- China

- /

- Communications

- /

- SZSE:300570

Top Asian Growth Stocks With High Insider Ownership For October 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by U.S.-China trade tensions and evolving monetary policies, investors are keenly observing Asia's economic dynamics and their impact on regional equities. In this environment, growth companies with high insider ownership can offer unique insights into potential resilience and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Suzhou Sunmun Technology (SZSE:300522) | 33.2% | 84.7% |

| Sineng ElectricLtd (SZSE:300827) | 36.1% | 26.6% |

| Seers Technology (KOSDAQ:A458870) | 33.9% | 84.6% |

| Oscotec (KOSDAQ:A039200) | 12.7% | 104.1% |

| Novoray (SHSE:688300) | 23.6% | 30.3% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.2% |

| J&V Energy Technology (TWSE:6869) | 17.5% | 24.9% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.6% | 50.7% |

| Ascentage Pharma Group International (SEHK:6855) | 12.8% | 91.9% |

Here we highlight a subset of our preferred stocks from the screener.

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

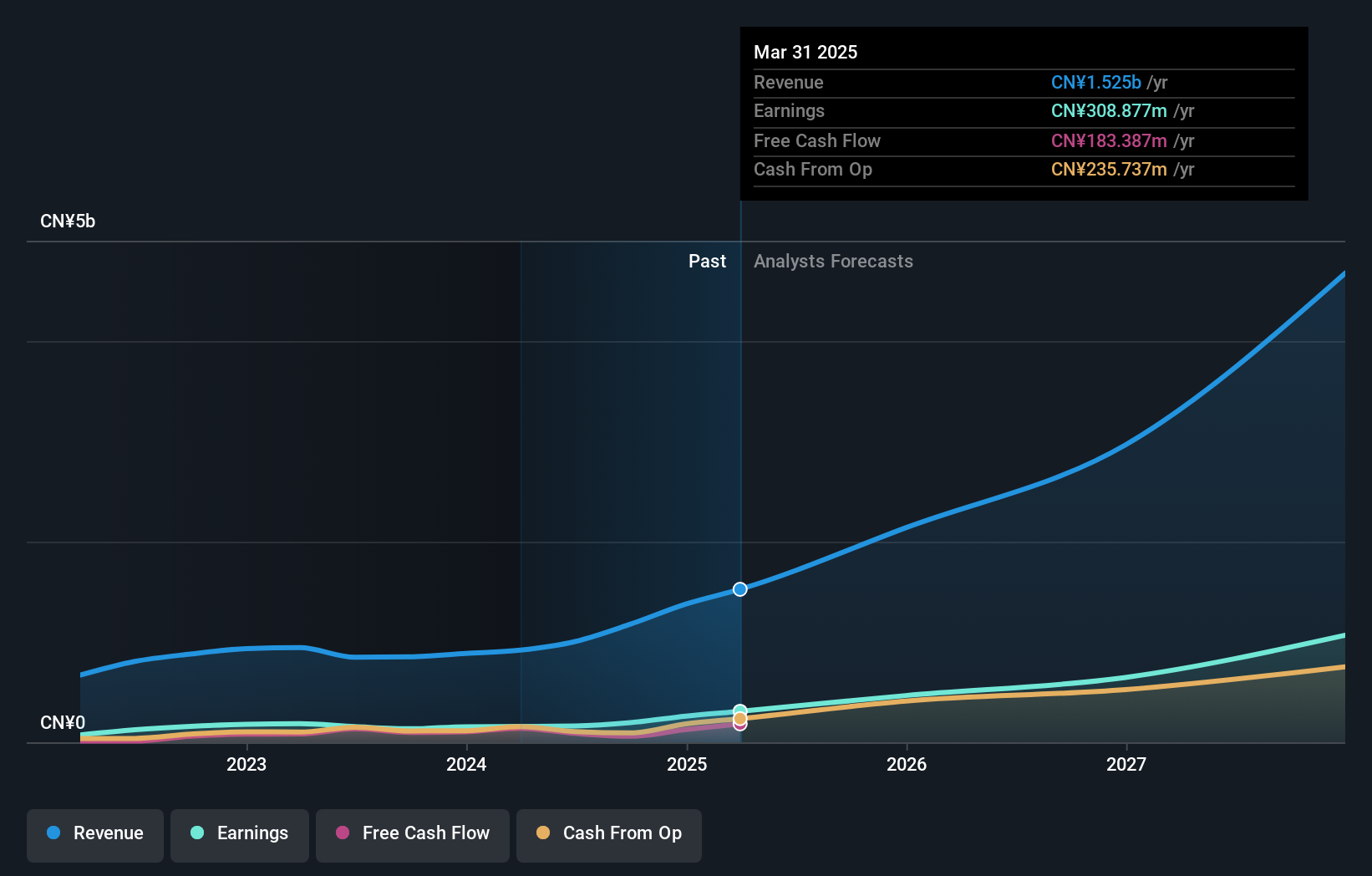

Overview: T&S Communications Co., Ltd. develops, manufactures, and sells fiber optics communication products in China with a market cap of CN¥22.94 billion.

Operations: The company generates revenue primarily from Optical Communication Components, amounting to CN¥1.69 billion.

Insider Ownership: 23.5%

Return On Equity Forecast: 35% (2028 estimate)

T&S Communications Ltd. demonstrates strong growth potential with earnings increasing by 117.9% over the past year and forecasted to grow by 45% annually, surpassing market expectations in China. Despite a volatile share price, it trades at a favorable price-to-earnings ratio of 64.6x compared to industry peers. Recent earnings results show significant revenue and net income growth, highlighting its robust performance trajectory amid high insider ownership levels in Asia's competitive landscape.

- Navigate through the intricacies of T&S CommunicationsLtd with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that T&S CommunicationsLtd's share price might be on the cheaper side.

PAL GROUP Holdings (TSE:2726)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PAL GROUP Holdings CO., LTD. operates in Japan, focusing on the planning, manufacture, wholesale, and retail of men's and women's clothing and accessories, with a market cap of ¥356.67 billion.

Operations: The company generates revenue primarily from its Clothing Business, amounting to ¥138.52 billion, and Miscellaneous Goods Business, contributing ¥84.72 billion.

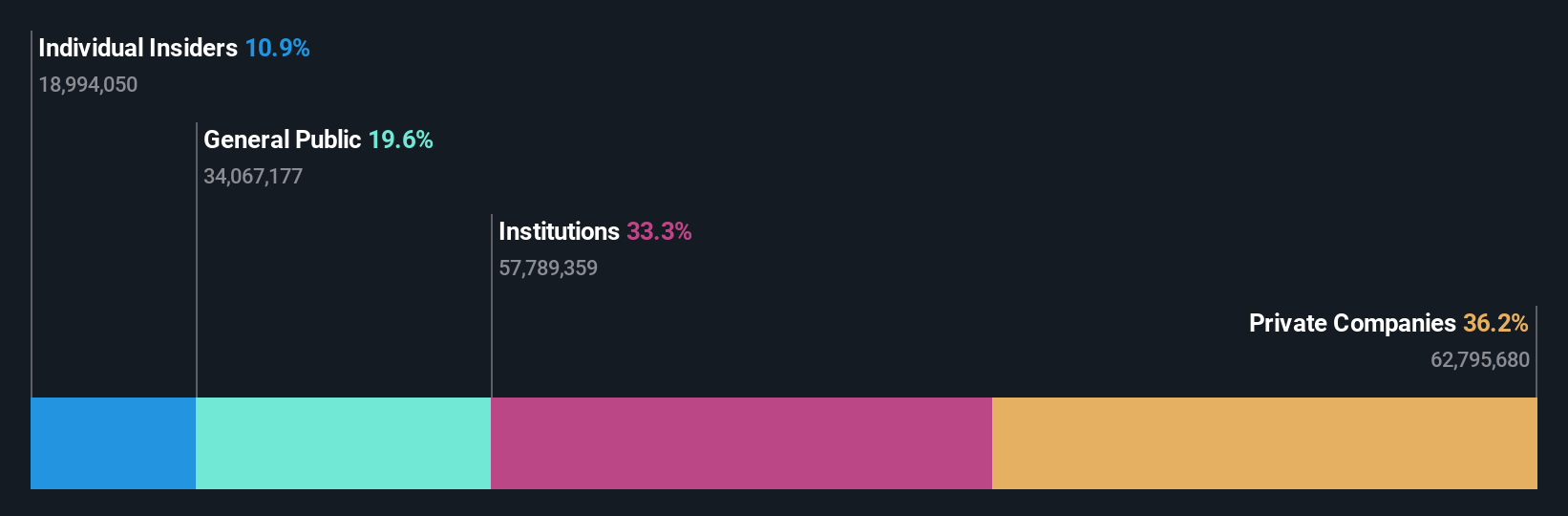

Insider Ownership: 10.9%

Return On Equity Forecast: 21% (2028 estimate)

PAL GROUP Holdings shows promising growth potential with earnings forecasted to grow 15.84% annually, outpacing the Japanese market average. Despite a volatile share price, it trades at 11.9% below its estimated fair value. Recent half-year results reported sales of ¥117 billion and net income of ¥9.19 billion, marking significant year-over-year increases in both metrics. The company also announced changes to its stock split schedule, reflecting strategic adjustments amidst stable insider ownership levels in Asia's dynamic market environment.

- Click to explore a detailed breakdown of our findings in PAL GROUP Holdings' earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of PAL GROUP Holdings shares in the market.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★★☆

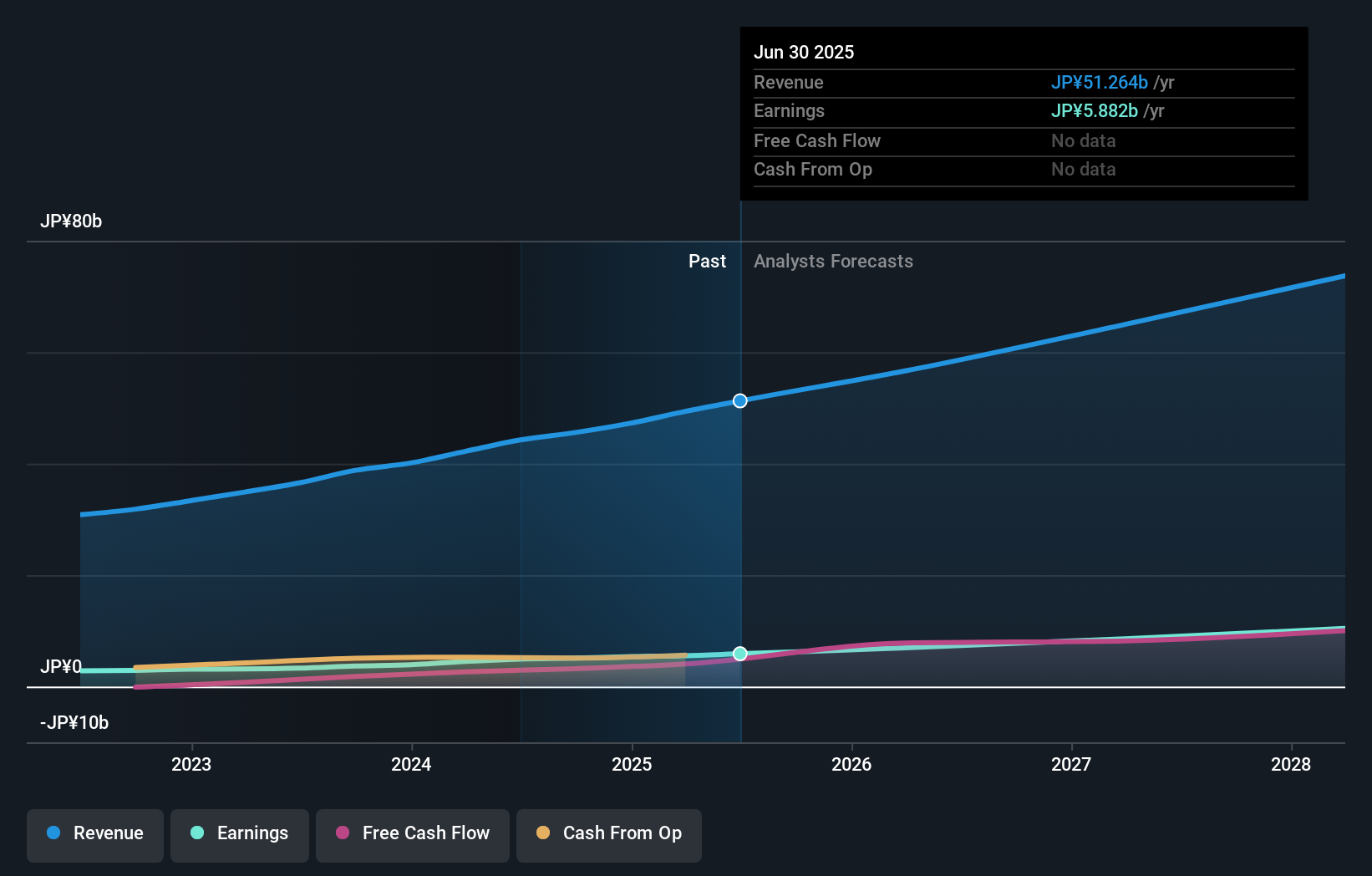

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in repair, maintenance, and modernization services for elevators and escalators in Japan, with a market capitalization of ¥342.63 billion.

Operations: The company generates revenue primarily from its Maintenance Business segment, which reported ¥51.26 billion.

Insider Ownership: 21.4%

Return On Equity Forecast: 34% (2028 estimate)

Japan Elevator Service Holdings is poised for significant growth with earnings expected to rise 21.35% annually, surpassing the Japanese market average. Despite slower revenue growth at 13.2%, it remains above market trends. Recent board decisions include a 2:1 stock split effective September 29, 2025, doubling authorized shares to enhance liquidity and shareholder value. Stable insider ownership complements its robust return on equity forecast of 34.4% in three years, reflecting strong internal confidence in future prospects.

- Click here and access our complete growth analysis report to understand the dynamics of Japan Elevator Service HoldingsLtd.

- Our valuation report here indicates Japan Elevator Service HoldingsLtd may be overvalued.

Summing It All Up

- Explore the 615 names from our Fast Growing Asian Companies With High Insider Ownership screener here.

- Looking For Alternative Opportunities? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if T&S CommunicationsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300570

T&S CommunicationsLtd

Develops, manufactures, and sells fiber optics communication products in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Community Narratives