- South Korea

- /

- Entertainment

- /

- KOSDAQ:A293490

High Growth Tech Stocks To Consider This December 2024

Reviewed by Simply Wall St

As global markets navigate a period of economic adjustments and monetary policy shifts, the technology-heavy Nasdaq Composite has reached record highs despite broader market declines, highlighting the resilience and potential of tech stocks in today's dynamic environment. In such conditions, identifying high-growth tech stocks involves looking for companies with strong innovation capabilities and adaptability to changing market trends, which can offer promising opportunities amid fluctuating economic indicators.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 27.24% | 28.74% | ★★★★★★ |

| Medley | 25.57% | 31.67% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

Click here to see the full list of 1267 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

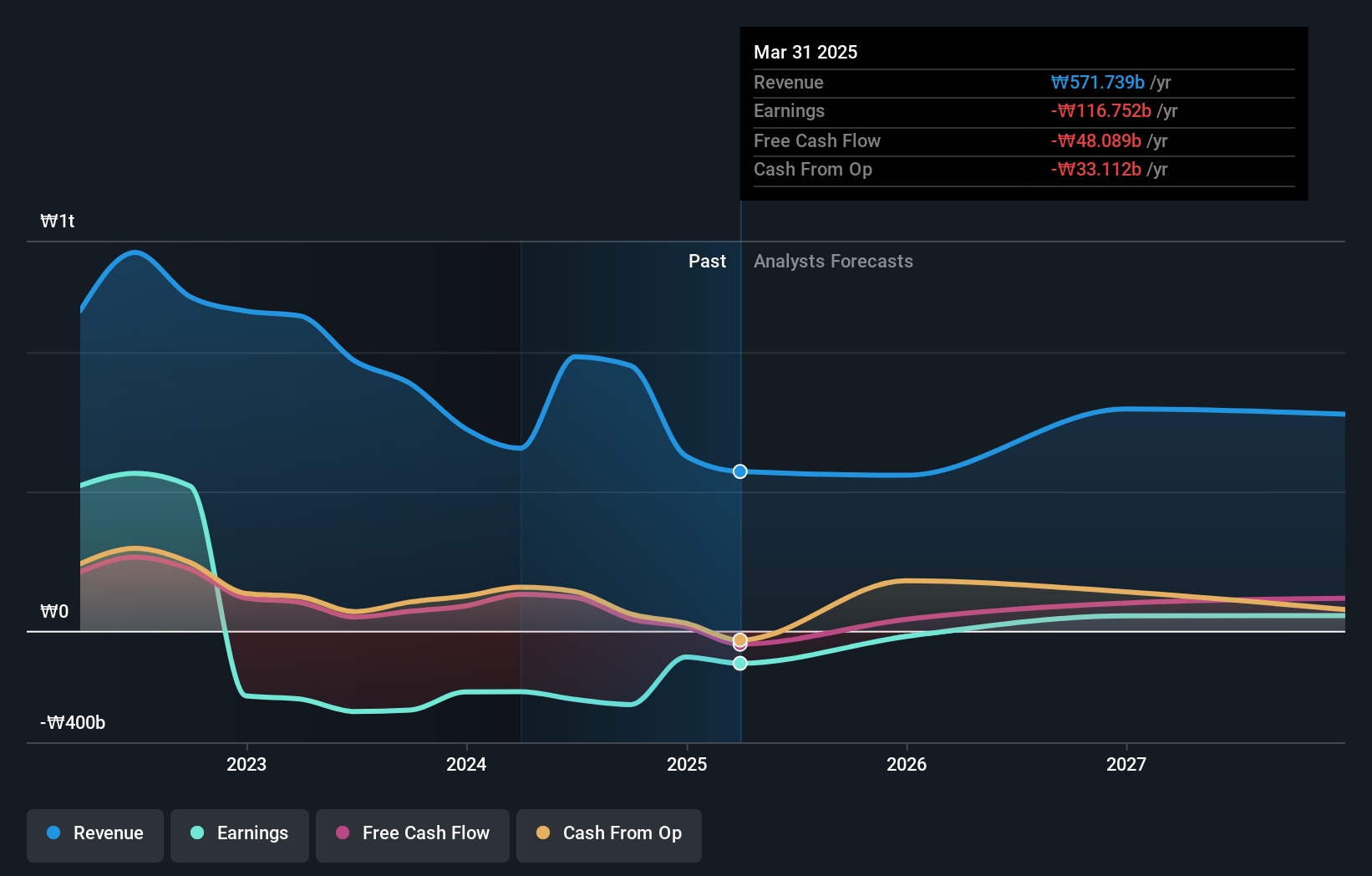

Kakao Games (KOSDAQ:A293490)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide with a market capitalization of ₩1.56 trillion.

Operations: The company generates revenue primarily through its computer graphics segment, which contributes ₩951.76 billion. It focuses on providing gaming services across mobile and PC platforms globally.

Kakao Games, amidst a challenging tech landscape, has shown resilience with a projected annual revenue growth of 9.5%, notably outpacing the Korean market's average of 5.4%. Despite current unprofitability, the company is poised for significant earnings expansion, with forecasts suggesting an impressive 133.48% growth annually over the next few years. This potential turnaround is underpinned by strategic R&D investments and recent presentations at Citi's Korea Corporate Day hinting at innovative future projects that could redefine its market stance.

- Dive into the specifics of Kakao Games here with our thorough health report.

Understand Kakao Games' track record by examining our Past report.

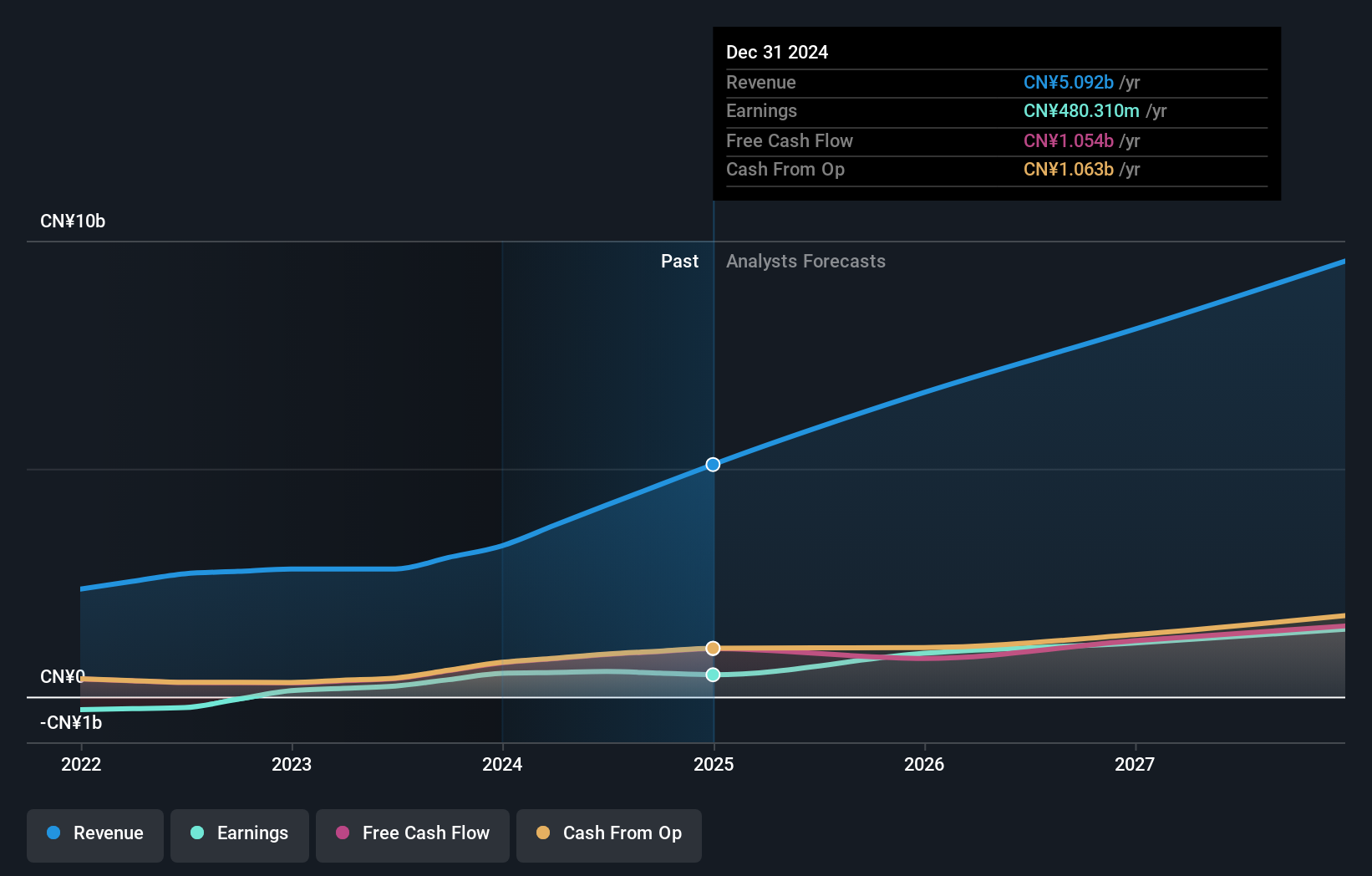

Newborn Town (SEHK:9911)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Newborn Town Inc. is an investment holding company that operates in the global social networking sector, with a market capitalization of HK$4.77 billion.

Operations: The company primarily generates revenue from its social networking business, contributing CN¥3.80 billion, while its innovative business adds CN¥406.28 million.

Newborn Town, with a robust 137.3% earnings growth over the past year, significantly outperforms its industry average of 16.9%, showcasing its potential in the competitive tech sector. This performance is bolstered by strategic R&D investments, which are crucial as the company's R&D expenses have been substantial, aligning with its innovation-driven approach to capture market share. Moreover, anticipated annual revenue and earnings growth rates of 15.6% and 21% respectively exceed Hong Kong's market averages, positioning Newborn Town favorably for future expansion. The recent shareholder meeting underscores a commitment to strategic acquisitions and operational enhancements that could further solidify its market position.

- Delve into the full analysis health report here for a deeper understanding of Newborn Town.

Examine Newborn Town's past performance report to understand how it has performed in the past.

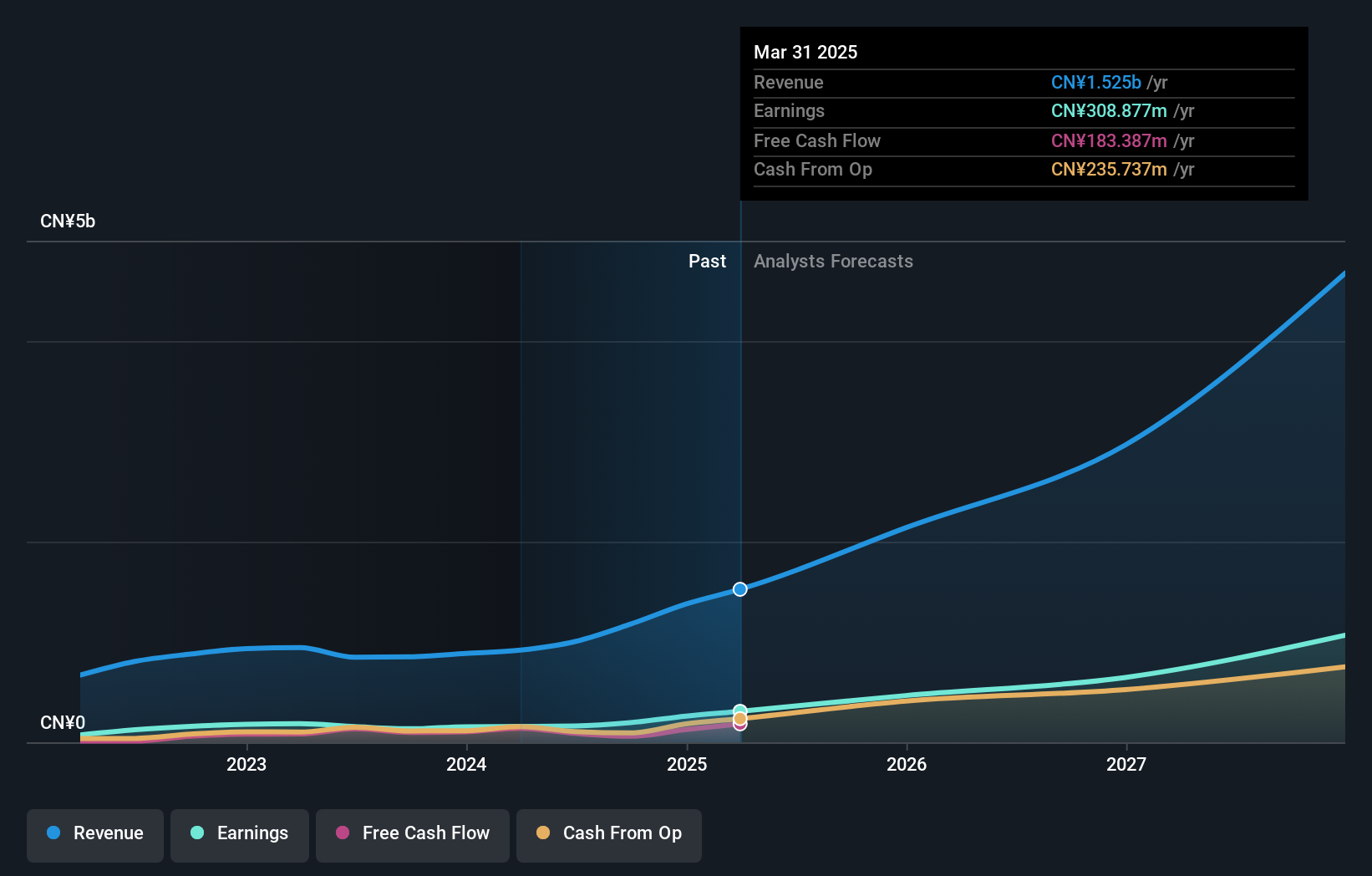

T&S CommunicationsLtd (SZSE:300570)

Simply Wall St Growth Rating: ★★★★★★

Overview: T&S Communications Co., Ltd. is a company that develops, manufactures, and sells fiber optics communication products in China, with a market capitalization of CN¥15.02 billion.

Operations: T&S Communications focuses on the development, manufacturing, and sale of fiber optics communication products. The company generates revenue primarily from its Optical Communication Components segment, amounting to CN¥1.17 billion.

T&S CommunicationsLtd has demonstrated a robust growth trajectory with a 38.3% annual revenue increase and an even more impressive 44.7% surge in earnings, figures that outpace the broader Chinese market's averages significantly. This financial vigor is underpinned by strategic R&D investments, which have been substantial, reflecting the company's commitment to innovation and technological advancement in the communications sector. Recent inclusion in the S&P Global BMI Index and a notable jump in net income from CNY 104.83 million to CNY 145.81 million over nine months highlight its growing industry influence and operational success, positioning T&S CommunicationsLtd well for future advancements within tech landscapes driven by cutting-edge research and development initiatives.

Summing It All Up

- Click through to start exploring the rest of the 1264 High Growth Tech and AI Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Kakao Games, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kakao Games might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSDAQ:A293490

Kakao Games

Kakao Games Corporation operates a mobile and PC online game service platform for gamers worldwide.

Reasonable growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives