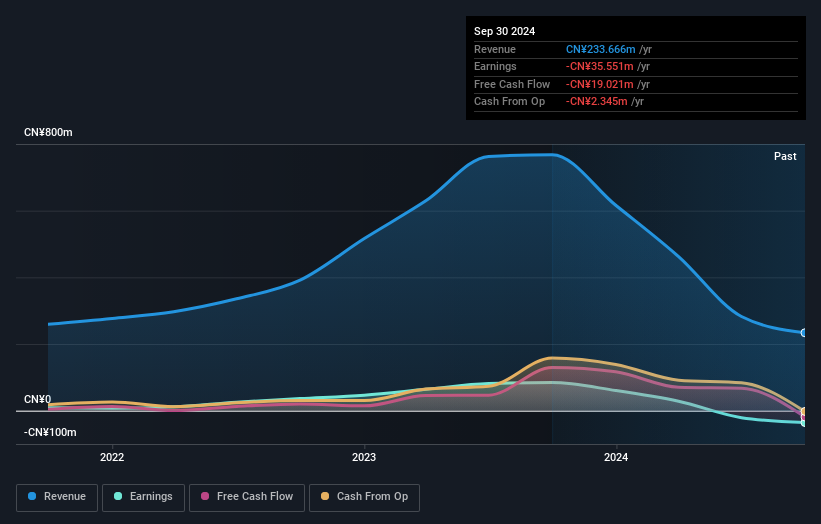

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling XDC Industries (Shenzhen) stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

It's good to see that XDC Industries (Shenzhen) has rewarded shareholders with a total shareholder return of 40% in the last twelve months. Of course, that includes the dividend. That certainly beats the loss of about 5% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for XDC Industries (Shenzhen) you should be aware of.

But note: XDC Industries (Shenzhen) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:300615

XDC Industries (Shenzhen)

Engages in the research and development, production, and sale of RF devices in the mobile communications industry in China and internationally.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives